The AMP Valuation Case

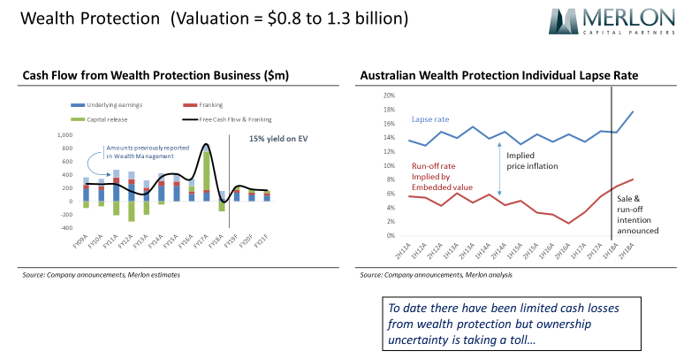

AMP have advised the sale of its insurance operations is “highly unlikely” to proceed on current terms due to challenges in meeting the condition precedent for Reserve Bank of New Zealand (RBNZ) approval.

We have been longstanding critics of the insurance sale from both valuation and governance perspectives as our investors and followers will be aware. We believe that terminating the transaction is in the best long-term interests of shareholders.

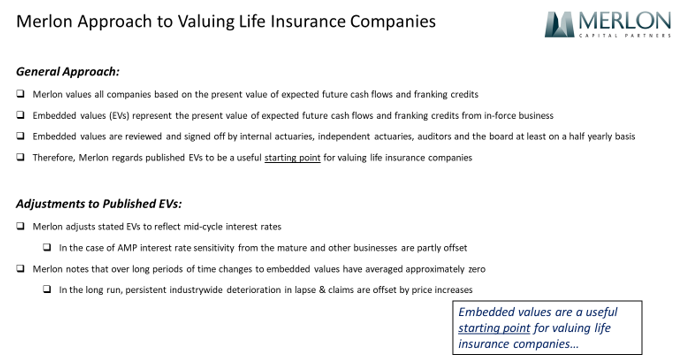

Nonetheless, the poor performance of the stock has prompted questions from many of our clients and other stakeholders so we thought it might be worthwhile outlining some of our thinking in relation to the segmental value of AMP.

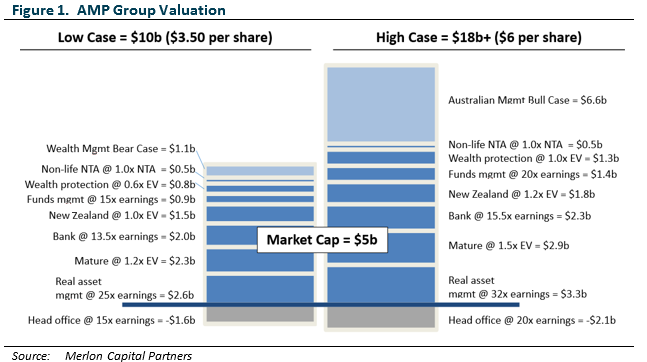

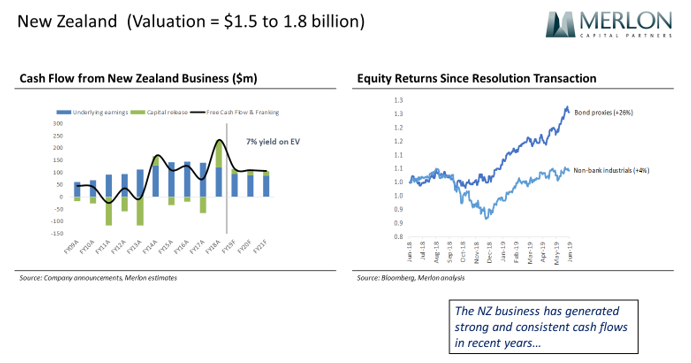

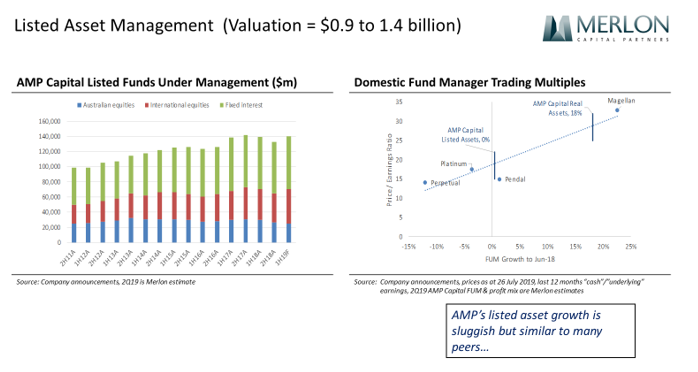

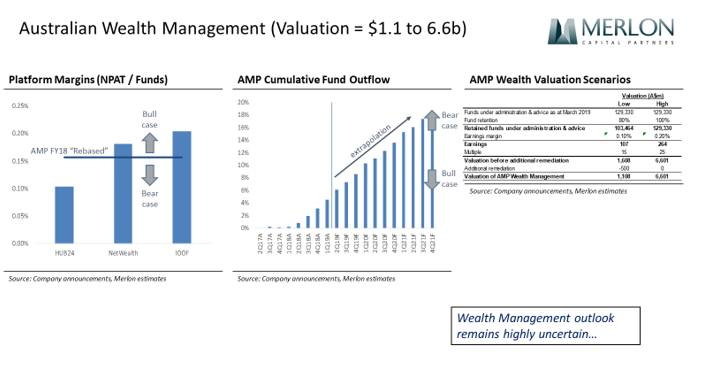

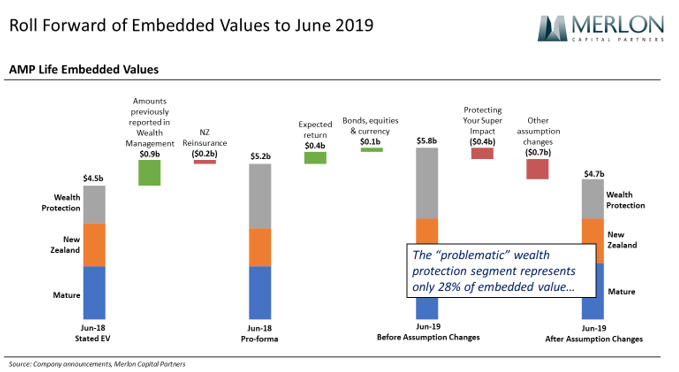

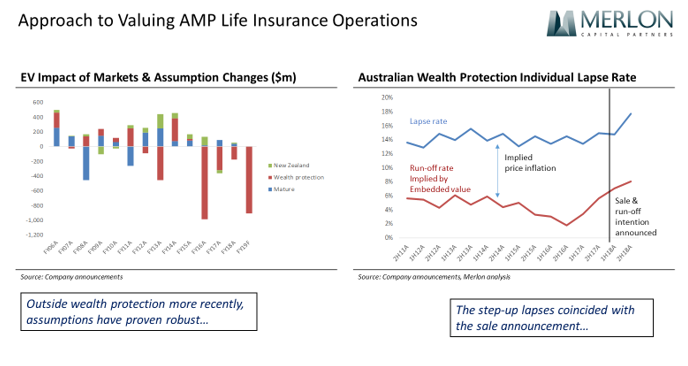

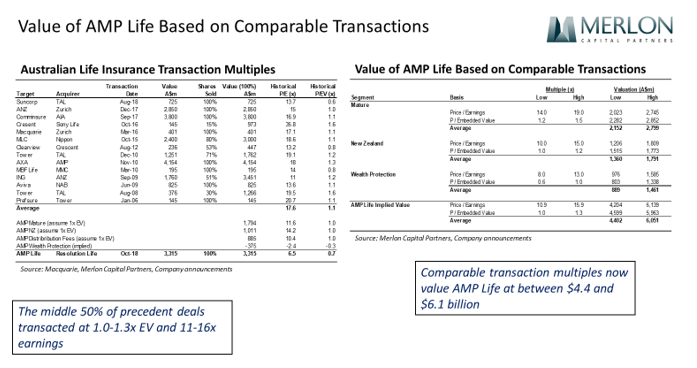

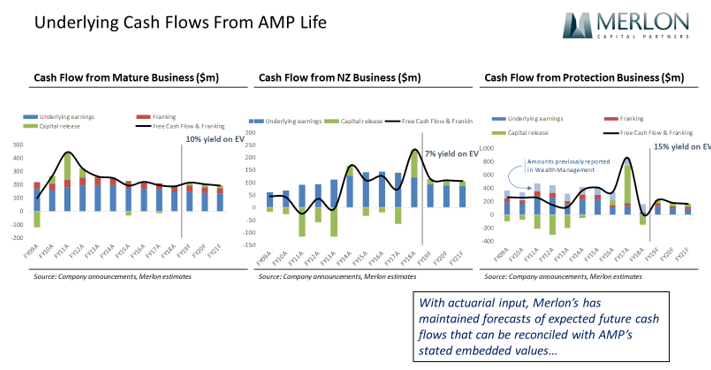

We currently value AMP at between $3.50 and $6.00 per share. The low end of this this valuation range ascribes very little value to the “problematic” Australian Wealth Protection and Wealth Management divisions and is still roughly double the company’s current market capitalisation. A more detailed analysis is attached.

It is easy to confuse a company with “problems” with a “bad investment”. A key investment lesson that we always return to is that a company with problems can still offer good returns if investor expectations are sufficiently low.

It is clear to us that in the case of AMP, expectations are very low. There is no telling whether expectations are at “rock bottom”. It is impossible to predict at what price the most panicked investor will sell. Yet, a large part of the investment community focus on trying to answer such questions. If AMP ultimately delivers on conservative expectations it will be a good investment. If it meets our expectations it will be a great investment.

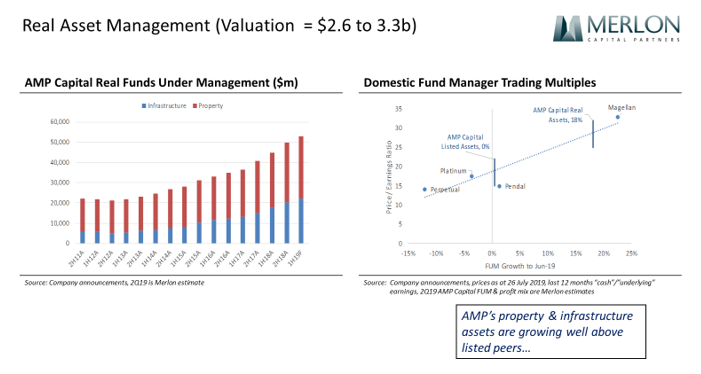

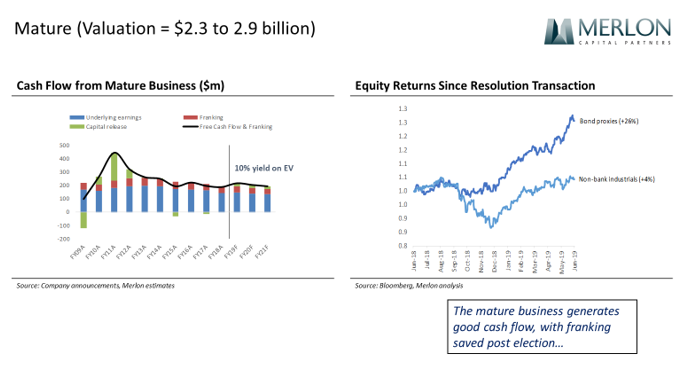

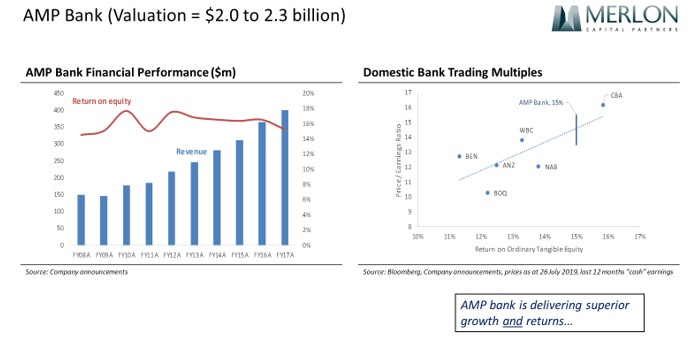

AMP Segment Valuation Highlights

Author: Hamish Carlisle, Portfolio Manager/Analyst

Disclaimer

Any information contained in this publication is current as at the date of this report unless otherwise specified and is provided by Fidante Partners Ltd ABN 94 002 835 592 AFSL 234 668 (Fidante), the issuer of the Merlon Australian Share Income Fund ARSN 090 578 171 (Fund). Merlon Capital Partners Pty Ltd ABN 94 140 833 683, AFSL 343 753 is the Investment Manager for the Fund. Any information contained in this publication should be regarded as general information only and not financial advice. This publication has been prepared without taking account of any person’s objectives, financial situation or needs. Because of that, each person should, before acting on any such information, consider its appropriateness, having regard to their objectives, financial situation and needs. Each person should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about the product. A copy of the PDS can be obtained from your financial planner, our Investor Services team on 133 566, or on our website: www.fidante.com.au. The information contained in this fact sheet is given in good faith and has been derived from sources believed to be accurate as at the date of issue. While all reasonable care has been taken to ensure that the information contained in this publication is complete and accurate, to the maximum extent permitted by law, neither Fidante nor the Investment Manager accepts any responsibility or liability for the accuracy or completeness of the information.