A Letter to AMP Directors…

Members of the Board of Directors

AMP Limited

33 Alfred Street

Sydney, NSW 2000

Re: The Board’s Approval to Sell Businesses to Resolution Life

Lady and Gentlemen:

As you may be aware, Merlon Capital Partners owns 25 million AMP Limited shares on behalf of our clients, being retail and institutional investors. Although not the largest AMP shareholder, Merlon is a high conviction manager with our investment in AMP representing a significant proportion of our portfolios which in turn also represent a significant proportion of our own personal wealth. By comparison, we note the 9 directors collectively own 234,371 AMP shares which are valued at a small fraction of the $3.3 million in directors’ remuneration paid by AMP during 2017.

We conduct our own detailed independent research and invest considerable resources and energy in developing a deep understanding of the value of the businesses we own. This allows us to patiently hold investments for long periods of time when many others are fearful, overly pessimistic, short term oriented and/or unwilling to deviate from popular opinion.

We are writing to inform you that we are extremely disappointed with the terms of AMP’s dilutive, under-priced and value destroying divestment of its Australian and New Zealand wealth protection and mature businesses. In the two trading days since the deal was announced, AMP’s market capitalisation has declined by $2.7b or 28%. Regardless of any “strategic merit”, the proposed divestment makes no economic sense relative to simpler alternatives such as doing nothing, and shows a reckless disregard for shareholders’ funds. We have held discussions with a number of much larger AMP shareholders who are similarly disappointed with this preposterous transaction.

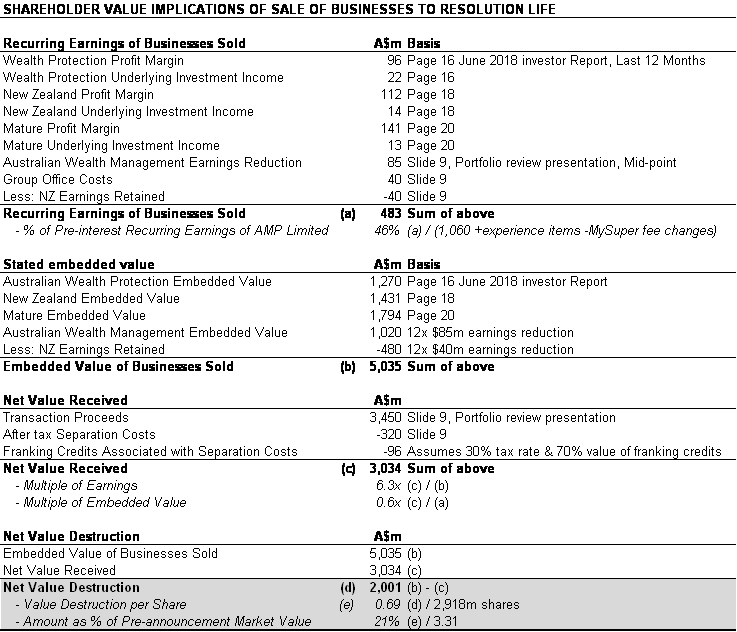

We believe AMP has significantly undervalued its wealth protection and mature businesses, in particular based on AMP’s own actuarial assessment of embedded value and as multiples of earnings and cash-flows foregone. As illustrated in the table overleaf, the transaction represents approximately 0.6x embedded value and 6.3x historic earnings. By comparison, this compares to a multiple of approximately 16x earnings that AMP paid for AXA in 2010 and an earnings multiple of approximately 17x for the Australian market. The discount is even larger on a cash-flow basis with the average Australian listed company trading on 23x last reported cash-flow.

The disclosure by AMP that “the total value equates to approximately 0.82x pro forma embedded value” was disingenuous, highly misleading, irreconcilable to any information disclosed by the company prior to the announcement and served only to deflect attention from the poor economics of the deal.

We have concerns regarding the Board’s determination to ignore the value of franking credits in its disclosure of the value of the transaction when such value had been explicitly included in AMP’s financial disclosures for many years and is clearly of value to shareholders.

In addition, we have concerns regarding the Board’s complicity in misrepresenting the profitability of various operating segments through internal transfer pricing which served to adversely distort the financial attractiveness of the Australian wealth protection businesses, and overstate the attractiveness of the advice business, in the eyes of analysts and investors for many years prior to the transaction. For example, in the absence of “internal distribution arrangements” (that appear to have had no commercial basis and were only disclosed upon announcement of the deal), the return on equity for the wealth protection business would have been closer to 20% rather than the 10% (before non-recurring experience items) advertised on page 16 of the company’s most recent investor report. The disclosure of such returns would have dramatically altered investor perceptions about the value of this business and the rationale to sell it.

It is simply unfathomable to us the board could consider it in the best interest of shareholders to sell businesses representing 46% of AMP’s recurring earnings before interest at such a low multiple and large discount to already written down embedded values.

We were assured in our discussions with the most senior executives of AMP that the actuarial valuations of the various businesses were taken very seriously and that a lot of thought, time and effort had gone into developing the various assumptions that underpinned these valuations over many, many years. We expressed willingness on multiple occasions to share our investment thesis and deeply considered views in relation to the long term value of AMP’s various components with management, directors and the Chairman of the Board around the time of his appointment. All shareholders would have been better served if management and the board allocated more time to test the opinions of long-term investors as opposed to conflicted investment bankers. Now, you have chosen to disregard the deeply considered views of your own actuaries and your shareholders in the interest of “reducing complexity” or “because this was the best offer on the table.”

Over the years we have unfortunately seen many boards allocate capital poorly, but we cannot recall a transaction as inept as this one. This is a particularly pertinent point in a situation where there was no pressing need to raise capital or divest assets. To the contrary, the strong run-off cash-flows and franking of the wealth protection and mature businesses might have diversified against adverse developments in the advice business. Further, it would appear to us current conditions are not ideal to be selling such assets with life insurance industry profits historically depressed, the major banks rushing to exit and potential for further favourable changes to sales-based commissions that might emerge following the Royal Commission. Any option to participate in the growth of the wealth protection industry in the event market conditions improve has been squandered.

We have concerns not only about the Board’s decision to sell the various businesses at the price proposed but also about its decision not to offer existing – and often long suffering – shareholders the ability to participate in realising the future value of these assets. This could have been achieved via an in-specie distribution, an initial public offering or simply retaining ownership of the businesses.

Your apparent disregard for accountability to the owners of AMP is reprehensible and the statement in your recent release that your soon to be inherited pool of shareholders’ capital “provides strategic flexibility for a range of options including growth investments” in light of the company’s track record reflects a level of hubris reminiscent of AMP’s prior history of buying disparate assets at the peak of their popularity with reckless abandon.

The proposed value destroying divestment of AMP’s Australian and New Zealand wealth protection and mature businesses, together with your failure to adequately consult shareholders in the making of such decisions have convinced us you do not have the best interests of shareholders’ at heart or are lacking the financial acumen required to make decisions of this magnitude. We are deeply concerned more value destruction may be in store if shareholders do not revolt against this transaction and seek assurances the Board of Directors will sensibly allocate capital on a go forward basis.

Because your actions have exceeded the bounds of sensible decision making and we have lost confidence that the transaction or its implications were or are well understood by the Board of Directors, we seek the following:

- That the directors disclose to the market the embedded value of the assets to be sold reconciled with and presented on a consistent basis to the embedded value disclosures as presented in the company’s most recent investor report;

- That the directors disclose to the market the cash flow and franking credit projections (presented on an annual basis) that give rise to the embedded value calculation referred to in point 1 above;

- That the directors disclose to the market pro-forma adjustments to the table of eligible and surplus capital on page 24 of AMP’s most recent investor report showing the impact of the transaction both initially and under a scenario where the “income generating equity investments” and preference shares are liquidated into cash;

- That the directors disclose to the market the recurring earnings and franking credits for the divested businesses on a debt-free basis and before any earnings on the proceeds from sale;

- That the directors disclose to the market all legal avenues under which the proposed sale may not proceed and associated costs;

- That the directors disclose to the market any independent advice assessing the shareholder value implications of the transaction as well as minutes of any meetings of the board of directors where such advice was discussed. In particular, we are interested in understanding whether the directors sighted and considered the cash flow and franking credit projections utilised in the published embedded values for the assets to be divested or whether directors relied on valuation methodologies that were linked to multiples of embedded value or multiples of earnings;

- That the directors provide to the market a firm commitment that the proceeds of the sale will be returned to shareholders as soon as funds become available and that such funds will not be redeployed into growth investments that exceed AMP’s normal accumulation of retained earnings.

We are prepared to lobby other investors to convene an Extraordinary General Meeting calling for the above mentioned undertakings and/or a board spill if the matters are not adequately addressed within the next week. We reserve the right to publish this document on the internet and distribute it to our clients, media outlets and other investors.

Sincerely