COVID-19 Roadmap

Dear Fellow Investors

On behalf of the team at Merlon Capital Partners, our thoughts go out to everyone who has been directly impacted by the Coronavirus and especially to those who have had to endure the loss of loved ones. The pandemic can be deadly which makes it absolutely critical that we all follow the advice and precautions being put in place to protect the most vulnerable.

There is no shortage of analysis and predictions about when the rate of growth of the virus will flatten out, disruptions will ease, and markets will bottom. We only need to look at how things have developed over the last two weeks to know how speculative such analysis can be and how wrong it can be to compare the experience of Asian countries to what we are seeing in parts of Europe and the US.

What we know is this:

90% of the value of companies is dependent on cash-flows beyond 1 year into the future. It is an unwavering focus on long dated cash flows that forms the foundation of our investment approach.

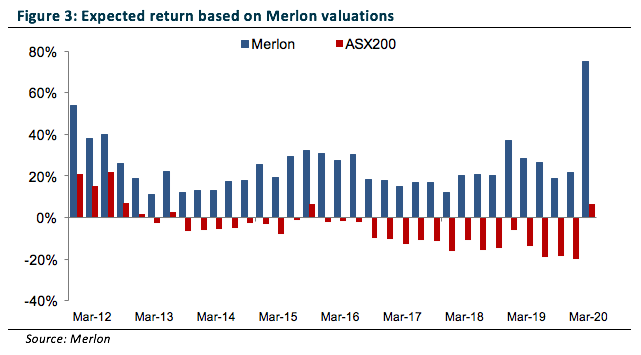

Times of panic have proven to be the best times to add to equity portfolios. Buying stocks at reasonable levels relative to history has always paid off for the long-term investor. We are strongly cautioning our investors not to do anything rash. In fact, across our team we have added to holdings in our funds and the market.

Temporary losses can be made permanent by panicked decision making or excessive levels of debt. Given the role of debt in exacerbating losses it is no surprise that that some of Australia’s most indebted companies have been the most volatile. We comment on the role of debt further below.

We will get through the Covid-19 crisis. There will be a vaccine, herd immunity will develop and ordinary life will bounce back. In the meantime, policy response is already and will be extraordinary and unprecedented. This is a deadly enemy we are dealing with and in the end, we fear, will be remembered more by the human tragedy than the financial losses.

Australia is in a vastly better position to deal with the crisis than the US. We have a better government that is listening to expert advice, bipartisan policy support, a better fiscal position, a stronger financial system and a vastly superior health system.

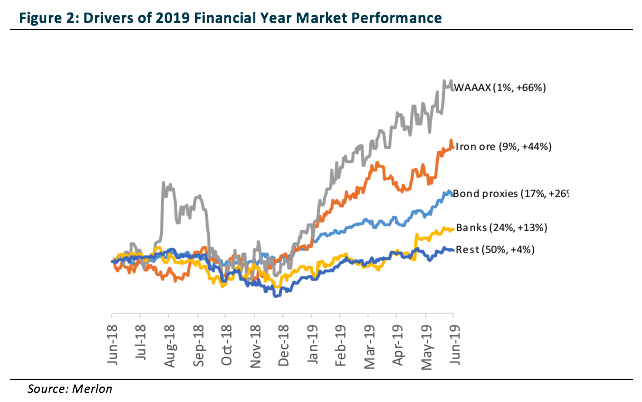

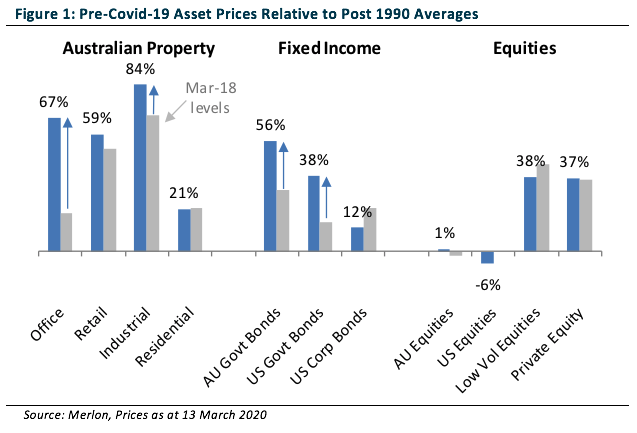

Asset prices were historically high leading into the current crisis. Interestingly the most historically over-valued asset classes have not been punished much more than the market at large so far into this sell-off which has been broad based.

Pre-Covid-19 Asset Prices

Property, risky fixed income and unlisted assets had “re-rated” in the years leading into the current episode.

So had the tech sector with record amounts of venture capital chasing ever increasing public market valuations. Investors were treating certain parts of the equity market as “bond proxies” and in doing so were placing a low price on risk.

Thinking about risk:

We define risk as the risk of a permanent loss of value. The way many professional fund managers and corporate boards think about risk is very different to the way we think about risk. We define risk as the risk of a permanent loss of value, not the risk of short-term share price underperformance relative to a benchmark.

Risk of permanent loss is exacerbated by panic, misaligned incentives and leverage. Panic swings fast from fear of losing money to fear of missing out on the bounce. Professional fund managers and corporate management paid bonuses based on short term performance relative to an index or a peer group are hard-wired to take excessive levels of risk (“heads I win, tails you lose”). Such incentives are grossly misaligned with end investors and simply do not exist at Merlon Capital.

Calls from banks and debt holders can force companies and investors, that in the absence of leverage, would see no long-term permanent loss to be bankrupt. Given the role of debt in exacerbating losses it is no surprise that some of Australia’s most indebted companies have been the most volatile in recent weeks.

Our approach to dealing with debt is simple, we take the view that it needs to be repaid. With the exception of banks, which we deal with separately below, for every company in our portfolio and under our coverage we deduct the full value of debt from what we think the company would otherwise be worth.

The risk of permanent loss is mitigated by owning undervalued assets. This is not to say that undervalued assets cannot fall more than expensive assets over short periods of time. In fact, in the current episode the reverse has been true. But in the long term, the market is a “weighing machine” not a “popularity machine”.

Liquidity plays an important role. Unlisted property, infrastructure assets and corporate debt were historically expensive coming into the current episode and already we are seeing valuation mark-downs. When all is said and done, if listed assets are cheaper than unlisted assets investors will sell unlisted assets and buy listed assets. In the long term, the market is a “weighing machine”.

The Hedge Overlay has provided protection to the falls in the underlying share portfolio. The Fund is constructed to deliver a risk profile equivalent to a portfolio with 70% equity exposure and 30% cash exposure. This is achieved by “protecting” 30% of a fully invested equity portfolio using put and call options. The objective is to retain exposure to fully franked dividends over the entire portfolio without taking on undue risk profile.

As it did in the GFC and every other market downturn, the hedge overlay is contributing strongly.

Our portfolio:

Rest assured, our philosophy and process have not changed. We take a long-term view, focus on long-term value based on Sustainable Free-Cash-Flow and weigh up every decision we make against the risk of permanent loss.

In the absence of leverage, the risk of permanent loss is low. Remember, we will get through the Covid-19 crisis. Also remember that for every single investment we made coming into this crisis we fully deducted the debt from our valuations in developing our investment view.

Like every cycle, the property sector came into this episode expensive and leveraged. We came into this cycle without REIT exposure and – with the exception of a small opportunistic purchase this month – we remain largely unexposed. This is not to say we won’t add more exposure but only after fully deducting the value of any debt in developing our investment case.

No companies are more leveraged than the banks. Leverage is the enemy of the investor seeking to avoid permanent loss. The good news for Australian equity investors who in general remain absurdly exposed to the banking sector is that the banks survival is critical to the “whatever it takes” strategy to get through the Covid-19 crisis.

The bad news is this doesn’t guarantee the banks will be good investments. Make no mistake, we will have a recession. And there has never been a meaningful recession in any economy anywhere without bank-failures or near-bank-failures that wipe out equity owners.

At best, there is a non-trivial risk that the banks emerge with significant non-performing loan portfolios and lower profits due to constraints by governments in their ability to enforce security and charge commercial rates of interest and late fees to customers.

We did not hold Macquarie Bank coming into this crisis and have reduced our relatively modest major bank exposure to an immaterial level in recent weeks.

Dry powder. We regard it as sensible to be measured and selective about how we invest through this downturn and currently hold more cash than we have in the past. This is balanced by holdings in fund managers which while their profits are sensitive to market movements their balance sheets are unleveraged, mitigating the risk of permanent loss.

This risk of being too conservative is simply that we might not make as much money as we would have otherwise. But we’ll still make money and given the opportunities being thrown up in the panic we’ll still probably be better off than we would have been had the Covid-19 crisis never emerged.

Hedge Overlay. The hedge overlay will continue to insulate the Merlon Australian Share Income Fund should the market continue to decline. We do not seek to “time” markets and as such will continue to remove 30% exposure via this overlay.

Alignment:

Rest assured we have considerable amounts of our own funds invested alongside our investors. We also own the majority of our firm. We have added to our own investments in recent weeks because of the amazing opportunities the crisis is presenting for long term investors.

We reiterate, that this is a deadly enemy we are dealing with and in the end will probably be remembered more by the human tragedy than the financial losses. We are working extraordinarily hard – from our homes – to ensure that any financial losses incurred are temporary and not permanent.