ESG Integration at Merlon – Part 3: Engagement

Merlon focuses on active ownership and proactive engagement with investee companies, paired with Environmental, Social and Governance (ESG) integration, to inform our investment decisions. This stems from our broader belief that deep consideration of ESG issues – coupled with active ownership – enhances investment, business and community outcomes.

We have established a structured and formal approach to engaging investee companies, which includes sending formal letters to board directors of our investee companies, outlining key issues and recommendations for improving outcomes.

Our approach recognises not all ESG factors are relevant to all investments. Our assessment of a company’s ESG exposure and performance drives and prioritises our proactive and formal engagement agenda. We also focus on what is most material and where we can make a difference, depending on the companies’ sector, business model and governance practices.

Merlon is a signatory to the Principles for Responsible Investment (PRI) as part of our commitment to active ownership. Our commitment to the PRI Principle to be active owners is demonstrated through our engagement activities across our portfolio of investee companies.

We aspire to be leaders in assessing ESG risks and engaging with investee companies to improve investment and community outcomes and we highlight several case studies to demonstrate progress toward this goal.

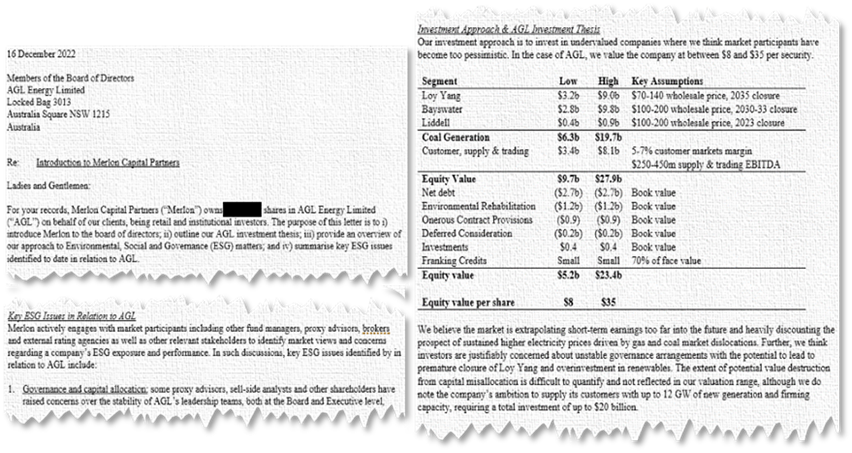

Figure 1: Extract of ESG letter to AGL Board

Source: Merlon Capital Partners

Commitment to Engagement

In 2021, Merlon undertook an in-depth process to establish its own philosophy to clearly articulate its ESG values and beliefs, both as an investment manager but also as a business. This philosophy forms the basis of our ESG process, engagement and decision making, and states:

We believe that deep consideration of governance, social as well as environmental issues – coupled with active ownership – enhances investment, business and community outcomes.

A key theme emerging as we developed this philosophy was a strong belief amongst the team that investment and societal outcomes are enhanced with responsible owners and active investors. As such, we have a strong preference for ESG integration paired with active ownership, rather than divestment or exclusion strategies.

The team had a view that simply divesting or excluding companies such as heavy carbon emitters, gambling or other businesses from portfolios could lead to greater private ownership of these assets, which in-turn could lead to detrimental social and environmental outcomes. This is because publicly listed companies are subject to more broad-based scrutiny, given the increased transparency and disclosure requirements. As such, the thinking is that public companies are more likely to act sustainably, with responsible and engaged owners only reinforcing this behaviour.

Given our fundamental beliefs around ESG and responsible ownership, proactively engaging with our investee companies is an important part of our overall ESG strategy.

Merlon’s dedicated ESG and Sustainability Manager is responsible for leading Merlon’s engagement efforts, working closely with the investment team to ensure all key issues are identified and clearly represented in communications with investee companies.

This paper represents the third of a three-part series describing ESG at Merlon. In our first paper, we explored our newly established ESG Philosophy, including how it was developed and key themes arising from it. In our second paper, we explored our deepened approach to ESG integration, leveraging our in-house specialised ESG capability.

In this paper, we will detail our refreshed approach to engagement, which includes a focus on proactively engaging our investee companies in a pursuit of making a difference through enhancing investment, business and community outcomes.

Integrating Engagement with our Investment Process

Given active ownership over divestment is our preference, and since establishing our ESG Philosophy, Merlon has established a structured and proactive engagement approach with board and management teams of our portfolio companies.

Following a stock review, and either before or coinciding with an initial investment, we send formal letters to boards of directors with the purposes of:

- Introducing Merlon, our beliefs and opening the door for future communications;

- Outlining our investment thesis, including valuation range and key assumptions;

- Providing an overview of our approach to ESG matters;

- Summarising the key ESG issues that were identified in our review; and

- Seeking future constructive engagement with the company.

We take a collaborative approach to our engagement efforts and view it as an integrated part of our investment process. This includes engaging company representatives such as investor relations teams and seeking feedback on written communications prior to finalising and distributing letters to board directors. We believe this approach leads to greater insights regarding investment and ESG issues, including enhancing the quality of letters for board consideration, as well as improving our relationship with investee companies and our ability to influence decision making that has the potential to deliver better investment and societal outcomes.

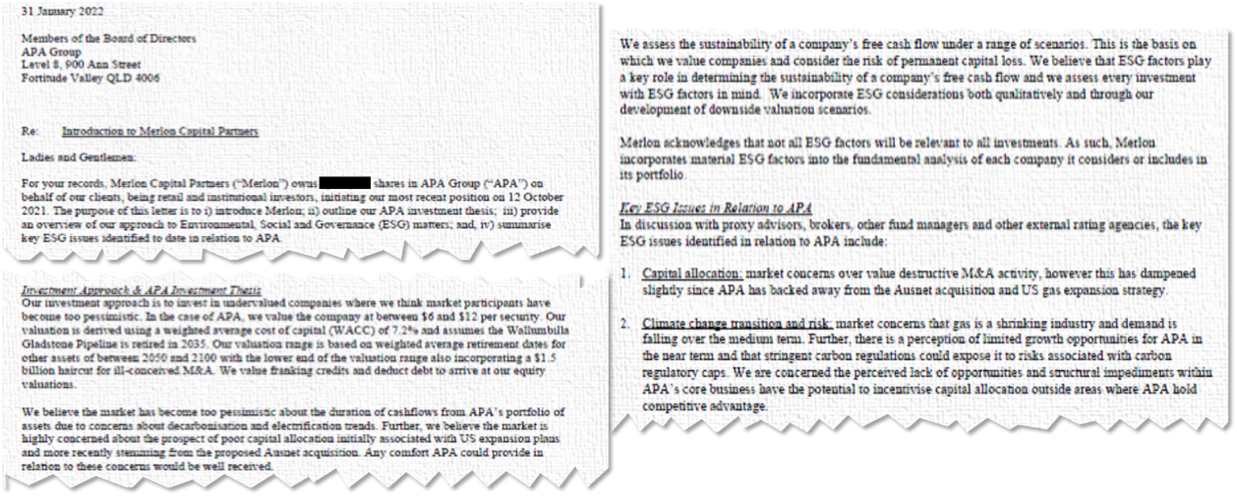

Figure 2: Extract of first formal ESG letters to portfolio company board of directors

Source: Merlon Capital Partners

Since beginning this structured engagement program in January 2022, we have sent more than 25 formal letters to board directors with further draft letters in progress. Outside of these initial letters, we have continued to write formally to board directors and engage them on more specific issues such as governance, remuneration, mergers and acquisitions, capital allocation and the distribution of franking credits.

Dual Goals with Collaborative Engagement

We have two clear goals through our engagement approach: optimise our investment decisions by further enriching our research and learning from the companies we engage with, as well as positively impacting the future decisions made by our portfolio companies for better investment and ESG outcomes.

Goal 1 – Optimise decisions: To be a good investment we need to understand the key investment issues, which include key ESG issues, and demonstrate these represent market misperceptions or that they are already reflected in market expectations. Following an in-depth assessment of an investment and associated key issues, we will seek to engage with boards and management prior to or following a small initial investment in the company.

We will formally engage company representatives and board directors through our letters, seeking their input on the issues identified and any feedback on our recommendations. We will increase our initial investment when we form the view the company has responded well, understood the concerns identified and is taking corrective measures to address the risks. However, we may limit further investment or divest the initial investment where this engagement process uncovers additional risks or an inadequate awareness amongst management and boards of the risks raised.

Goal 2 – Make a difference: Merlon aims to influence our investee portfolio companies for the better. Through our letters and ongoing engagements with investee portfolio companies, we highlight where we believe market participants, and sometimes ourselves, have become too pessimistic about certain ESG and other issues. Where relevant, we clearly outline how such pessimism may be impacting the market valuation of the company and provide clear recommendations around communications and other remedial actions that might bridge valuation discounts.

We believe this approach is effective in assisting company directors and management to understand how we think about the linkages between ESG‑related matters, sustainable free-cash-flow, the valuation range of their businesses and company share price discounts. The aim is to add to the breadth of information that boards and management draw on to make decisions. We hope that clearly and formally articulating the significance of ESG and other issues, encourages decision makers to consider our opinions driving better decisions in the future and creating positive change from both societal and investment perspectives.

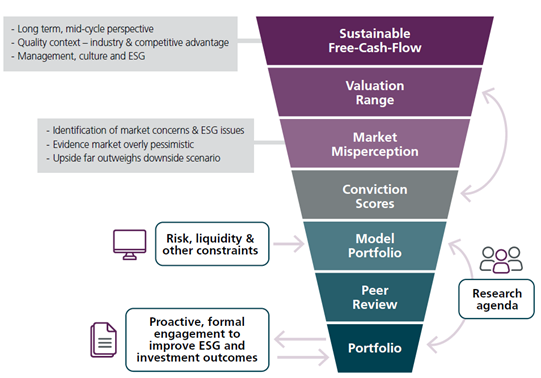

We demonstrate the two-way nature of our engagement in our investment process by including the two-way arrows next to engagement in the schematic below, demonstrating we seek to improve both ESG outcomes and our own investment decision making (Figure 3).

Figure 3: Merlon Investment Process – ESG & Engagement

Source: Merlon Capital Partners. Note: “Free-Cash-Flow” defined as operating cash flow before interest minus capital expenditure plus value of franking credits. “Valuation Range” calculated as capitalised value of “Sustainable Free-Cash-Flow” adjusted for long term growth and risk minus net debt under a range of scenarios.

Broad Based and Continuous Engagement

Merlon aims to engage with the board directors of all companies in which we have invested or are closely considering investing in at least annually. The focus is to understand and encourage alignment and strong representation of shareholders, including in relation to ESG.

Outside of boards of directors, Merlon also engages with the management teams and other company representatives on a regular and less formal basis to discuss a variety of issues. This includes seeking further clarification and providing feedback on the ESG and other issues we have identified and help them understand how we think about ESG in our investment process. The key objective of these engagements is to ensure the companies remain committed to delivering the best outcomes for investors, including ESG outcomes.

Merlon focuses and engages on an array of ESG issues, with key examples listed below.

Table 1: Examples of ESG issues discussed with portfolio companies

| Environmental | Social | Governance |

|

|

|

Source: Merlon Capital Partners

Clear Responsibility and Accountability for Engagement

Merlon takes its engagement activities very seriously. As an owner-managed firm with significant co-investment alongside our clients, the investment team have a strong alignment with clients on engagement matters. Further, all formal communications with portfolio company boards are subject to approval by the Merlon Board.

Merlon’s dedicated ESG and Sustainability Manager has overall responsibility for driving engagement activities and ensuring a consistent approach, as well as coordinating Merlon’s voting decisions. We keep records of company and other engagements, drawing on these for future engagements and monitoring, as well as potentially influencing investment decisions. We also track our voting decisions, including rationale for contentious issues.

Engagement activities and voting decisions are tracked and reported to Merlon’s Board, investors, the PRI, and other key stakeholders annually. We also have a weekly investment team meeting to coordinate our engagement activity and resolve contentious issues.

ESG Engagement – Case study examples and outcomes

Engagement Theme: Problem gambling harm and social licence risk

Problem gambling harm is an important social consideration, which can also lead to financial risk to businesses from both a reputational and regulatory perspective. Community members with addictions, including problem gamblers, are considered to suffer from mental health issues. Companies which take advantage of these customers by knowingly targeting or not taking reasonable steps to reduce significant harm would be acting in a way which we deem as unsustainable.

Over the last 12 months, Merlon has committed a lot of effort into understanding problem gambling harm in Australia, including engaging industry experts, conducting a literature review of existing research and undertaking a proprietary independent third-party survey (Merlon commissioned) to quantify the size of the issue and potential regulatory changes to minimise harm. We leveraged this research to engage with gaming companies exposed to this issue, including the Star Entertainment Group (SGR), Tabcorp Holdings Limited (TAH) and Endeavour Group Limited (EDV).

Initially we engaged SGR in the middle of 2022, as the company became undervalued due to market concerns regarding its ability to retain its casino licence, the proceeding leadership clear-out and evidence of poor compliance with respect to anti-money laundering responsibilities. Having met with the company, we felt that its strategies to reduce harm caused by problem gambling were not sufficient, nor was the culture within the organisation appropriate to reduce its exposure to social licence risk and regulatory changes associated with this risk. As such, we heavily discounted the cash flows from our central case valuation to reflect the proportion of total revenues associated with problem gamblers [1].

At a similar time, Merlon also engaged Tabcorp Holdings Limited (TAH), Australia’s largest provider of wagering and gaming products and services. In the second half of 2022, we had several one-on-one engagements with various TAH representatives, including the CEO and General Manager Risk and Compliance to understand its strategies to reduce harm caused by problem gambling and its own risk management tools to reduce its exposure. We found from these engagements that the company was better prepared than SGR and has a more appropriate culture of responsibility regarding the issue. Despite this, we still felt there is more work to be done and gaps in its approach. As such, we continued to engage external industry experts to understand where TAH could improve.

At a similar time, Merlon also engaged Tabcorp Holdings Limited (TAH), Australia’s largest provider of wagering and gaming products and services. In the second half of 2022, we had several one-on-one engagements with various TAH representatives, including the CEO and General Manager Risk and Compliance to understand its strategies to reduce harm caused by problem gambling and its own risk management tools to reduce its exposure. We found from these engagements that the company was better prepared than SGR and has a more appropriate culture of responsibility regarding the issue. Despite this, we still felt there is more work to be done and gaps in its approach. As such, we continued to engage external industry experts to understand where TAH could improve.

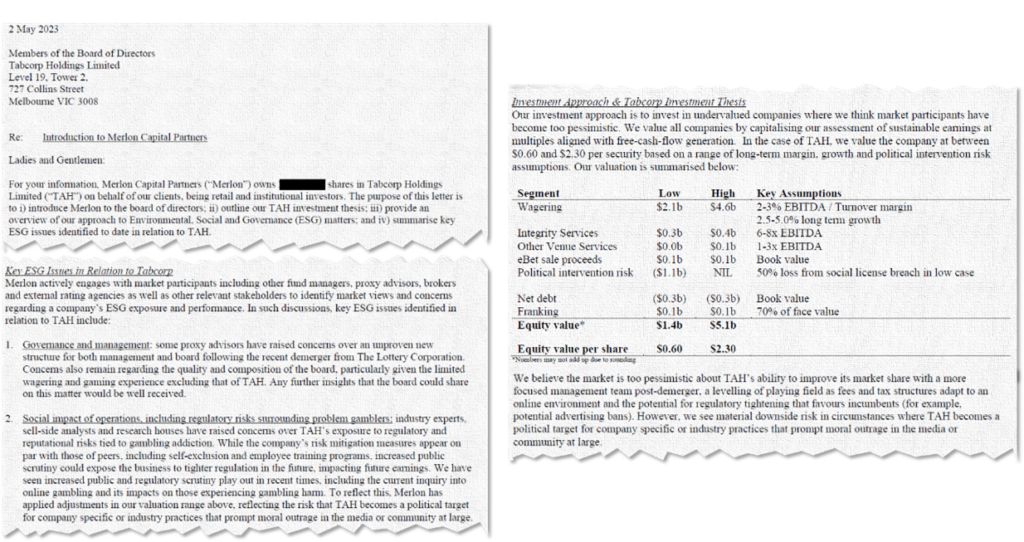

Since this time, we have sent a letter to TAH board directors outlining the research we have undertaken to date and documenting clear recommendations to improve its behaviour and risk management of problem gambling harm (Figure 4). In this letter, we also demonstrated the link of social licence risk related to problem gambling and our TAH investment thesis, including applying a 50% haircut to wagering revenue from our normalised forecasts in our low case valuation.

Figure 4: Extract of ESG letter to TAH Board

Source: Merlon Capital Partners

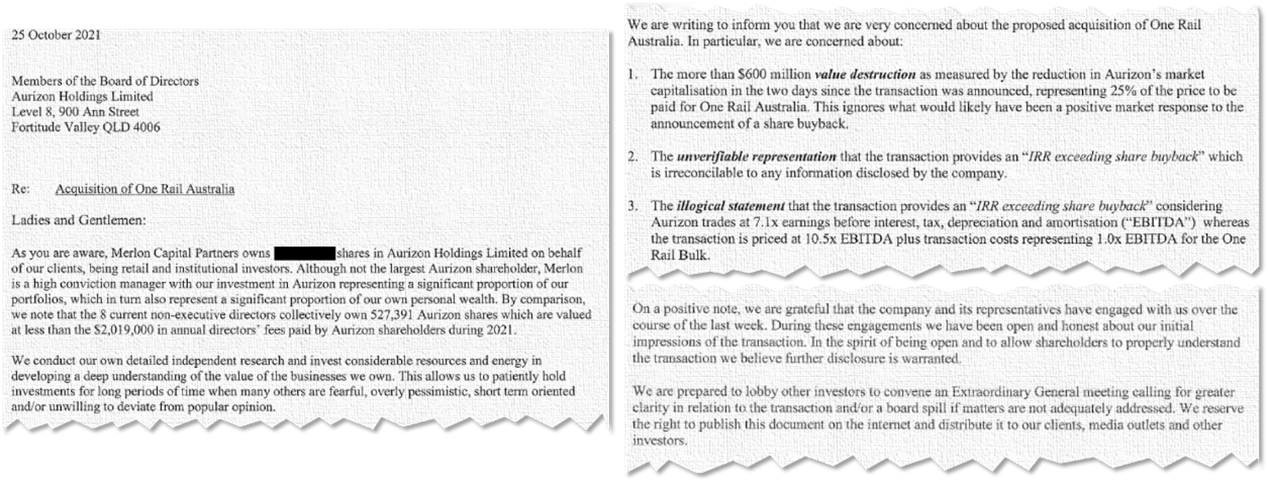

Engagement theme: Poor capital allocation

Understandably, most of the market’s ESG focus has been on environmental risk as these are long dated and material, but in the short-term poor capital allocation decisions can have a much more material impact on minority shareholders life savings. This risk stems from the agency conflict that unfortunately exists between some misaligned directors and shareholders. An example of this misalignment is the fact that director shareholdings in the company are often a fraction of the annual director fees. They are also vulnerable to being manipulated by seasoned investment bankers touting “earnings accretion” from relying on ambitious cost synergies and cheap debt to fund the “strategic deal”, while overlooking negative revenue synergies such as losing loyal customers by terminating brands or being distracted from serving these customers.

Our investment philosophy is we believe people are motivated by short-term outcomes, overemphasise recent information and are uncomfortable having unpopular views. Company directors are equally vulnerable to this behavioural bias of greed and fear, jettisoning out-of-favour segments and doubling down on expensive acquisitions. This leads to pro-cyclical capital allocation.

For example, when Boral acquired US-listed Headwaters in 2016 for $3.7b we noted publicly on our website the company had paid 38x free cash flow, only to see the business sold for $1.2b less four years later. Headwaters was a “roll-up” and the fact its own share price had climbed 10x since GFC lows was overlooked when it was acquired.

![]() A more recent example of capital misallocation is Aurizon Holdings Limited (AZJ), who paid $1.5b or more than 15x EBITDA for non-caul haulage company One-Rail in 2021 (net of divesting the East Coast coal haulage business) when its own shares were trading at less than 8x EBITDA. Much like the rest of the market, we felt that it was a big price to pay for increasing the attractiveness of their business mix.

A more recent example of capital misallocation is Aurizon Holdings Limited (AZJ), who paid $1.5b or more than 15x EBITDA for non-caul haulage company One-Rail in 2021 (net of divesting the East Coast coal haulage business) when its own shares were trading at less than 8x EBITDA. Much like the rest of the market, we felt that it was a big price to pay for increasing the attractiveness of their business mix.

The Aurizon value destruction occurred just after our dedicated ESG and Sustainability Manager joined the team and before we started our proactive formal engagement approach. We had no choice but to send a “reactive” letter to the Chair after the damage had been done. While these letters can make us “feel better” through venting our disappointment, they have limited ability to improve shareholder outcomes. We would like to think our current “proactive” approach would have prevented the acquisition or at least impacted the negotiations by highlighting the undervalued nature of AZJ’s existing core business and encouraging share buybacks.

Figure 5: Extract of letter to AZJ Board

Source: Merlon Capital Partners

Since this time, we have continued to constructively engage with AZJ, including sending a letter to board directors in the same ESG format we have rolled out across other portfolio companies. In these interactions, we remain clear around our expectations from a governance and capital allocation perspective, as well as our assumptions regarding decarbonisation risks and opportunities facing AZJ, including valuation haircuts aligned to the International Energy Agency’s coking and thermal coal trade forecasts.

Examples of capital allocation risks and opportunities highlighted by our proactive engagement approach include:

- the potential value destruction of APA’s US expansion (which was averted for now);

- the potential value destruction of AGL’s attempt to replace coal-fired generation with renewable generation, competing with financial sponsors with lower cost of capital;

- encouraging A2 Milk to distribute excess capital and franking credits to shareholders;

- encouraging AMP to distribute material excess capital to shareholders;

- dissuading Unibail-Rodamco from engaging in a fire-sale of its US property assets to de-leverage the balance sheet; and

- highlighting the large corporate cost impost within Newscorp as well as the latent value of existing assets as opposed to further acquisitions.

The Merlon investment team prides itself as “acting like owners” and expect company directors to do the same, including by owning more shares and seeking approval for material transactions regardless of ASX rules which some consider lax by global standards.

Portfolio company directors are generally surprised by how wide the valuation range in our letters is. However, this is the brutal truth of any company with volatile input prices, high fixed costs and debt. Our view is there would be less value destructive mergers and acquisition activity if more directors adopted our humble approach when valuing companies.

Engagement theme: Climate change and stranded asset risk

Merlon frequently engages with companies regarding their management of climate change physical and transitional risks, as well as their efforts to reduce their environmental footprint. We have held shares in energy and coal mining companies, taking a conservative approach to valuations, and use our position to actively engage with Board and management on a regular basis. These engagements have included formal letters addressed to the board of directors, as well as one-on-one meetings with directors and management to articulate our key concerns and obtaining commitments from the company around climate change management, including ensuring that all investments are aligned to a 2050 net zero future.

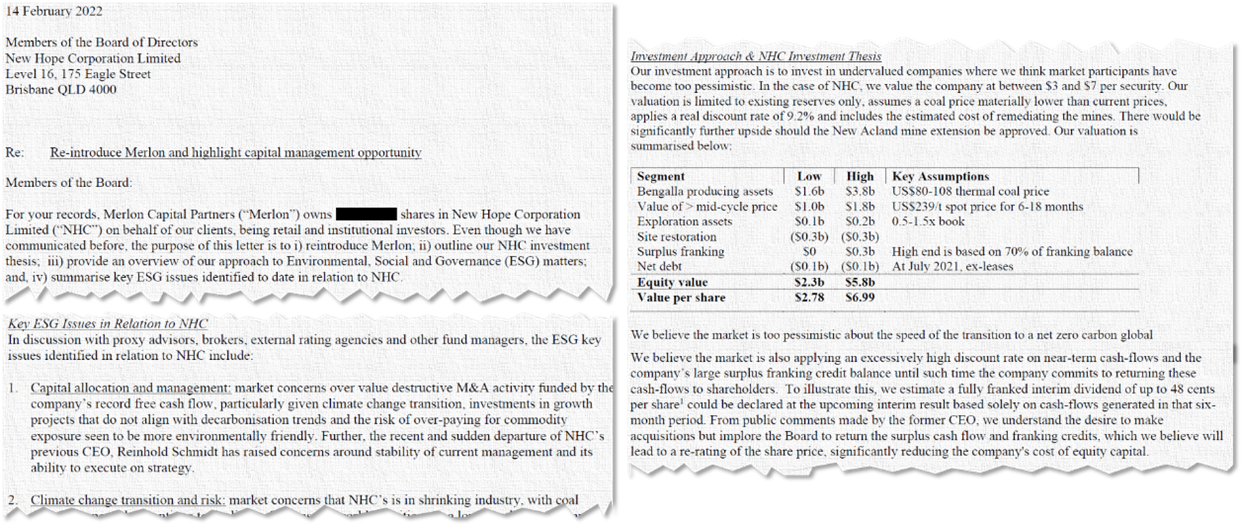

Merlon has owned shares in New Hope Coal Limited (NHC), a large Hunter Valley thermal coal producer. In February 2022, we used our shareholder position to formally write to the board of directors outlining its exposure to climate change transition risks, including the fact that it is in a shrinking industry (Figure 6). We strongly urged the return of surplus cash flow and franking credits to shareholders of up to 48 cents per share, and to not pursue investments in growth projects or acquisitions that do not align to a net zero 2050 future. We also requested further information on its environmental impacts, including expected future remediation programs and costs.

Merlon has owned shares in New Hope Coal Limited (NHC), a large Hunter Valley thermal coal producer. In February 2022, we used our shareholder position to formally write to the board of directors outlining its exposure to climate change transition risks, including the fact that it is in a shrinking industry (Figure 6). We strongly urged the return of surplus cash flow and franking credits to shareholders of up to 48 cents per share, and to not pursue investments in growth projects or acquisitions that do not align to a net zero 2050 future. We also requested further information on its environmental impacts, including expected future remediation programs and costs.

This led to a one-on-one meeting with the Chair, Robert Milner and CEO, Robert Bishop in May 2022. At this meeting, the company committed to returning capital to shareholders, not pursuing growth projects, and increasing its climate readiness and environmental disclosures. This was also confirmed in a formal letter response written from the Chair. Since this exchange, NHC declared a record dividend payout, including a special dividend and has expanded its disclosures, including outlining its emission profiles by scopes and benchmarking analysis. We will continue to engage with NHC on this issue and monitor its progress against its commitments, particularly its climate related disclosures.

Other companies we formally wrote to on this issue include APA Group (APA), AGL Energy (AGL), Origin Energy (ORG), A2 Milk (A2M), Qantas (QAN), Woodside (WDS) and Suncorp (SUN).

Figure 6: Extract of ESG letter to NHC Board

Source: Merlon Capital Partners

Engagement theme: Leadership composition, culture and other ESG issues

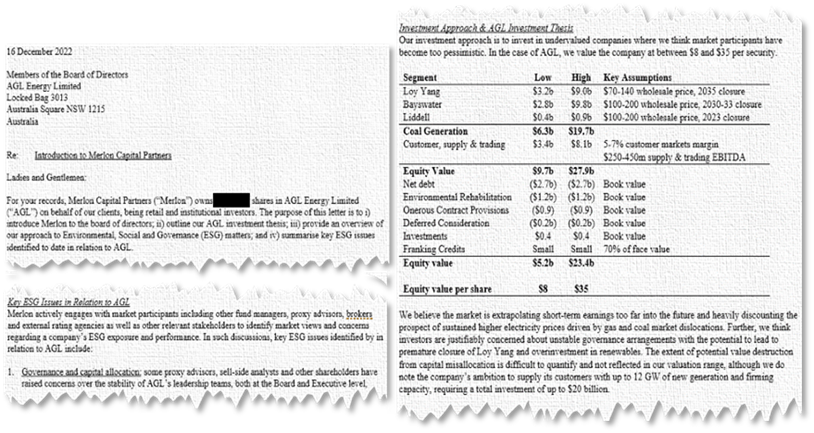

AGL Energy Limited (AGL) supplies around 4.2 million retail and commercial energy customers and operates Australia’s largest private electricity generation portfolio, comprising coal and gas-fired generation, renewable energy sources and gas production and storage assets. AGL is targeting a complete exit from coal fired generation by the end of FY35.

AGL Energy Limited (AGL) supplies around 4.2 million retail and commercial energy customers and operates Australia’s largest private electricity generation portfolio, comprising coal and gas-fired generation, renewable energy sources and gas production and storage assets. AGL is targeting a complete exit from coal fired generation by the end of FY35.

At its November 2022 Annual General Meeting (AGM), AGL had four proposed director candidates by shareholder Galipea Partnership. These four candidates being Mark Twidell, Dr Kerry Schott, John Pollaers and Christine Holman.

In the weeks leading up to the AGM, Merlon undertook significant engagement ahead of formulating our voting decision. This included individual meetings with three of the four proposed candidates, discussions with other AGL shareholders, detailed review of proxy advisor reports and our own assessment of the relevant information. Following this, our intention was to vote FOR three out of the four candidates, being Mark Twidell, Dr Kerry Schott and Christine Holman (together, the “three candidates”).

Prior to voting, as part of our commitment to active ownership and responsible voting, Merlon engaged the existing Board of Directions via a formal letter, outlining our voting intentions and rationale. The reasons for our decision included, but not limited to:

- The three candidates’ skills and experience, including understanding of the energy market, battery and emerging technologies, as well as stakeholder and government relations.

- Our view that for a business as complex as AGL, facing such a significant transformation, fundamental questions about the future need deeper thought and sharper focus. The three candidates are all very different in their backgrounds and capabilities, bringing much needed diversity of thought to the board room and a “fresh set of eyes” to such discussions.

- The three candidates’ open-mindedness in relation to AGL’s strategic direction including: the basis for owning (or underwriting) new generation and storage against a backdrop of highly uncertain government policy and the potential benefits of focusing more exclusively on leveraging AGL’s primary sources of competitive advantage being its retail brand and customers through “behind the meter” and “load sharing” services.

- Our belief is that AGL needs a cultural rejuvenation, to provide a firm sense of purpose to current and prospective employees. This begins with the Board. We believe the three candidates will support this cultural refresh and provide a greater sense of stability and action moving forward.

- Our concern was that the Board’s ability to attract a high calibre Chief Executive Officer (“CEO”) was be constrained by what appeared to be an entrenched position on the business’s strategic direction.

- We gained reassurance that the three candidates will act independently from Galipea Partnership, Grok Ventures and Mike Cannon-Brookes in the interests of all shareholders.

Around this time, we also shared an initial draft letter to the AGL Board in the same ESG format we have rolled out across other portfolio companies. In this letter, we outlined our AGL investment thesis and key ESG issues identified to date in relation to the company. These issues included governance and capital allocation; decarbonisation risk and opportunities, including the retirement of coal fire generation assets; community and social performance, with a focus on affordable energy and social licence; and human capital management, with a focus on culture and safety.

Following these two letters, including our draft ESG letter, Merlon met with three Non-Executive Directors including the Chair to discuss our concerns and recommendations.

While our engagements are almost always held privately, there are instances where we publicly express concerns if we feel it is in the best interests of shareholders. As such, soon after our meeting with AGL directors, Merlon was engaged by the AFR and views were published in an article released on 9 November.

After extensive engagement with AGL directors, including the then prospective directors, as well as other AGL shareholder, Merlon finalised our voting decision and ESG letter (Figure 6). Merlon received a written response from the Chair to our letter in December 2022.

Figure 6: Extract of ESG letter to AGL Board

Source: Merlon Capital Partners

Engagement theme: Electrification and capital management opportunities

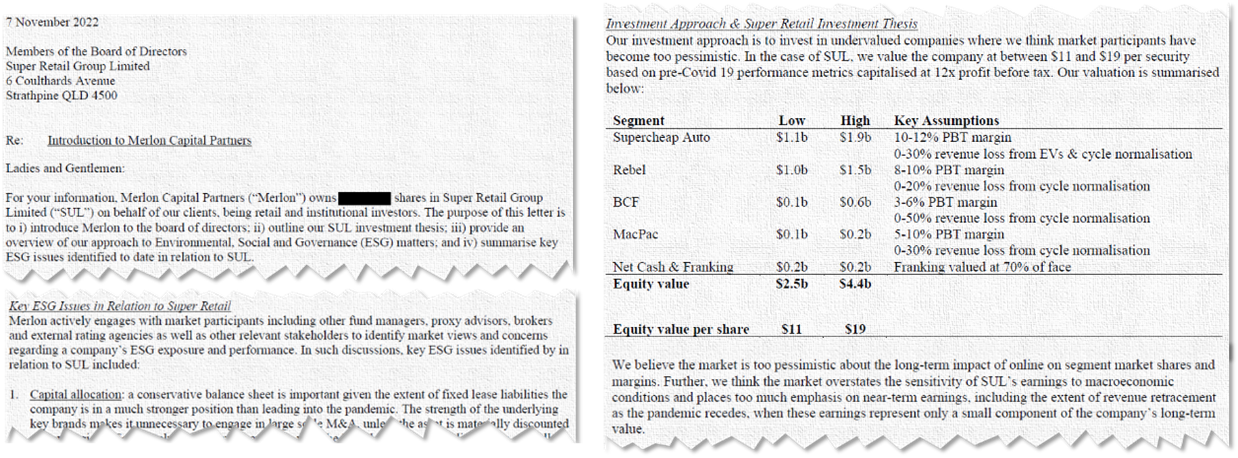

Super Retail Group Limited (SUL) owns and operates a portfolio of four retail brands across Australia and New Zealand, comprising of Supercheap Auto, rebel, BCF and Macpac. The company has market leading positions in key segments across auto, sports and leisure.

Super Retail Group Limited (SUL) owns and operates a portfolio of four retail brands across Australia and New Zealand, comprising of Supercheap Auto, rebel, BCF and Macpac. The company has market leading positions in key segments across auto, sports and leisure.

At Merlon, we focus on developing valuation scenarios that cater for a range of sensible scenarios, including in relation to ESG issues. Despite factoring in significant revenue haircuts to adjust for cyclical and structural issues, at the time of our engagement, the company was trading below our low case valuation.

In August, Merlon met with SUL Management and flagged that we would be formally writing to the board, as per our commitment to active ownership. Given our collaborative approach to engagement, we sent an initial draft letter to investor relations in September to seek their feedback, which outlined our SUL investment thesis and key ESG issues identified to date in relation to the company. These issues included structural issues relating to the electrification of vehicles impacting the Supercheap Auto segment, social trends towards online impacting the group, as well as shorter term cyclical issues related to macroeconomic conditions and the extent of revenue retracement as the pandemic recedes. In our letter, we clearly stated how these issues were reflected in our valuation range, which had a low case valuation of $11 and a high case valuation of $19 when the share price was trading at only $9.

Following feedback from the company, we finalised our letter in November 2022 for board consideration (Figure 7). This letter was well received and led to a productive meeting with three Non-Executive Directors including the Chair, as well as a written response from the Chair. In these engagements, we were able to obtain a commitment from the company to:

- Consider capital management activity, including a special dividend and / or a share buy-back in the first half of 2023

- Continue its preparedness for the transition to electric vehicles

- Work towards other social outcomes including responsible supply chain and labour management through improved systems and processes

We will continue to engage with the company of these issues and monitor its progress against its commitments.

Figure 7: Extract of letter to SUL Board

Source: Merlon Capital Partners

Concluding Remarks

At Merlon, we are highly committed to active ownership and engagement with investee companies. We achieve this through a structured and formal engagement agenda, including letters to board directors which clearly articulate key issues identified, including ESG related considerations, the linkages to sustainable free-cash-flow and the resultant the valuation of their businesses. The purpose of this engagement is to enrich our research, as well as drive positive ESG and investment outcomes.

[1] Browne, M, Greer, N, Armstrong, T, Doran, C, Kinchin, I, Langham, E & Rockloff, M 2017, The social cost of gambling to Victoria, Victorian Responsible Gambling Foundation, Melbourne. Table 11

Further reading – ESG Integration at Merlon 3-part series

Part 1 – ESG Philosophy, explores our newly established ESG Philosophy, including how it was developed and key themes arising from it.

Part 2 – ESG Process, details our deepened approach to ESG process integration leveraging our in-house specialised ESG capability.

Part 3 – ESG Engagement, outlines our commitment actively engage with investee companies on key issues, including ESG considerations, to drive positive outcomes.