COVID-19 – One Year On

In our COVID-19 Roadmap letter from April 2020, we outlined our approach to the early stages of the global pandemic. One year on, we reflect on the impact it has had on the world and for the companies we research.

As It Happened

- COVID-19 became the worst global pandemic since the beginning of the 20th century

- Australia’s June quarter GDP fell 7.5% and entered the first recession since 1990

- Re-evaluating Our Thoughts:Between 21st of February and 27th of March 2020, the ASX 200 index fell 32%

- The market bottomed after just three months, significantly faster than prior crises. In comparison, it took 16 months to base during the global financial crisis which began in 2008

- As of March 2021, the ASX 200 has recovered to be within 5% of its February peak.

- The Australian Federal Government announced an unprecedented $130bn stimulus program in response to COVID 19 coronavirus pandemic

- Australia’s response and health outcomes are significantly better compared to the rest of the world, with its “elimination” strategy reducing cases to low single digits.

- Unlike credit crunches that usually accompany recessions, low interest rates, availability of credit from “Team Australia” banks, extraordinary fiscal support and cashed up household budgets have insulated our economy from widespread defaults

Re-evaluating Our Thoughts:

In the early stages of the pandemic, we cautioned against making predictions or speculating on the nature of the coronavirus and its impacts. Given the unprecedented nature of this pandemic, we stuck to the facts and the fundamentals of our investing philosophy. We think it is important to revisit our original assertions and the implications they have as we navigate through the recovery.

90% of a company’s value is dependent on cash-flows beyond one year into the future. Our unwavering focus on the long term, sustainable cash flows remains the foundation of our investment approach.

Times of panic have proven to be the best times to add to equity portfolios. We saw the market react fearfully as the pandemic began to spread and valuations began dramatically widening between perceived COVID “winners” and “losers”. As a result, we were able to buy positions in some companies at the largest discounts to our valuation that we have seen since the inception of Merlon. Examples of additions to the portfolio during this time included Star Entertainment Group, Unibail-Rodmaco-Westfield and Oil Search.

Temporary losses can be made permanent by panicked decision making or excessive levels of debt. At Merlon, we undertake deep research into understanding the companies we invest in, which helps us to avoid making panicked investment decisions during times of stress. We define risk as the risk of a permanent loss of value, rather than the risk of short term underperformance. While indebted COVID-impacted companies were particularly volatile, we were active in engaging with their management and supported those with additional capital where we saw appealing long-term value. Examples included late night and weekend conversations with companies such as Flight Centre, Ooh Media and QBE.

Disaggregating COVID Performance

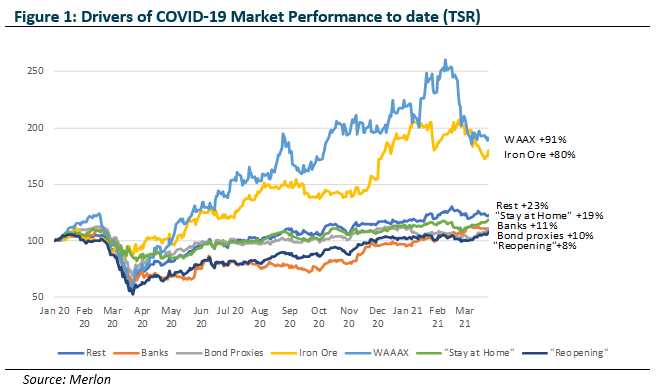

Entering the pandemic, we observed the main drivers of the market return came via the re-rating of the technology, “bond proxy” and iron ore sectors which, particularly for the first two, had been exacerbated by low interest rates and by extension investors lowering their return expectations relative to risk. In the case of iron ore, COVID further compounded Vale’s supply deficiencies in the wake of its dam disruption, but this is also likely to be a temporary effect. Furthermore, the growing number of projects being sanctioned as a result of the temporarily high prices is increasingly likely to be a long term overhang on the market relative to what was likely pre-COVID.

Unlike past crises, the market correction has not completely reversed the fortunes of cheaper “value” stocks that have lagged the market. WAAAX “technology” stocks and iron ore continue to perform strongly whilst “bond proxies” and “stay at home” stocks which did well early in the pandemic have lagged. Pleasingly, we have seen signs of “value” stocks catching up, highlighted by the recovery of banks and “reopening” cyclical sectors. We maintain high conviction in the continued outperformance of these “value” sectors and see ample opportunity to invest in companies trading well below their long term cash flow-based valuations.

Where to From Here?

We will get through the Covid-19 crisis. We are now in the recovery phase – we have vaccines being rolled out globally, more-developed protocols to managing viral spread and strong (but reducing) stimulus. We are on track to returning to ordinary life and while there may be some structural changes in specific industries, we believe most will return to pre-COVID norms.

Possibility of higher inflation and rising interest rates. Significant government stimulus, pent up household savings, improving unemployment and upward pressure on supply costs set a fertile environment for higher inflation. We explore the further implications of inflation in our paper on Interest Rates & Inflation.

Concerns about tighter fiscal & macro-prudential policy. The scale of government spending was unprecedented and helped many companies avoid collapse. As the economy recovers and unemployment eases, the “load” will shift to the broader economy. An area of concern is heavily indebted companies and households that may struggle as policy initiatives fade. Also of concern is booming asset prices fuelled by low interest rates. With central banks bent on keeping rates lower for longer we see a highly likelihood of macro-prudential tightening. This has already happened in New Zealand. With bank stocks trading higher than pre-pandemic levels the sector looks vulnerable and still suffers from saturated household credit which will inhibit long term growth.

Continued earnings recovery of cyclical stocks. While earnings recovery has been positive, many cyclical sectors are yet to return to “pre-COVID” earnings. The reopening of international borders and increasing global economic activity will provide substantial benefit to cyclical companies, such as refiner-marketer companies including Ampol, Viva Energy, and oil exposed names such as Oil Search, Woodside Petroleum and Origin Energy.

Super-normal COVID profits retrace from “stay at home” stocks. We believe it is likely that people will return to their ‘normal’ way of life prior to COVID-19. Elevated spending on healthcare, groceries, furniture, and other “stay-at-home” categories will revert down as consumers shift back towards travel, entertainment and other goods and services “unlocked” through border re-openings.

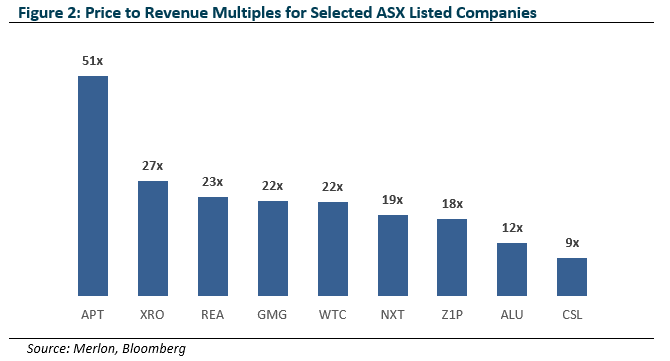

Parts of the market could be in bubble territory. So-called “technology” companies and “defensive-growth” stocks are absurdly valued in our view. This is a global phenomenon fuelled by cheap money, massive inflows into venture capital, leveraged investor activity, retail speculation, the emergence of Special Purpose Acquisition Companies (“SPACs”) and, locally, a boom in “pre-IPO” funds. Chasing these types of investments conflicts with our approach of buying established companies where valuations can be justified on the basis of long-term sustainable cash flow and where the market is overly pessimistic about the company’s growth and risk outlook.

We have seen this before. In March 2002, after Sun Microsystemsmp had lost around 90% of its market value the company’s founder Scott McNealy said this:

“…two years ago we were selling at 10 times revenues when we were at $64. At 10 times revenues, to give you a 10 year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees.

“That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain my current revenue run rate. Now, having done all that, would any of you like to buy my stock at $64? Do you realise how ridiculous those basic assumptions are? You don’t need transparency. You don’t need footnotes. What were you thinking?”

Conclusion:

Economic conditions are certainly improving but valuations remain frothy in some parts of the market and the risk of inflation and higher interest rates threaten asset prices. In other parts of the market, we see appealing valuation upside and limited downside in specific companies in sectors such as energy, financials and real estate investment trusts (REITs), despite a degree of recovery seen to date.

Our portfolio is focused on long-term value based on sustainable free cash-flow and we weigh every decision we make against the risk of permanent loss. While it is impossible to predict with certainty the timing of economies “re-opening” or higher inflation and interest rates, our portfolio is prepared irrespective of the conditions which may unfold.

Author: Joey Mui, Analyst/Portfolio Manager