The Merlon Approach to Corporate Governance

In 2019 we outlined our views on quality and how it fits in our investment process (Quality in the Merlon Process). With governance being a key focus in our assessment of the overall quality of company, this paper expands on our previous discussion and details how governance is integrated into our investment thinking. Future papers will cover how environmental and social factors are incorporated into our investment process. The key points in this paper are:

The role of governance is highly integrated into our process. We explicitly rate Governance & Management as part of our Qualitative Scorecard. We believe companies rating higher on our Qualitative Scorecard will tend to generate higher returns on capital through time and therefore convert a greater proportion of accounting profits into free-cash-flow.

Our relentless focus on free-cash-flow can identify governance concerns. Free-cash-flow is the basis upon which we value all companies. Companies with significant divergence between advertised performance metrics and free-cash-flow often suffer from poor governance and are often expensive relative to sustainable free-cash-flow.

We do not screen out companies based on governance. Rather, we seek to determine whether the upside of an investment is sufficient given the risk of permanent loss including permanent losses attributable to potential governance failures.

We seek to identify market misperceptions about governance. We believe markets are mostly efficient and therefore think popular governance views are usually discounted into stock prices. Rather it is through identifying market misperceptions about governance that we think we have the capacity to generate excess returns.

We have a strong track record of engaging on governance issues. We regularly engage with management and boards to understand and encourage alignment and strong representation of shareholders. Appendix 1 discusses our approach to engagement with portfolio companies and Appendix 2 contains several case studies demonstrating our engagement track record.

Governance and Shareholder Outcomes

At Merlon we adopt a broad definition of governance as the responsibility of the board and management to represent the interests of shareholders over the long-term. Our view is that the primary focus of the board is to address agency problems that emerge when management and shareholders have conflicting interests. In assessing management and governance we closely consider (a) the personal integrity and track records of the individuals involved, including any dominant personalities, (b) long-term alignment; and (c) culture.

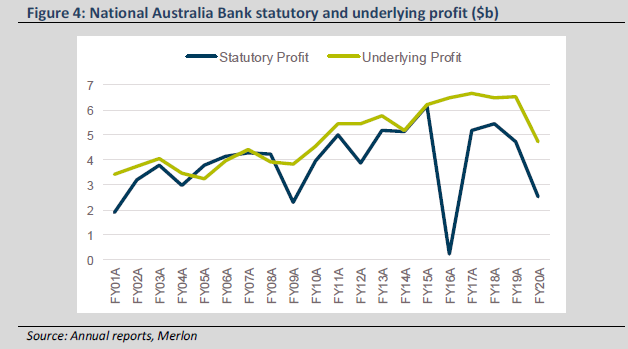

In 2019 we authored a paper (Quality in the Merlon Process) concluding that companies of higher quality (favourable industry structure, demonstrable competitive advantage, good governance and management) can generally be expected to drive sustainably higher returns on capital and free-cash-flow.

Drilling down into governance, we consider it to be an important factor when assessing the overall quality of a company due to its significant influence on capital allocation and management behavior. For example, if the incentive structure set by the board is ill-conceived, it can result in poor capital allocation decisions and/or management being too focused on maximising short-term outcomes at the expense of long-term shareholder value.

Case Study – Boral’s Acquisition of HeadwatersCompanies that allocate capital poorly destroy shareholder value. For example, Boral’s acquisition of Headwaters in 2016 for $3.7b resulted in a significant destruction of shareholder value as recently acknowledged by Boral through its recent $1.1b write-down of Headwaters goodwill. The specific failings in this case included company reliance on over-optimistic forecasts and synergies, whether appropriate board challenge of management views took place and the integration of the businesses post acquisition. We publicly commented on this transaction in 2016 (Boral’s High Price Acquisition of Headwaters Incorporated). We exited the position within 12 months when the market became more complacent about the merits of the transaction and the share price recovered. |

There are many empirical studies that show that good governance structures and practices are associated with better stock performance. For example, Gompers, Ishii and Metrick, authors of “Corporate governance and equity prices”, found a strong relationship between corporate governance (as determined by 24 different provisions) and stock returns.[1]

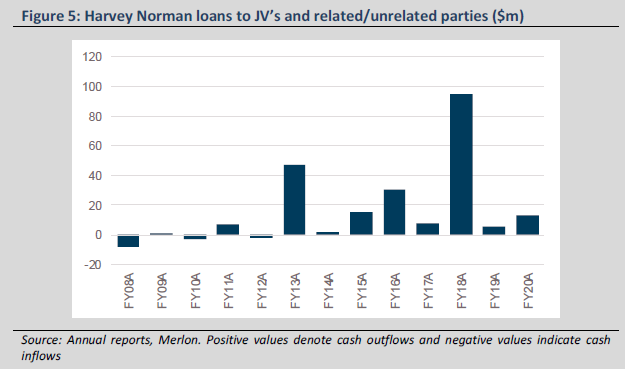

Using our proprietary quality scores (of which governance represents a sizeable component) as a measure of quality, high quality stocks have outperformed low quality stocks (Figure 2)

However, we would caution that the period since Merlon’s inception has been defined by historically low and declining interest rates. We remain mindful that valuations for quality stocks remain above historic norms. This potential “bubble” in quality stocks increases the importance of long-term fundamental valuation for investors, including the integration of governance views and determining where the market might be overly optimistic or pessimistic in relation to governance and other quality factors.

The Merlon Qualitative Scorecard

As also detailed in Quality in the Merlon Process, we assess quality through our qualitative scorecard. This covers Industry Structure (score out of 15), Competitive Advantage (score out 9) and Governance & Management (score out of 11).

Our Governance & Management scorecard is critical in that the existence of a favourable industry structure or company specific competitive advantage may not necessarily result in higher rates of return. For example:

- A firm may trade current returns for investment in market share or other uneconomic growth strategies.

- A firm may forgo returns in the interests of customer satisfaction, employee benefits or executive perks.

- A firm may lack the ability to identify and respond to external change.

- A firm may seek to uneconomically deploy capital to drive “growth for growth’s sake” entering into poorly structured industries or where its competitive advantage is lacking.

Our Governance & Management score is decomposed into Governance; Capital Allocation; and Execution. In reality there is an interrelationship between these components with overarching governance processes, structures and cultures driving all elements. Over longer periods, there is also an interrelationship between Governance and Management and a firm’s Competitive Advantage as well as the choices a firm makes about which Industry Structures it chooses compete in.

As can be seen in Table 1, in determining our Governance & Management scores we review board composition for diversity and balance of power; examine remuneration models/equity alignment; consider the track records of the companies and individuals concerned; and, seek to understand companies’ strategies to generate acceptable and sustainable returns.

Table 1: Governance & Management Scorecard |

|

| Factor: Governance

A board’s existence is principally to address agency issues that arise between shareholders and management. |

What does a score of 5 look like?

What does a score of 0 look like?

|

| Factor: Capital Allocation

The essence of this factor is the recognition that companies operating in the interests of their shareholders, whose interest is in maximising their wealth. |

What does a score of 3 look like?

What does a score of 0 look like?

|

| Factor: Ability to identify change & execute

Any external change creates opportunities for profit. The ability to identify and respond to opportunity lies at the core of management capability. To the extent that opportunities are fleeting or subject to first move advantage, speed of response is critical to exploiting business opportunity.

|

What does a score of 3 look like?

What does a score of 0 look like?

|

Source: Merlon

Peer Review

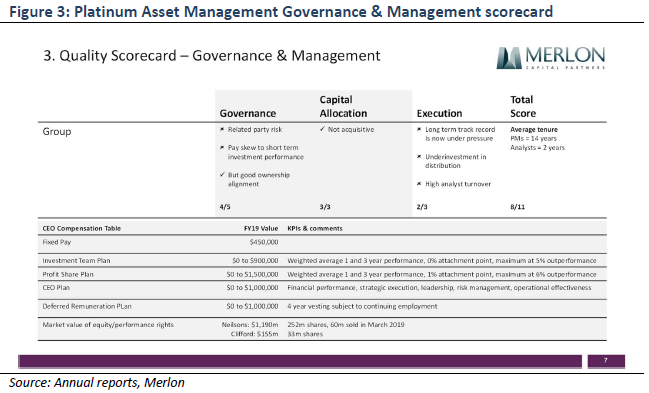

All scores are subject to rigorous peer review. A sample of the way in which we present our Governance & Management scorecards as part of our peer review process is shown in Figure 3.

Interrelationship Between Remuneration, Management Tenure & Governance

As part of the peer review presentations, we place emphasis on the remuneration structure of the CEO and key management personnel (Figure 3). The purpose is to understand the alignment with shareholders through short-term and long-term incentives, co-investment in the company and whether the CEO has been selling shares.

Remuneration structures in themselves are a small part of overall assessment of governance processes, structures and cultures but are readily observable and often indicative of broader issues. A poorly designed remuneration structure could well be symptomatic of bigger underlying problems. To quote Warren Buffett on Wells Fargo: “There’s never just one cockroach in the kitchen”.

Similarly, we place emphasis on management tenure as an indicator of where there might be lingering cultural issues.

Third Party Research

Ownership Matters is our primary governance advisor. We also subscribe to ISS and will actively engage with other advisers such as CGI Glass Lewis and ACSI where appropriate.

We have a regular quarterly meeting with Ownership Matters to discuss governance issues but engage with them on specific matters on a much more frequent basis. When assessing governance, we refer to Ownership Matters’ assessment of the key governance concerns for the company and where they rank the company in their ASX 100 or Ex 100 rankings.

“OM helps investors to identify, price and remediate governance risk in the companies they own. Perverse management incentives can drive dodgy accounting – where this is overseen by a dopey board, it can be a dangerous combination where there is little margin for safety.

We always look forward to being interrogated by Merlon on the risks we identify – they take the time to consider the issues.”

– Dean Paatsch, Ownership Matters

It’s important to recognise that our views can and often do differ from research providers and popular consensus.

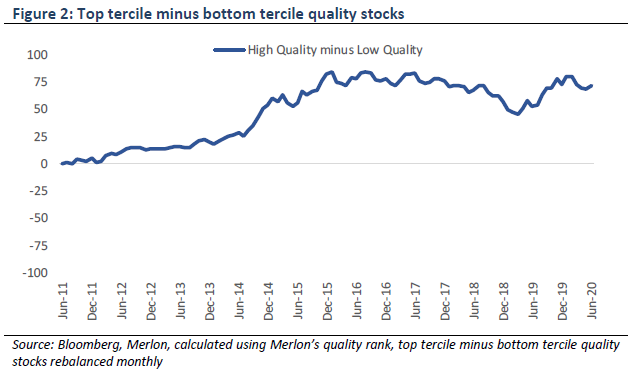

Case Study – Views that Differ from Popular OpinionOwnership Matters and the market have a very negative view of Harvey Norman’s governance owing to concerns including, but not limited to, executive pay, lack of independent directors, related party transactions etc. While we acknowledge some of these concerns, we feel they need be weighed against positive steps to improve its governance (appointment of two new independent directors, tightening its capital allocation etc.) and the cultural benefits of having board members very well aligned to shareholders through their ~33% combined holding in the company. We see this alignment evidenced in the positive steps taken in recent years to unlock shareholder value through distributing excess franking credits. |

The Merlon Valuation Approach

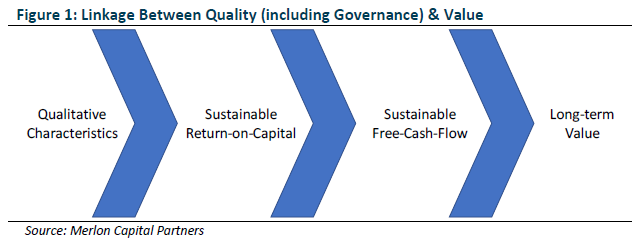

Now more than ever, traditional classifications of “value” based on accounting earnings, net assets and dividends are readily manipulated by management. The relatively recent ramp up in dividend payout ratios and the growing divergence between statutory and “underlying” earnings are examples of this.

Our approach to dealing with this issue is to classify stocks based on their capacity to generate cash flow over and above that needed to sustain and grow their businesses free-cash-flow”). The use of free-cash-flow rather than accounting earnings, net assets or dividends is important because the measure is less readily manipulated by management and less readily observable by investors.

Our process tends to highlight situations where there is a significant divergence between management measures of performance and free-cash-flow. Such gaps emerge where companies:

- overestimate the useful lives of their assets causing depreciation and amortisation charges to understate the amount of capital required to sustain and grow their businesses;

- repeatedly report of “one-off” or “significant” items outside “underlying” measures of performance; and/or

- require a significant amount of working capital to sustain their businesses.

Again, Merlon’s approach to dealing with this issue is to classify stocks based on their capacity to generate cash flow over and above that needed to sustain and grow their businesses free-cash-flow”). However, where key performance measures incorporated into company presentations are remuneration models differ from free-cash-flow there may also be governance issues at play.

Case Study – Diverging Management Performance Measures and Free-Cash-FlowThe gap between National Australia Bank’s “underlying profit” and statutory profit has totaled almost $20 billion over the last 20 years (Figure 4). Further the gap between statutory profit and free-cash-flow has represented an additional $35 billion. The widespread use of “underlying” earnings as the basis for determining management incentives is of great concern to us, especially considering the average ASX200 company only converts around 70% of its accounting earnings into free-cash-flow.

|

Governance, Poor Capital Allocation & Valuation

Poor capital allocation can be an outcome of poor governance Sometimes, poor capital allocation can be quantified and factored into our estimates of sustainable free-cash-flow, which drives valuation.

Case Study – Persistent non-core Investing ActivitiesHarvey Norman is an example where governance concerns can be explicitly factored into our estimate of sustainable free cash flow and valuation. Up until recently, there were investments in “non-core” activities, such as a dairy farm and mining camp accommodation, via joint venture and other structures, averaged ~$30m pa since 2013 (Figure 5).

These investments incurred significant losses and were exited at low values or written off. To account for the risk of further shareholder value destruction, we capitalized $30m per annum into our assessment of fundamental value, reducing our valuation of Harvey Norman by 5%. This in turn drove a lower portfolio weight. We made our position clear to the company on several occasions and obtained commitments these investments would reduce. Pleasingly this has materialised through significantly reduced cash outflows in this investing cash flow line during the last two years and so we have removed this impact from our projected free-cash-flow and valuation. We would add that while frustrating at times, these investments are not overly material and can be far less damaging than very large acquisitions, often in offshore markets, made by CEOs with limited personal investment alongside shareholders. |

The Merlon Conviction Score

A key tenant of Merlon’s investment philosophy is that markets are mostly efficient and that cheap stocks are always cheap for a reason. We are focused on understanding why cheap stocks are cheap. To be a good investment, market concerns need to be priced in or deemed invalid. We incorporate these aspects with a Conviction Score that feeds into our portfolio construction framework.

For governance concerns that can be quantified, such as the risk of poor capital allocation, we may apply a more adverse outcome to our downside valuation scenario than our central case valuation. If the share price is already trading below our downside scenario, we may conclude the market is overly pessimistic on governance, leading to a positive conviction bias. Alternatively, if the share price is trading well above our valuation, but we still consider capital allocation risk to be a key issue, this may lead us to have a negative conviction bias.

Not all governance risks can be expressed quantitatively but can still be factored into conviction to the extent that our views on a company’s governance differ to the market and we believe it has the potential to materially impact the investment case.

Case Study – Market underestimating poor capital allocationWe invested in Clydesdale Bank (CYB) when it was demerged from National Australia Bank in 2016 on the basis of self-help cost, capital and de-risking initiatives. However, in June 2018, CYB announced the acquisition of Virgin Money UK with a 61% increase in its share count to effect the merger. We immediately reduced our conviction score to reflect the unsustainable aspects of the Virgin Money business, including rapid market share growth via third parties, a risky expansion into balance transfer credit cards, over-reliance on wholesale and cheap government funding, and an unrealistic cost synergies. However, the market did not initially share our pessimistic view and the share price rallied from A$5.50 to over $6, allowing us time to completely exit the investment at a favourable price. The shares traded at $2 a year later, even before the COVID-19 impacts. |

Other examples of where governance has impacted our conviction include:

- Newscorp – governance is improving, not being appreciated by the market

- Harvey Norman – governance concerns overstated by the market, strong alignment

- Nick Scali – minor related party risk but overridden by strong alignment

- iiNet – poorly structured and managed sale process

Impact of Governance on Portfolio

As described above, through our quality assessment, valuation and conviction, governance concerns directly impact portfolio decisions. Importantly, we do not screen out companies based on governance, preferring to identify whether the upside of an investment is sufficient given the risk of permanent loss from potential governance failures.

Concluding Remarks

Good governance is by no means sufficient on its own to determine company performance. Alternatively, bad governance can erode shareholder value over time, particularly when not priced in by the market. We see this frequently through poor capital allocation decisions, poor handling of takeover approaches and high turnover among talented management.

Having said that, there is an increasing appetite in the market to pay a premium (i.e. employ a lower discount rate) for companies with good governance. By definition, lower discount rates will lead to lower returns and well governed companies might have a higher hurdle to continue outperforming.

The role of governance is highly integrated into our process. We explicitly rate Governance & Management as part of our Qualitative Scorecard. We believe companies rating higher on our Qualitative Scorecard will tend to generate higher returns on capital through time and therefore convert a greater proportion of accounting profits into free-cash-flow.

Free-cash-flow is the basis upon which we value all companies. Companies with significant divergence between advertised performance metrics and free-cash-flow often suffer from poor governance and are often expensive relative to sustainable free-cash-flow.

Importantly, we do not screen out companies based on governance, preferring to identify whether the upside of an investment is sufficient given the risk of permanent loss from potential governance failures. All else equal, we would have a positive conviction score where market prices are already below levels consistent with major governance failings. Conversely, if the market is complacent about governance risks, we would be more cautious. It is through identifying market misperceptions about governance that we think we have the capacity to generate excess returns.

Appendix 1: Engagement with Portfolio Companies

Introduction

At Merlon we focus on assessing the sustainability of a company’s free-cash-flow because we believe that is the basis on which companies should be valued. We also place emphasis on identifying market misperceptions and on downside valuation scenarios which we reflect in our “Conviction Score”.

We incorporate information garnered from engaging with company management, board members, competitors, suppliers, customers and third-party research providers in developing both our assessment of sustainable free-cash-flow and in arriving at Conviction Scores.

We are committed to engaging with portfolio companies on a broad range of issues including ESG where relevant. Engagement activities are carried out routinely by all Merlon portfolio managers and analysts. The outcomes of the engagement are reflected in our research which has a direct relationship with portfolio positioning.

Case studies highlighting our strong engagement track record are outlined in Appendix 2.

Effective Stewardship

Merlon recognises that investment managers play a key role in fulfilling stewardship obligations to ensure responsible management and robust corporate governance practices through engagement activities.

Shareholder stewardship is an assessment of whether a company’s senior management and board have, or are likely to act, in the best interests of shareholders. This includes an analysis of historical decision making, management and board effectiveness, remuneration structures, corporate governance, culture, financial controls, the personal integrity and track records of the individuals involved, long-term alignment and culture.

The Financial Services Council introduced its Internal Governance and Asset Stewardship code in January 2018. The code is a disclosure-based standard requiring members to articulate and promote their approach to internal governance and asset stewardship. Whilst Merlon is not required to adopt this code, we recognise the importance of internal governance and asset stewardship and appreciate that as investment managers we have the privilege to engage proactively with companies.

Management Engagement

We believe that engagement (both private and public) can be an important aspect of the investing process. There is usually a distinction between board engagement and management engagement.

Engagement with management is focused on understanding the company strategy and assessing the outlook for sustainable free-cash-flow and range of outcomes, including downside scenarios. Our frequency of engagement with management is naturally higher than with boards. An important part of our process is corroborating usually positive management views with former executives, competitors, suppliers and customers through our extensive independent expert network. We believe that verifying management views, and challenging these perspectives is our obligation as managers of capital.

Board Engagement & Voting

We aim to engage with the boards of all companies in which we have invested at least annually, in addition to those in which we might consider investing. The focus is to understand and encourage alignment and strong representation of shareholders.

A significant part of our engagement with boards occurs prior to AGMs. We research the recommendations of the proxy advisors prior to meeting. If we intend to vote against a board recommendation, we discuss this with the company prior to voting. If the board’s reasoning is sound, we may consider changing our view, however the engagement and discussion with company is key to understanding their perspective.

In terms of the nature of questions we might ask at a board level, while there will always be some specific to each company, there are some core questions relevant to all as outlined in Table 1 overleaf:

Table 1: Sample of engagement questions |

|

| Board composition and functioning

|

|

| Incentives

|

|

| Accounting

|

|

| Capital allocation |

|

| Environmental and social risks |

|

Source: Merlon

Approach to Voting

We provide recommendations to institutional clients and to the responsible entity for pooled funds. We draw on the views of Ownership Matters and ISS when determining our voting intentions. While we are inclined to follow the proxy advisors’ recommendations, on occasion our views may differ. For example, the proxy advisors recommended voting against many of the Harvey Norman 2019 AGM resolutions. Specifically, they recommended voting for a new independent director who we felt had no relevant experience to offer to the board and would have been extremely disruptive, so we voted in-line with the board recommendation.

We keep records of contentious voting issues, noting how and why we voted either against board recommendations and/or proxy advisors.

In 2019, 91.8% of our voting instructions were made in-line with board recommendations and 8.2% were against.

Third Party Engagement

In addition to board engagement and management engagement we also engage with third parties including:

- Other shareholders and investors;

- Regulators, with an example being active lobbying of the ASX to improve its listings rules to provide greater shareholder protection for minority shareholders (A Case Study in Poor Capital Allocation: The Need for Greater Shareholder Protections) and Divestments & Shareholder Rights);

- Investment banks and other advisors, including proxy and governance firms; and

- The media by providing public commentary or background material with the purpose of influencing better corporate governance.

Private vs Public Engagement

Our engagement will almost always be held privately, through emails, letters, face-to-face meetings, teleconferences etc. However, there are instances where we publicly express concerns if we feel it is in the best interests of shareholders and hence our investors. This has typically been in relation to critical issues (e.g. divestments, takeover approaches etc.) where we felt our concerns were not being adequately addressed and / or where we would like to garner the support of other investors.

Case studies highlighting our strong engagement track record are outlined in Appendix 2.

Engagement and ESG

We have a strong commitment to engaging on ESG issues. We seek to engage regularly with the management teams and boards of companies with the objective of better understanding their position and share ours on key ESG issues. We also believe it is important to assist them in understanding how we think about ESG in our investment process and how this can drive the sustainability of cashflow and mitigate downside scenarios into the future.

We incorporate environmental, social and governance (ESG) considerations into our assessment of sustainable free-cash-flow and in arriving at Conviction Scores. This means we are less likely to invest in companies if the market is complacent about ESG risks that we see as significant.

As part of this process and where relevant, we engage with management teams and boards of companies to understand their positions on key ESG issues and to influence or change their view where ours differs. We also believe it is important to assist companies in understanding how we think about the linkages between ESG related matters, sustainable free-cash-flow and the resultant the valuation of their businesses.

As part of our commitment to active ownership, Merlon is a signatory to the Principles for Responsible Investment (PRI). The PRI is the overarching framework of our ESG approach and we commit to the following:

- We will incorporate ESG issues into our investment analysis and decision-making processes;

- We will be active owners and incorporate ESG issues into our ownership policies and practices;

- We will seek appropriate disclosure on ESG issues from entitles in which we invest;

- We will promote acceptance and implementation of the PRI within the investment industry;

- We will work to enhance our effectiveness in implementing the PRI; and

- We will report on our activities and progress towards implementing the PRI.

Our commitment to the PRI Principle to be active owners is demonstrated through our engagement activities across our portfolio of investee companies. A sample of the specific ESG issues we might raise with companies is outlined in Table 2:

Table 2: Sample of specific ESG issues that may be raised with companies |

|

| Environmental

|

|

| Social

|

|

| Governance

|

|

Source: Merlon

Responsibility for Engagement

Within the investment team, we have a senior investment professional with overall responsibility for coordinating engagement activities and ensuring a consistent approach. The senior portfolio managers have ultimate responsibility for voting decisions. However, our general approach is to provide a high degree of autonomy, accountability and responsibility to responsible analysts.

As an owner-managed firm with significant co-investment alongside our clients, the investment team have a strong alignment with clients on engagement matters.

Tracking Engagement Activity

We keep a notes and records of company and other engagements and draw on these for future engagements and monitoring. We maintain proprietary qualitative scores, financial models and Conviction Scores on companies in our investible universe including scores specific to management and governance. These scores and models may be influenced by our engagement activities which in turn impact portfolio investment decisions.

Engagement activities are tracked and reported to our investors and the PRI annually. We have a weekly investment meeting to coordinate our engagement activity and resolve contentious issues.

Conflicts of Interest

In accordance with regulatory requirements, Merlon maintains a conflict of interest policy to ensure that any actual, potential and/or perceived conflict of interest that may arise both between itself and its clients, a staff member and a client and between clients are identified, prevented or managed and disclosed in the best interests of clients.

All Merlon staff are required to complete annual conflicts of interest training to ensure they have the appropriate understanding to identify and report conflicts of interest which can then be prevented or managed pursuant to its conflicts of interest framework.

Appendix 2: Engagement Case Studies

Case Study 1: AMP’s Life Insurance Sale

Governance issue: Poor capital allocation

On 25 October 2018, AMP announced the sale of its Australian and New Zealand wealth protection and mature businesses (AMP Life) for A$3.3b to Resolution Life. We believed the sale represented a destruction of shareholder value, as evidenced by the 28% decline in the share price in the two days following the announcement. Our engagement with the company was as follows:

Table 3: AMP engagement |

|

| Dates | Actions |

| 25 October 2018 |

|

| 27 October 2018 |

|

| October 2018 to April 2019 |

|

| 31 October 2018 |

|

| 1 November 2018 |

|

| 15 November 2018 |

|

| 31 March 2019 |

|

| 12 April 2019 |

|

| 30 July 2019 |

|

| 1 July 2020 |

|

Source: Merlon

Case Study 2: Boral’s acquisition of Headwaters

Governance issue: Poor capital allocation

On 21 November 2016, Boral announced the acquisition of Headwaters Incorporated – a US listed company – for US$24.25 per share or A$3.7b in total. The acquisition was funded by a mixture of debt and a $2.1b capital raising.

Table 4: Boral engagement |

|

| Dates | Actions |

| 1 December 2016 |

|

| 31 December 2016 |

|

| 2 August 2017 |

|

| June 2017 to September 2017 |

|

| December 2018 to June 2019 |

|

| 27 August 2019 |

|

| 1 November 2019 |

|

| 10 February 2020 |

|

| 15 June 2020 |

|

| 28 August 2020 |

|

| 28 September 2020 |

|

| 13 October 2020 |

|

| 15 October 2020 |

|

Source: Merlon

Case Study 3: Caltex’s takeover approach

Governance issue: Not acting in shareholder’s interests

On 28 November 2019, Caltex announced the receipt of a non-binding, indicative and conditional proposal from Alimentation Couche-Tard for $34.50 per share in cash. This followed an earlier proposal in October for $32 per share that was not disclosed. On 3 December 2019, Caltex announced that the Board had concluded that the proposal undervalued the company but offered to provide Alimentation Couche-Tard with selected non-public information to allow it to submit a revised proposal.

Table 5: Caltex engagement |

|

| Dates | Actions |

| 28 November 2019 |

|

| 4 December 2019 |

|

| 5 December 2019 |

|

| 6 December 2019 |

|

| December 2019 |

|

| 17 December 2019 |

|

| 13 February 2020 |

|

| 20 April 2020 |

|

Source: Merlon

Some other examples

Some other examples include formally engaging with the chair of Wotif in July 2014 and iINet in March 2015 to express our disappointment and urge the rejection of the low takeover offers from Expedia and TPG Telecom respectively; the chair of Seven West Media in April 2015 in relation to convertible preference shares that diluted the value of ordinary shares; and more recently publicly shared our disapproval of the Amaysim board’s support of the low takeover offer from Optus (The Strategic Value of Amaysim).