ESG Integration at Merlon – Part 2: Process

Environmental, Social and Governance (ESG) matters are increasingly important and there is a growing expectation that companies better manage their ESG risks and opportunities. These issues must be reflected in investment decisions and engagement.

We value every potential investment with ESG factors in mind because ESG factors play a key role in determining the sustainability of Free-Cash-Flow, Merlon’s primary valuation consideration.

Companies with heightened ESG risks carry a higher conviction threshold due to a wider range of valuation scenarios.

Markets can become too pessimistic about ESG risks which can present high conviction investment opportunities.

Case studies demonstrate how we factor in ESG risks and determine whether or not the market is too complacent or pessimistic in this regard.

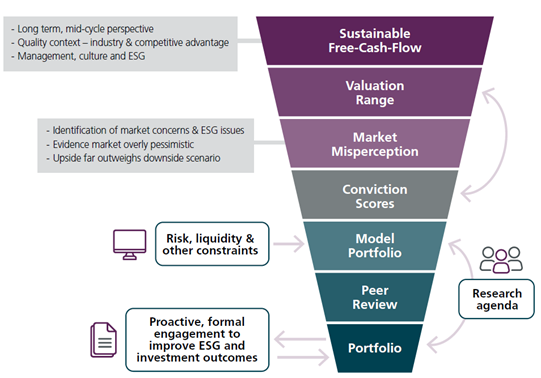

Figure 1: Merlon Investment Process Overview & ESG Integration

Source: Merlon Capital Partners. Note: “Free-Cash-Flow” defined as operating cash flow before interest minus capital expenditure plus value of franking credits. “Valuation Range” calculated as capitalised value of “Sustainable Free-Cash-Flow” adjusted for long term growth and risk minus net debt under a range of scenarios.

Focused on in-depth ESG integration

In 2021, in recognition of the increasing importance of ESG, as well as the need for specialised capability in this space, Merlon hired a dedicated ESG and Sustainability Manager to further develop and implement our ESG philosophy and processes.

Since this time, Merlon established its own ESG Philosophy in November 2021, which very closely aligns to our investment philosophy, and forms the basis of our ESG process, engagement and decision making.

At Merlon, we believe that deep consideration of governance, social as well as environmental issues – coupled with active ownership – enhances investment, business and community outcomes.

This paper represents the second of a three-part series describing ESG at Merlon. In our first paper, we explored our newly established ESG Philosophy, including how it was developed and key themes arising from it.

In this paper, we will detail our deepened approach to ESG process integration, leveraging our in-house specialised ESG capability. This includes:

- incorporating ESG considerations into our qualitative scorecard;

- heightening our emphasis on ESG related issues in our assessment of sustainable Free-Cash-Flow;

- assessing whether markets are too optimistic or too pessimistic about the potential impact of ESG issues on expected future cash-flows; and

- developing valuation scenarios that cater for a range of sensible scenarios in relation to ESG issues.

Typically, companies that have more exposure to ESG factors will have lower sustainable Free-Cash-Flow, face a wider range of possible valuation scenarios, and carry a heightened risk of permanent capital loss. We will only have sufficient conviction to invest in stocks with heightened ESG risks if the share price adequately compensates, and the market has become overly pessimistic about future prospects.

In our third paper, we will explore our commitment to active ownership and engagement.

An integrated ESG approach that aligns with our values and beliefs

At Merlon, we believe that factors incorporated within ESG (Environmental, Social and Governance) are playing an increasingly key role in determining the sustainability of a company’s Free-Cash-Flow and therefore need to be assessed.

At a fundamental and investment philosophy level, our view is that companies should be valued on the basis of sustainable Free-Cash-Flow under a range of scenarios, including in respect to what is environmentally and socially sustainable. While we are required to rely on good governance, we also have the flexibility to factor in governance risks where appropriate. This is the basis on which we value companies and consider the risk of permanent capital loss.

To be a good investment we need understand the key investment issues, which include key ESG issues, and demonstrate these are already discounted in valuation scenarios.

Focusing on what’s material

Merlon acknowledges that not all ESG factors will be relevant to all investments. As such, for each of our investee companies, Merlon considers what matters most depending on the companies’ sector, business model and governance practices.

To achieve this, Merlon applies an issues-based approach, considering the top 3-5 material ESG issues which are relevant for each company. An issues-based approach is considered more effective than a systematic scorecard-based approach as it allows us to focus our resources on a deeper and more comprehensive assessment of material ESG risks and opportunities.

To determine what issues are most material, Merlon considers the Sustainability Accounting Standards Board (SASB) Materiality Map for different sectors and industries, third party ESG rating agencies and data providers, including MSCI and Sustainalytics, company annual and sustainability reports and our own internal research.

Merlon also actively engages with market participants including proxy advisors, other fund managers and brokers to understand market views and concerns regarding a company’s ESG exposure.

Integrated into stock review process via quality scorecard

Dedicated sections of our qualitative scorecard are allocated to the assessment of ESG related matters. Prior to establishing our ESG Philosophy and within our qualitative framework we already explicitly rated (i) industry structure; (ii) competitive advantage; and (iii) management and governance.

Since establishing our ESG Philosophy, we have expanded our qualitative scorecard to include two key additions which cover:

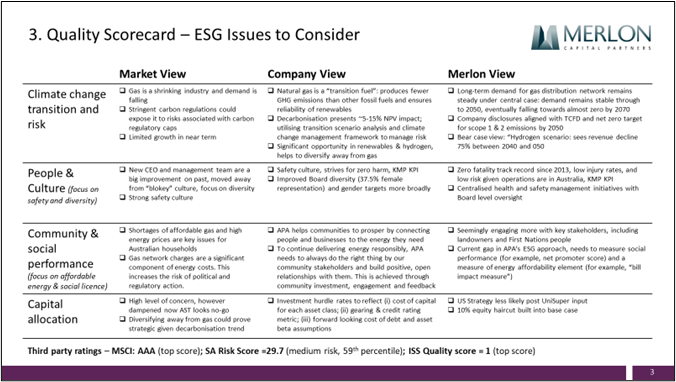

- “ESG Issues to Consider” – a qualitative assessment of the top 3-5 material ESG issues relevant to the stock we are considering (Figure 2). This includes an in-depth assessment to understand the market view, the company view and form our own proprietary “Merlon” view. Where ESG issues are highly material they will flow through to key investment issues and may result in adjustments to central case valuations, valuation ranges and conviction scores.

Figure 2: Assessment of material ESG issues in stock review process

Source: Merlon Capital Partners

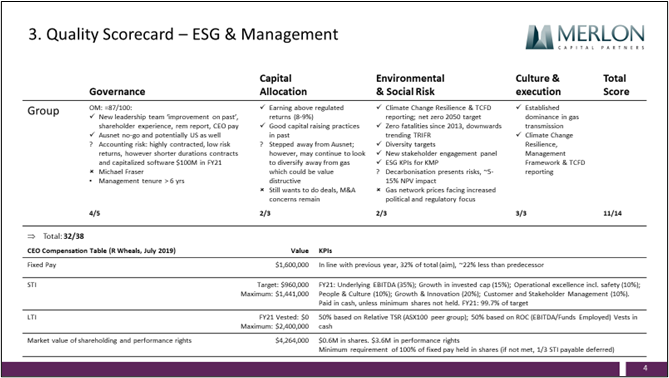

2. An expanded “ESG and Management Scorecard” – an assessment of a firm’s management and governance which is also informed by our assessment of material ESG issues (Figure 3). We rate a company on its approach to governance, capital allocation, environmental and social risk, and culture and execution. Apart from the ‘Governance’ factor, each factor is rated on a score of 1 to 3. The Governance factor is rated on a score of 1 to 5 reflecting the breadth of issues considered and its relative importance. Higher quality firms will be leaders in their sectors on these issues. Lower quality firms will be laggards in their sectors and may experience lower profitability and greater tail risks.

Figure 3: Integration of ESG quality score into stock review process

Source: Merlon Capital Partners

Table 1 provides a summary of the characteristics of a company that has good and bad scores.

Table 1: ESG and Management Scorecard factor descriptions

| Factor | Score allocation |

| Governance

A board’s existence is principally to address agency issues that arise between shareholders and management |

What does a score of 5 look like?

What does a score of 1 look like?

|

| Capital allocation

The essence of this factor is the recognition that companies operating in the interests of their shareholders, to maximise their wealth |

What does a score of 3 look like?

What does a score of 1 look like?

|

| Environmental and Social risks

Industries and companies are increasingly exposed to environmental and social risks, driven by external change such as shifting societal expectations. This creates risks to profitability and sustainability of a business, as well as new opportunities for profit. The exposure to these risks is often fundamental to an industry, but also relates to the ability of leadership to identify and respond to risks and opportunities |

What does a score of 3 look like?

What does a score of 1 look like?

|

| Culture and execution

Any external change creates opportunities for profit. The ability to identify and respond to opportunity lies at the core of management capability, as well in its ability to inspire a strong culture of engagement and key talent retention. To the extent that opportunities are fleeting or subject to first move advantage, speed of response is critical to exploiting business opportunity |

What does a score of 3 look like?

What does a score of 1 look like?

|

Source: Merlon Capital Partners

Implications for valuation and conviction

At a philosophical level, Merlon is focused on ESG integration. That is, we seek to incorporate the financial impacts of ESG factors into our process where relevant and seek to ensure our estimates of sustainable Free-Cash-Flow and return on capital appropriately reflect qualitative characteristics for companies under research coverage. This includes discounting any cash flows that relate to unsustainable practices, such as practices which knowingly target vulnerable groups, or do not take reasonable steps to reduce significant harm.

We incorporate ESG considerations both in our fundamental analysis and our valuation assessment, including:

- The assessment of sustainable Free-Cash-Flow, which drives our valuation.

- Whether markets are too optimistic or pessimistic, which drives conviction.

- The range of valuation outcomes, both downside and upside, which drives conviction.

Highly material ESG issues become key investment issues, which are reflected in valuation scenarios and conviction scores. Valuation scenarios and conviction scores in turn drive portfolio weights.

An outcome of our approach is that we do not “screen out” particular companies or sectors. Rather, companies that have more exposure to ESG issues will have lower qualitative scores, lower assessments of sustainable Free-Cash-Flow and, commensurately, lower valuations. These companies also typically have wider range of valuation outcomes and might have lower conviction scores if the share price does not adequately compensate for these risks.

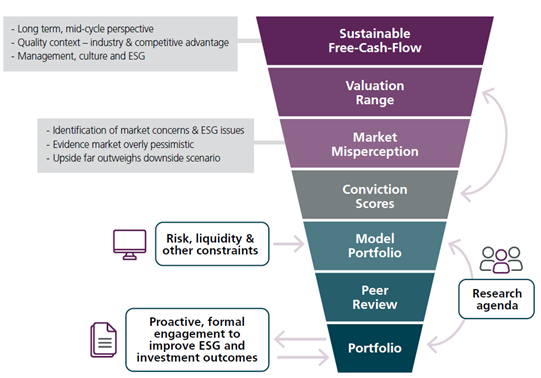

Figure 4: ESG integration into our investment process

Source: Merlon Capital Partners. Note: “Free-Cash-Flow” defined as operating cash flow before interest minus capital expenditure plus value of franking credits. “Valuation Range” calculated as capitalised value of “Sustainable Free-Cash-Flow” adjusted for long term growth and risk minus net debt under a range of scenarios.

Environmental considerations

The “E” in ESG refers to environmental factors and aims to assess how a company performs as a steward of nature, which includes analysing both its activities and how it impacts the surrounding environment, as well as how it manages current and emerging environmental risks, such as changes in weather patterns. Examples include resource scarcity and management, animal treatment, climate change and decarbonisation.

Some examples of our key environmental considerations, including decarbonisation trends and the transition to net zero are highlighted below.

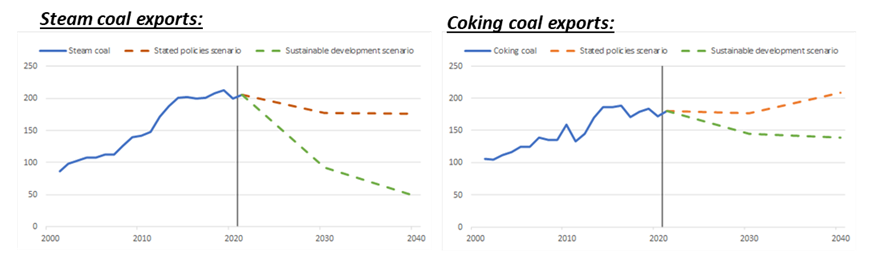

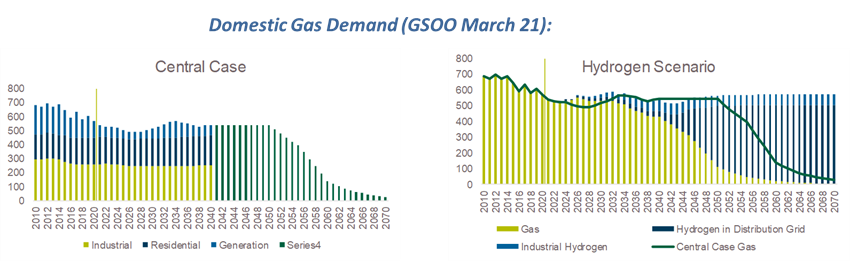

- Fossil fuel supply and demand, including coal exports and gas production and demand. For coal exports, Merlon recognises thermal and coking coal are different, and that emerging countries are further behind developed countries in regard to the energy transition, including are longer reliance on coal fire generation for energy security and reliability. For gas production and demand, Merlon considers both a central case and downside “hydrogen” scenario based on the Australian Energy Market Operator (AEMO) forecasts.

Figure 5: Fossil fuel projections

Source: Merlon Capital Partners

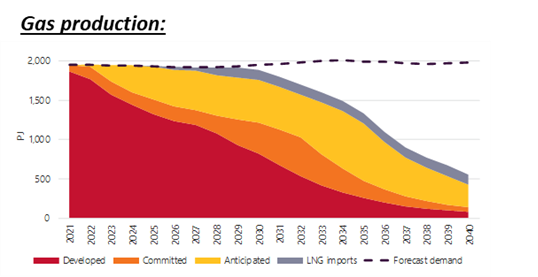

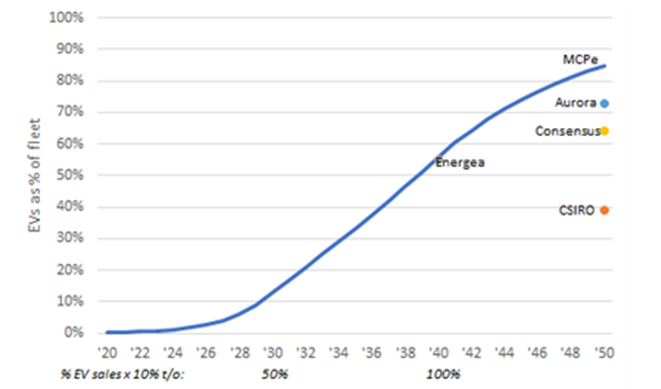

- Electricity mix and impact on electricity spot prices, including the continued evolution of the energy industry leading to increased intermittent renewable generation capacity coming online. This has led to a growing prevalence of negative pricing, particularly during the day, falling minimum demand levels and a crunch on EBITDA margins for energy market participants.

Figure 6: Count of electricity spot prices below zero

Source: Merlon Capital Partners

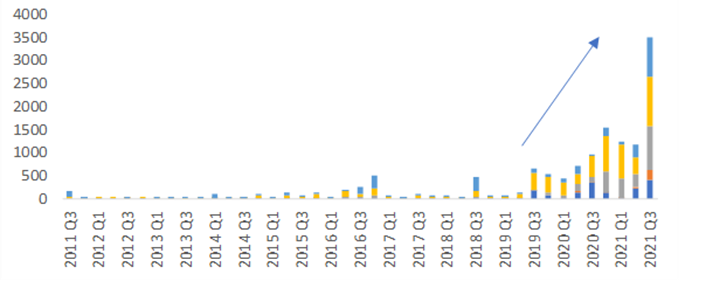

- Electric vehicle (EV) take-up, both as a percentage of new sales and as a percentage of total fleet. We see the EV as both a risk and opportunity for portfolio companies, as it will reduce the demand for oil and fuels but will lead to an increase in demand for aluminium and electricity.

Figure 7: Electric vehicle take-up

Source: Merlon Capital Partners

Merlon remains conservative in how we value resource companies, with our valuations focusing on existing 2P reserves, discounting new projects which do not align to a net zero 2050 future and fully deducting site restoration costs. We consider all scenarios, including downside risk and upside opportunities as they relate to decarbonisation trends.

Social considerations

The “S” in ESG refers to social factors and aims to assess a company’s ability to manage relationships with various key stakeholder groups including employees, suppliers, customers, and the communities where it operates. Relevant criteria include modern slavery, supply chain risk, treatment of suppliers, human capital management, health and safety, diversity, community relations and meeting societal expectations (i.e. social licence).

A key social consideration for Merlon is the treatment of vulnerable groups. Vulnerable groups could include employees, customers and members of the broader community. Examples of unfair treatment of vulnerable groups include:

- Modern slavery and human rights abuse pose both a serious ethical concern, as well as a financial risk to businesses both from both a reputational perspective and from a disruption to their supply chains. While it is more prevalent in companies with offshore staff and / or sourcing, there are still instances of modern slavery within Australia, particularly in high-risk industries such as textiles, financial services (through their supply chains), mining, construction, property, food and beverages, agriculture, and healthcare. When analysing companies in these higher risk industries, or companies with supply chains in high-risk regions overseas, Merlon will conduct additional due diligence to ensure the company has appropriate policies in place to manage these risks and treats its employees fairly. Where we deem a company is not sufficiently managing modern slavery and human rights abuse risks, we would engage as well as reflect this in qualitative scorecard and research outputs, including valuation and conviction.

- Management of problem gamblers is an important social consideration which, much like modern slavery and human rights abuse, can also lead to financial risk to businesses from both a reputational and regulatory perspective. Community members with addictions, including problem gamblers, are considered to suffer from a mental health issue. Companies which take advantage of these customers by knowingly targeting or not taking reasonable steps to reduce significant harm would be acting in a way which we deem as unsustainable. In Australia, the issues around problem gamblers are more profound given gambling losses are 1.5 times higher per capita than the next gambling country and 2.5 times greater than most developed countries. Both Australian and global research finds that problem gamblers disproportionately contribute to gaming revenue, typically ranging from between 40 to 60% of total revenues, despite making up about 1% of all customers, and gamblers are disproportionally represented in low-income households. The issues surrounding problem gamblers has been a longstanding social concern and we believe regulation will eventually catch up to respond to these concerns. An example of how we factor in such social issues is found in the Star Entertainment Group (SGR) case study below.

Governance considerations

The “G” in ESG refers to governance factors and aims to assess the strength of a company’s leadership, executive pay, audits, internal controls, and shareholder rights. It is important for investors to have confidence that the directors and management of a company are acting in the best interest of shareholders. It includes issues relating to relevant skills and experience, capital allocation, accounting practices, pay, bribery and corruption, culture and board diversity.

Merlon focuses particularly on capital allocation as this aligns with our long-term disciplined approach to investing. We engage with companies to understand their reasoning and investment process whilst also attempting to influence their thinking.

Merlon also focuses on corporate culture. Culture in an organisation has been long established as a key driver, or roadblock to success. We believe culture lies at the heart of governance, and matters as much, if not more than pure policies and procedures. Much like a lack of diversity can lead to the downfalls of “groupthink”, poor culture can lead to a lack of engagement, high employee turnover and loss of knowledge, and an overall inability to execute on even the best laid out strategies. Given its importance and capacity to impact future performance, Merlon seeks to understand a company’s current culture and employee satisfaction, as well as the quality of its leadership. Our assessment is incorporated into our qualitative scorecard, which can influence our valuation, conviction and whether or not we choose to invest.

Merlon has written extensively on key governance considerations in previous insights, including Merlon Approach to Corporate Governance in December 2020.

ESG Integration – Case study examples and implications

The Star Entertainment Group (SGR) owns and operates tourist, hospitality and entertainment properties across Sydney, Brisbane and the Gold Coast. This includes the Star Sydney, the Star Gold Coast and Treasury Brisbane, as well as jointly owned the Sheraton Grand Mirage on the Gold Coast and managing the Gold Coast Convention and Exhibition Centre on behalf of the Queensland Government.

The company became undervalued relative to our valuation in the middle of 2022, as the market remained concerned over its ability to retain its casino licence, following similar public hearings to that of the Bergin inquiry into the Crown, the proceeding leadership clear-out and evidence of poor compliance with anti-money laundering responsibilities, including junket operations and relationship with VIP patrons. To address these concerns, our central case valuation excluded VIP revenue, reflecting a view that this profit stream was unsustainable. Further, we assumed no new main floor capacity would be added, reflecting poor relations with the government and regulator.

Consistent with our newly articulated ESG philosophy and with the higher bar placed on incorporating unsustainable practices, we then decided to remove all cash flows associated with practices which knowingly target vulnerable groups, or do not take reasonable steps to reduce significant harm.

Having met with the SGR, we felt that the company’s strategies to reduce harm caused by problem gambling were not sufficient to reduce its exposure to such regulatory changes. This in part stemmed from personal views about the approach taken by the company but also, and perhaps more importantly, from a view that heightened public scrutiny would shift societal views towards our own and prompt policy action. Over time we expect cash flows associated with problem gamblers to be heavily discounted and/or greatly diminished.

Given we view the revenues associated with problem gamblers as unsustainable over the longer term, and with the expectation that Australian gaming regulation will eventually tighten to address these issues, we heavily discount these cash flows from our central case valuation by removing 40% of slot revenue and 60% of table game revenue from our normalised forecasts. These revenue haircuts reflect the proportion of total revenue associated with problem gamblers with respect to different types of gaming[1]. At the time of writing, these risks do not appear to be fully reflected in the company’s current market value.

Ampol (ALD) is Australia’s largest integrated oil refining, fuel distribution and marketing company, operating in a strong industry structure dominated by vertically integrated companies. Ampol supplies transport fuel to approximately 80,000 customers across a number of commercial sectors, including mining, transport, and aviation.

The company is exposed to decarbonisation and electrification risks over the medium to long term, as trends towards electric vehicles (EVs) continue. To address market concerns about longer term declining fuel volumes due to EV penetration, we have factored in an EV adjustment across our central, downside and upside valuations ranging from $2.4 billion to $5.9 billion, based on the assumption that EVs represent between 56% to 80% of total fleet vehicles by 2040.

Further, there remain concerns over capital allocation risks as the company is facing an existential crisis with declining fuel demand. While earnings accretive in the short-term, the recent acquisition of Z Energy (ZEL) in New Zealand further exacerbates long-term risks.

At the time writing, these risks do not appear to be fully reflected in the company’s current market value.

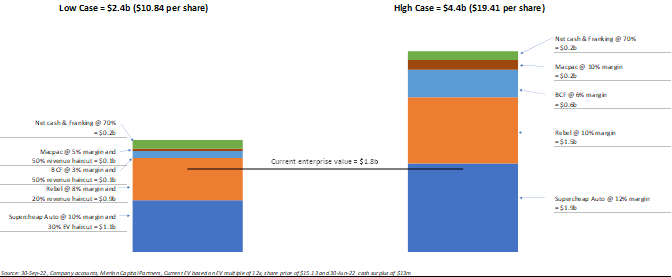

Super Retail Group (SUL) owns and operates a portfolio of four retail brands across Australia and New Zealand, comprising of Supercheap Auto, rebel, BCF and Macpac.

The company remains cheap as the market remains too pessimistic about longer term structural issues relating to the electrification of vehicles impacting Supercheap Auto, social trends towards online impacting the group, as well as shorter term cyclical issues related to macroeconomic conditions and the extent of revenue retracement as the pandemic recedes.

To address market concerns, we have factored in significant revenue haircuts in our downside valuation case to adjust for these cyclical and structural issues, including a 30% revenue haircut to the Super Cheap Auto segment to reflect revenue at risk due to increased uptake of electric vehicles. However, we believe SUL’s long term value will remain resilient to online trends, given its proven ability to execute its omni-retail strategy successfully, as well as continued ability to gain market share.

Harvey Norman (HVN) is a large Australian-based, multi-national retailer in a range of categories, including electrical goods, furniture, kitchen appliances and computerised communications. It operates under a franchise system under three leading brand names: Harvey Norman, Domayne and Joyce Mayne, comprising of 544 franchisees and 195 franchised complexes throughout Australia. The company also includes an additional 109 overseas company operated stores.

The company remains cheap relative to our valuation, in part due to lingering concerns over its governance structure, including a largely non-independent board, ongoing related party transactions and a history of investments in non-core activities. However, non-core investments have been largely immaterial in size and more recent history has demonstrated a commitment from leadership to focus solely on the core business moving forward. Merlon’s cash flow approach captures all non-core activities into the valuation and proves these issues are largely well known and factored into the share price.

Also, the company’s franchise structure is complex, and we have factored a material haircut into our central and downside valuations to reflect the risk franchisees are transitioned to store managers over time. The key point is the company remains undervalued after conservatively factoring in these risks.

Australian Pipeline Trust (APA) is Australia’s largest natural gas infrastructure business with over 15,000 kilometres of natural gas pipelines, connecting sources of supply and markets across mainland Australia.

We have since exited the holding but at the time of our initial investment, the company was undervalued as the market was overly concerned about decarbonisation and electrification trends, resulting in an overly pessimistic view on the duration of cashflows from APA’s portfolio of assets. The market was also highly concerned about the prospect of poor capital allocation, initially associated with US expansion plans and the proposed Ausnet acquisition domestically.

We initiated our position in APA when the share price was trading close to our downside scenario, which incorporated key ESG issues including decarbonisation and climate change transition risk. Under our central case, long term demand for gas distribution network remains

stable through to 2050, eventually falling towards almost zero by 2070. While, under our bear case, revenue declines by 75% between 2040 and 2050, and gas terminating in 2050. We also considered capital allocation risk in our bear case, including a $1.5b haircut for M&A capital misallocation. Ultimately the Board decided against the M&A, even in small part due to our engagement, which we will cover in more detail in the next part of our ESG series.

Concluding Remarks

At Merlon, we assess every investment with ESG factors in mind. We achieve this by incorporating ESG considerations in our qualitative analysis, range of valuations and conviction scores. We only invest in companies if the share price adequately compensates for ESG and other investment risks and opportunities.

In future papers, we will explore our commitment to active ownership and engagement.

Further reading – ESG Integration at Merlon

Read our previous paper Part 1 – ESG Philosophy, where we explored our newly established ESG Philosophy, including how it was developed and key themes arising from it.

In part 2 of this 3-part ESG series, we detail our deepened approach to ESG process integration leveraging our in-house specialised ESG capability.

[1] Browne, M, Greer, N, Armstrong, T, Doran, C, Kinchin, I, Langham, E & Rockloff, M 2017, The social cost of gambling to Victoria, Victorian Responsible Gambling Foundation, Melbourne. Table 11