Reinventing Value Investing

We were interested to read NYU Professor Aswath Damodaran’s series of articles on value investing that advocated a “New Paradigm for Value Investing”. We thought it would be worthwhile to reflect on our approach and whether it needed to be refined to incorporate the various changes Damodaran advocates.

In working through this exercise, most notable was the extent to which Damodaran’s suggested changes are aligned with our (now more than 10 year old) approach to investing. Consistent with Damodaran’s thinking:

We don’t pin our hopes on price-to-earnings or price-to-book ratios but rather focus on cash-flow, growth (emphasis on sustainability) and risk (valuation is always a range).

We are not averse to forecasting, provided we acknowledge associated uncertainties. In contrast many value investors have tended to avoid growth companies where you have to grapple with forecasting in favour of mature companies with tangible assets.

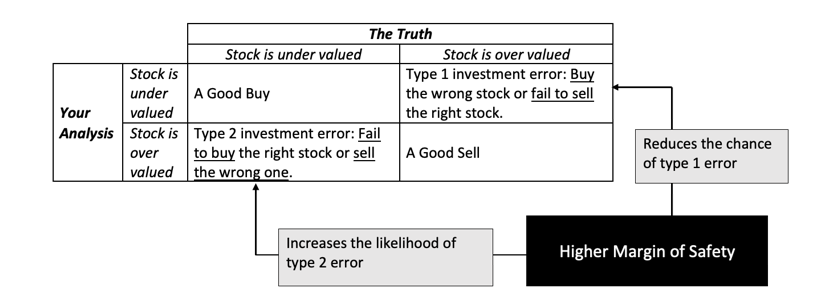

“Margin of safety” is not our substitute risk measure. Rather we combine our proprietary valuation signal based on sustainable-free-cash-flow with a “Conviction” score which considers risk to our base case valuations but most importantly reflects our view of risk bias to consensus expectations. We measure portfolio risk statistically on a daily basis and weigh large exposures against relevant Conviction scores.

We absolutely never take accounting numbers at face value with our focus is on the cash flow statement rather than measures of “advertised” earnings. Listed companies do a good job singing the virtues of such advertised metrics often with advisers, brokers, analysts, journalists and other commentators cheering on from the sidelines. Often these advertised metrics form the basis for variable remuneration prompting management and board members to join the chorus.

We are appropriately diversified with strict single stock, sector and liquidity limits that give risk to a portfolio of 30-40 names. Our reasoning for maintaining this level of diversification has always been built on the presumption that any investment, no matter how well researched is exposed to mistakes.

We recognise that markets are mostly efficient and that cheap stocks are always cheap for a reason. So we spend most of our time trying to understand why stocks are excessively cheap or expensive and asking ourselves how our views differ from popular opinion. We reflect this risk through our “Conviction Scores”

In summary, we are not “traditional” value investors and our approach has been consistent through time. While we need to constantly test and refine our process, at its core is a valuation basis premised on a range of long-term sustainable-free-cash-flow scenarios combined with an assessment of whether market expectations have become too pessimistic.

Historical Context

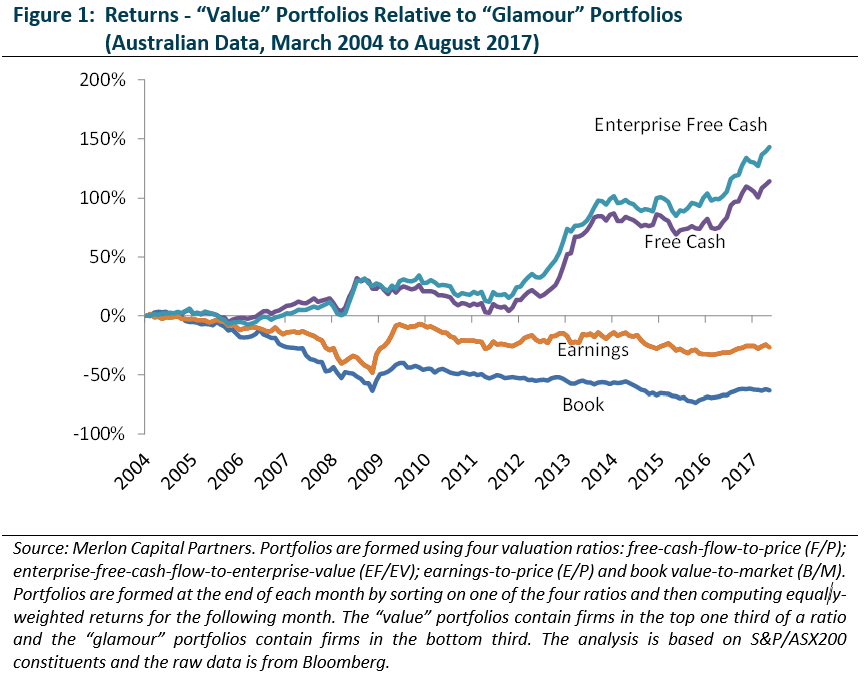

We wrote a series of articles in 2017 providing some perspectives on value investing in Australia. In the first paper we concluded that value investing on the basis of free-cash-flow has performed well through a number of market cycles and has displayed low levels of volatility when compared to traditional classifications of value such as earnings, book value and dividends.

In the second paper, we began to explore the question of why value strategies based on free-cash-flow outperform the broader market. Consistent with our philosophy, we presented findings that show a linkage between value investing on the basis of free-cash-flow and earnings quality and went on to dismiss the notion that value investing is “riskier” than passive alternatives.

In the third paper, we discussed some behavioural biases in investor risk assessments and expectations. We also point to various elements of the Merlon investment process, structure and culture that are aimed at minimising our exposure to these biases.

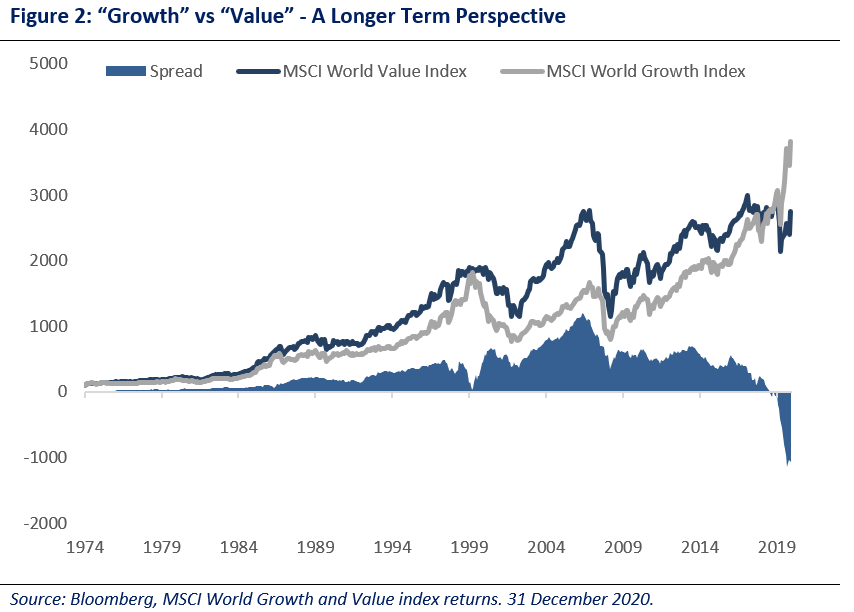

Since that time we have seen marked underperformance of “value” strategies relative to “growth” strategies across the globe. Among other indices this is evident in the spread between the MSCI World Value Index and the MSCI World Growth Index.

The extent of underperformance has prompted many commentators and institutional investors to question the role of value investing in portfolio construction.

Damodaran’s “Musings on Markets”

“I believe that value investing has lost its edge, partly because of its dependence on measures and metrics that have become less meaningful over time and partly because the global economy has changed, with ripple effects on markets. To rediscover itself, value investing needs to get over its discomfort with uncertainty and be more willing to define value broadly, to include not just countable and physical assets in place but also investments in intangible and growth assets.”

Aswath Damodaran, 23 Oct-2020

Stern School of Business at NYU

On 23 October 2020, NYU Professor Aswath Damodaran published the third in series of articles on value investing the final of which we have reprinted below.

Value Investing III: Requiem, Rebirth or Reinvention?

If you have had the endurance to make your way through my first two posts on value investing, I compliment you on your staying power, but I am sure that, if you are a value investor, you have found my take on it to be unduly negative. In this, my third post, I want to explain why value investing is in trouble and point to ways in which it can be reinvented, to gain new life. I am sure that many of you will disagree both with my diagnosis and my solutions, but I welcome your points of view.

Value Investing: Has it lost its way?

I have never made the pilgrimage to the Berkshire Hathaway meetings, but I did visit Omaha, around the time of the annual meeting, a few years ago, to talk to some of the true believers who had made the trek. I do not think that I will be invited back again, because I argued in harsh terms that value investing had lost its way at three levels.

- It has become rigid: In the decades since Ben Graham published Security Analysis, value investing has developed rules for investing that have no give to them. Some of these rules reflect value investing history (screens for current and quick ratios), some are a throwback in time, and some just seem curmudgeonly. For instance, value investing has been steadfast in its view that companies that do not have significant tangible assets, relative to their market value, and that view has kept many value investors out of technology stocks for most of the last three decades. Similarly, value investing’s focus on dividends has caused adherents to concentrate their holdings in utilities, financial service companies and older consumer product companies, as younger companies have shifted away to returning cash in buybacks.

- It has become ritualistic: The rituals of value investing are well established, from the annual trek to Omaha, to the claim that your investment education is incomplete unless you have read Ben Graham’s Intelligent Investor and Security Analysis to an almost unquestioning belief that anything said by Warren Buffett or Charlie Munger has to be right.

- It has become righteous: While investors of all stripes believe that their “investing ways” will yield payoffs, some value investors seem to feel entitled to high returns because they have followed all of the rules and rituals. In fact, they view investors who deviate from the script as shallow speculators, but are convinced that they will fail in the “long term”.

Put simply, value investing, at least as practiced by some of its advocates, has evolved into a religion, rather than a philosophy, viewing other ways of investing as not just misguided, but wrong and deserving of punishment.

A New Paradigm for Value Investing

For value investing to rediscover its roots and reclaim its effectiveness, I believe that it has to change in fundamental ways. As I list some of these changes, they may sound heretical, especially if you have spent decades in the value investing trenches.

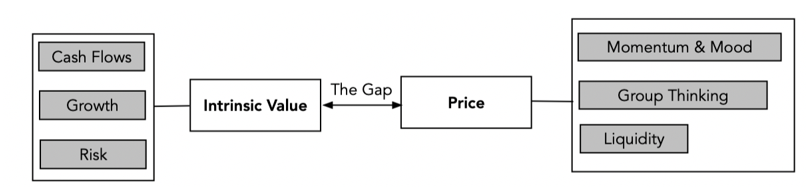

- Be clearer about the distinction between value and price: While value and price are often used interchangeably by some market commentators, they are the results of very different processes and require different tools to assess and forecast.

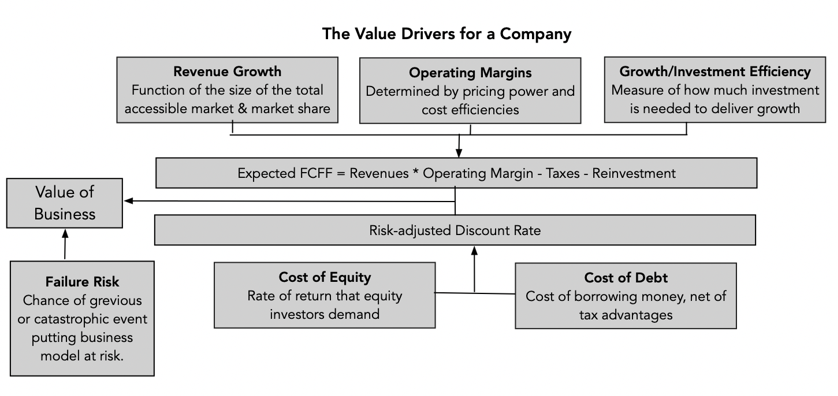

Value is a function of cash flows, growth and risk, and any intrinsic valuation model that does not explicitly forecast cash flows or adjust for risk is lacking core elements. Price is determined by demand and supply, and moved by mood and momentum, and you price an asset by looking at how the market is pricing comparable or similar assets. I am surprised that so many value investors seem to view discounted cash flow valuation as a speculative exercise, and instead pin their analysis on comparing comparing on pricing multiples (PE, Price to book etc.). After all, there should be no disagreement that the value of a business comes from its future cash flows, and the uncertainty you feel about those cash flows, and as I see it, all that discounted cash flow valuation does is bring these into the fold:

Value is a function of cash flows, growth and risk, and any intrinsic valuation model that does not explicitly forecast cash flows or adjust for risk is lacking core elements. Price is determined by demand and supply, and moved by mood and momentum, and you price an asset by looking at how the market is pricing comparable or similar assets. I am surprised that so many value investors seem to view discounted cash flow valuation as a speculative exercise, and instead pin their analysis on comparing comparing on pricing multiples (PE, Price to book etc.). After all, there should be no disagreement that the value of a business comes from its future cash flows, and the uncertainty you feel about those cash flows, and as I see it, all that discounted cash flow valuation does is bring these into the fold:

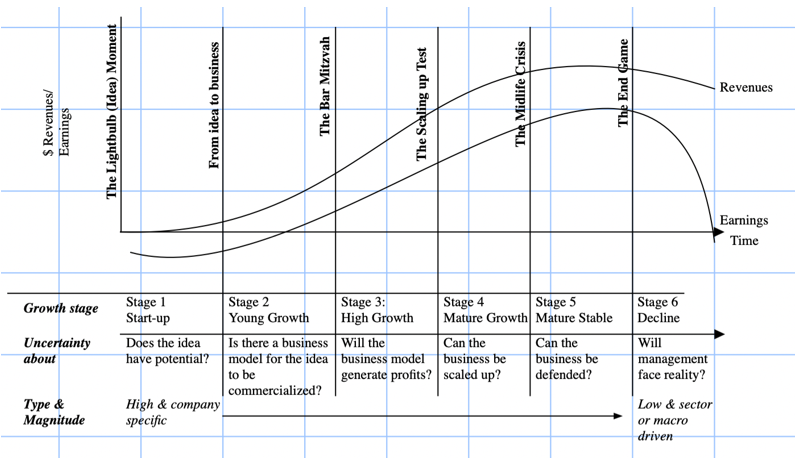

It is true that you are forecasting future cash flows and trying to adjust for risk in intrinsic valuation, and that both exercises expose you to error, but I don’t see how using a pricing ratio or a short cut makes that error or uncertainty go away. - Rather than avoid uncertainty, face up to it: Many value investors view uncertainty as “bad” and “something to be avoided”, and it is this perspective that has led them away from investing in growth companies, where you have to grapple with forecasting the future and towards investing in mature companies with tangible assets. The truth is that uncertainty is a feature of investing, not a bug, and that it always exists, even with the most mature, established companies, albeit in smaller doses.

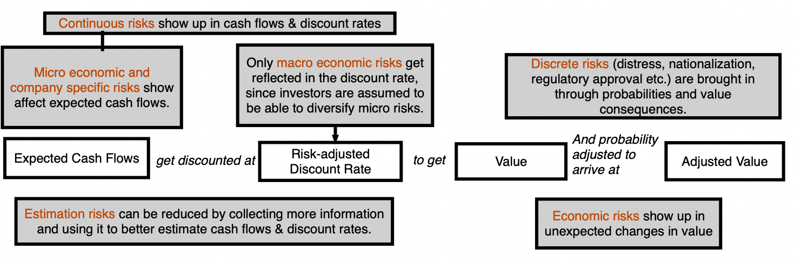

While it is true that there is less uncertainty, when valuing more mature companies in stable markets, you are more likely to find those mistakes in companies where the uncertainty is greatest about the future, either because they are young or distressed, or because the macroeconomic environment is challenging. In fact, uncertainty underlies almost every part of intrinsic value, whether it be from micro to macro sources:

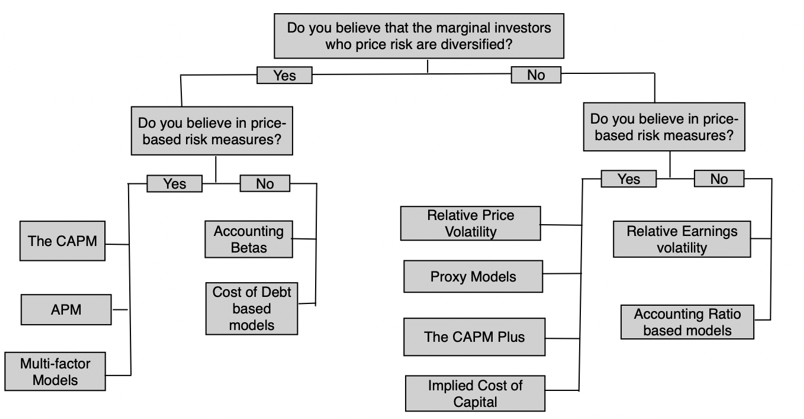

To deal with that uncertainty, value investors need to expand their tool boxes to include basic statistical tools, from probability distributions to decision trees to Monte Carlo simulations. - Margin of safety is not a substitute risk measure: I know that value investors view traditional risk and return models with disdain, but there is nothing in intrinsic value that requires swearing allegiance to betas and modern portfolio theory. In fact, if you don’t like betas, intrinsic valuation is flexible enough to allow you to replace them with your preferred measures of risk, whether they be based upon earnings, debt or accounting ratios.

For those value investors who argue that the margin of safety is a better proxy for risk, it is worth emphasizing that the margin of safety comes into play only after you have valued a company, and to value a company, you need a measure of risk. When used, the margin of safety creates trade offs, where you avoid one type of investment mistake for another:

As to whether having a large MOS is a net plus or minus depends in large part on whether value investors can afford to be picky. One simply measure that the margin of safety has been set too high is a portfolio that is disproportionately in cash, an indication that you have set your standards so high that too few equities pass through. - Don’t take accounting numbers at face value: It is undeniable that value investing has an accounting focus, with earnings and book value playing a central role in investing strategies. There is good reason to trust those numbers less now than in decades past, for a few reasons. One is that companies have become much more aggressive in playing accounting games, using pro forma income statements to skew the numbers in their favor. The second is that as the center of gravity in the economy has shifted away from manufacturing companies to technology and service companies, accounting has struggled to keep up. In fact, it is clear that the accounting treatment of R&D has resulted in the understatement of book values of technology and pharmaceutical companies.

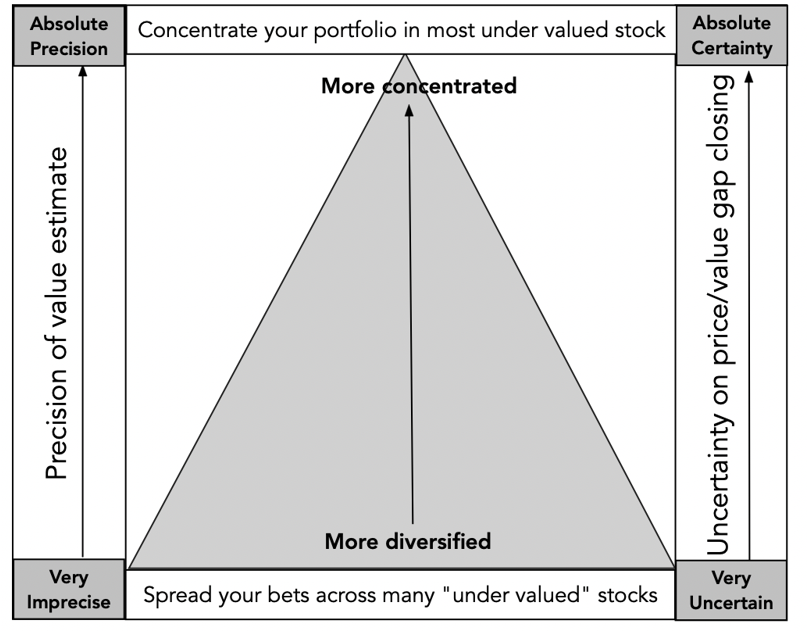

- You can pick stocks, and be diversified, at the same time: While not all value investors make this contention, a surprisingly large number seem to view concentrated portfolios as a hallmark of good value investing, arguing that spreading your bets across too many stocks will dilute your upside. The choice of whether you want to pick good stocks or be diversified is a false one, since there is no reason you cannot do both. After all, you have thousands of publicly traded stocks to pick from, and all that diversification requires is that rather than put your money in the very best stock or the five best stocks, you should hold the best thirty or forty stocks. My reasoning for diversification is built on the presumption that any investment, no matter how well researched and backed up, comes with uncertainty about the payoff, either because you missed a key element when valuing the investment or because the market may not correct its mistakes. In a post from a few years ago, I presented the choice between concentration and diversification in terms of those two uncertainties, i.e., about value and the price/value gap closing:

I think that value investors are on shaky ground assuming that doing your homework and focusing on mature companies yield precise valuations, and on even shakier ground, when assuming that markets correct these mistakes in a timely fashion. In a market, where even the most mature of companies are finding their businesses disrupted and market momentum is augmented by passive trading, having a concentrated portfolio is foolhardy. - Don’t feel entitled to be rewarded for your virtue: Investing is not a morality play, and there are no virtuous ways of making money. The distinction between investing and speculating is not only a fine one, but very much in the eyes of the beholder. To hold any investing philosophy as better than the rest is a sign of hubris and an invitation for markets to take you down. If you are a value investor, that is your choice, but it should not preclude you from treating other investors with respect and borrowing tools to enhance your returns. I will argue that respecting other investors and considering their investment philosophies with respect can allow value investors to borrow components from other philosophies to augment their returns.

Moving Forward

Investors, when asked to pick an investment philosophy, gravitate towards value investing, drawn by both its way of thinking about markets and its history of success in markets. While that dominance was unquestioned for much of the twentieth century, when low PE/PBV stocks earned significantly higher returns than high PE/PBV stocks, the last decade has shaken the faith of even diehard value investors. While some in this group see this as a passing phase or the result of central banking overreach, I believe that value investing has lost its edge, partly because of its dependence on measures and metrics that have become less meaningful over time and partly because the global economy has changed, with ripple effects on markets. To rediscover itself, value investing needs to get over its discomfort with uncertainty and be more willing to define value broadly, to include not just countable and physical assets in place but also investments in intangible and growth assets.

Authors: Hamish Carlisle, Analyst/Portfolio Manager