Asaleo Divestment Well Received

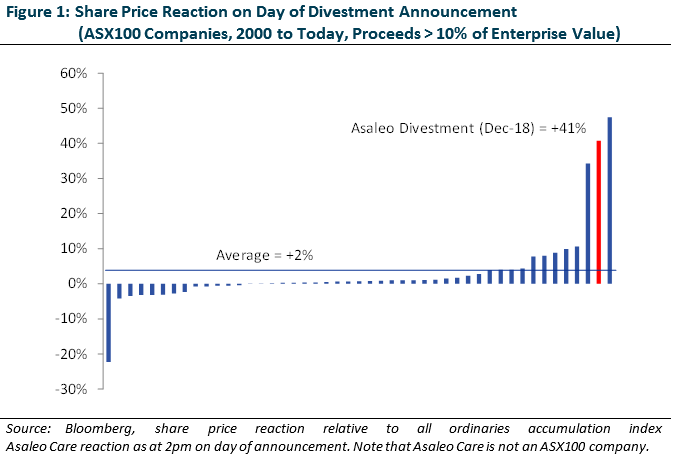

Last month we published an analysis of all divestment announcements of ASX100 companies in Australia since the year 2000. Of approximately 1,200 announcements, there were 46 cases where the sale proceeds exceeded 10% of the sellers’ enterprise value. On average, share prices responded positively to divestment announcements.

This overall finding is consistent with overseas academic research dating back to the 1980s that showed gains to shareholders around the announcement of divestments.

The market reaction to Asaleo Care’s 6 December 2018 announcement that it had reached agreement to sell its consumer tissue business was particularly well received against this backdrop with the share price outperforming the market by 40% on the day.

Merlon owns approximately 4% of Asaleo Care on behalf of institutional and retail clients and we had been adding to the position in recent months.

At the closing price of 65c the day before the announcement, the market was ascribing NIL value to the tissue manufacturing business on our estimates. The tissue business is more commoditised and more capital intensive than the stronger branded personal care business and has been suffering from higher pulp prices, a key input cost. However higher pulp prices are an industry issue which means consumer prices will eventually rise to offset, and the trade buyer has clearly taken the same view.

Also, investors had been concerned about high debt levels which can now be partly repaid. Our investment was made on the basis of a conservative valuation that assumed all debt would have to be repaid in determining value for equity shareholders.

On a long term view, we forecast that the currently unprofitable consumer tissue would return long term industry margins of 10% (Earnings before Interest and Tax) as the 3-player tissue market adjusted to higher pulp prices. While we are happy to be patient for the business to recover and value to be realised, we are supportive of the divestment made at a compelling mid-cycle price. At a sale price of $180m, this reflects a 24x multiple of our free cash flow (FCF) forecast using long term EBIT margins (a large premium to the 17x long term market FCF multiple we adopt as standard across our valuations).

Given that the value of the tissue business was largely factored into Merlon’s estimates, our overall valuation rose modestly relative to the share price performance. The consumer tissue business only represented around 15% of Asaleo’s normalised free cash flow.

Asaleo remains a portfolio holding as the company trades at an attractive valuation, with reduced debt and underpinned by the differentiated, lower capital intensity personal care business.

Authors: Joey Mui, Portfolio Manager/Analyst,