Who’s got the energy?

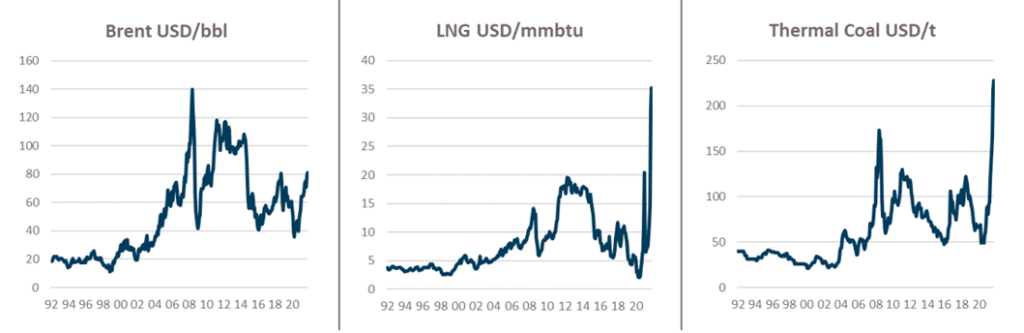

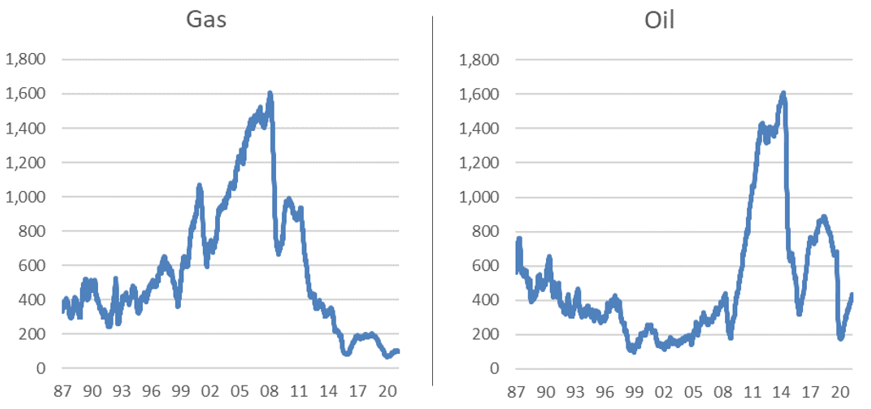

Traditional energy markets (coal, gas and oil) have tightened significantly recently, as the demand impulse following unprecedented global stimulus in response to COVID, was met with disrupted and / or underinvested supply of the major traditional sources of energy (coal, oil, and gas). This underlying supply tightness was exacerbated by the growing reliance on intermittent renewable energy generation, which had moved ahead of storage capacity. While we have for some time expected underinvestment in coal and gas to manifest in higher prices, the degree to which the market has tightened has been rapid, rewarding our patience across a number of positions.

In this paper, we will explore the current tightness across the major energy markets, the economic implications of this, followed by our outlook and implications for related equities, with the key points being:

- High energy prices have occurred as industrial activity has recovered more quickly than the disrupted supplies of oil, gas, and coal.

- The typical supply response to high prices has been impaired by reduced capital availability, risking further tightness in these markets.

- The European and Chinese renewable energy experiences are leading to questions around the extent and speed with which we can we decouple from hydrocarbons without adequate reserve power.

- We value decarbonisation-exposed equities by valuing the production we believe will be required by the market.

- We believe ‘active ownership’ of decarbonisation-exposed companies is the preferred method for addressing climate risks and balancing social benefits.

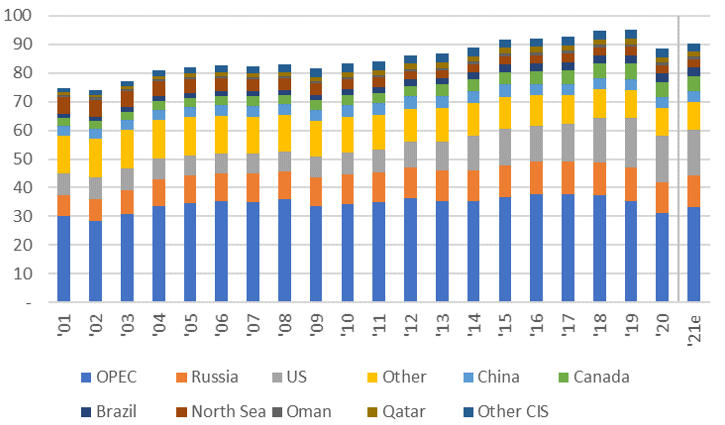

Figure 1: Energy Prices

Source: Bloomberg. Calculations: Merlon as at October 2021

Causes of the crunch

As commodity markets are necessarily designed for balance, there is little short to medium term flexibility to ramp production on demand shocks, or to offset supply shocks that occur in the system. As such it can sometimes take very little to cause instability and a rapid tightening. While negative demand shocks, as we saw during 2020, can see relatively quick production shut-ins, the reverse is not necessarily true. Thus, recovering demand was met by disrupted and under-invested supply of traditional fuels. Each of these are discussed below.

Supply factors

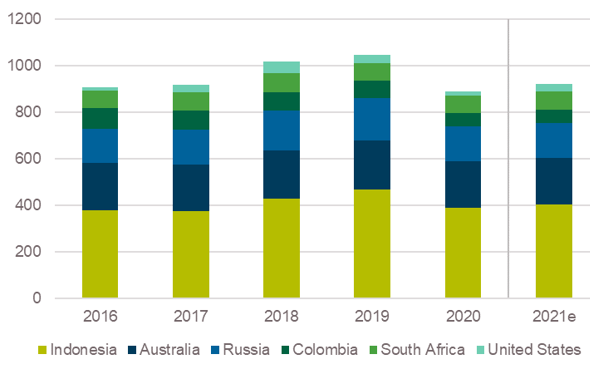

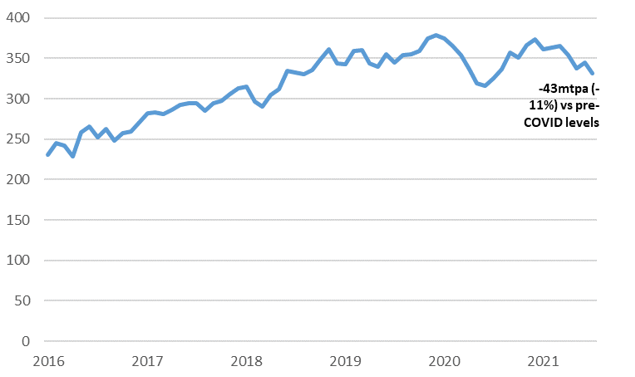

- Thermal coal (12% below pre-COVID levels): In the case of thermal coal, Indonesia, Colombia and South Africa all saw production and exports impacted. In the chart below we note Indonesian export volumes in particular, through the combination of COVID, weather events and domestic requirements, have declined back below 2018 levels.

Figure 2: Thermal coal suplly (mt)

Source: Department of Industry, Science, Energy and Resources. Calculations/forecasts: Merlon

- Gas (11% below pre-COVID levels): LNG export volumes are 11% lower relative to pre-COVID levels, with Qatar, Russia and Malaysia accounting for nearly three-quarters of this decline. According to the International Energy Agency, LNG outages were at all time highs (in percentage terms) in 2020 and have largely remained so into 2021. These declines came as maintenance activity that was deferred on account of COVID considerations, was rescheduled into 2021.

Figure 3: LNG supply (mt)

Source: JP Morgan/Bloomberg. Calculations: Merlon

- Oil (5% below pre-COVID levels): And in the case of oil, the response of OPEC+ in reducing output has seen a disciplined market. This has also had the effect of stifling the previously anticipated response from US onshore producers, fearful of investing in the face of latent OPEC+ volumes. Importantly, the longer the US underinvest, the greater the potential impact decline rates are likely to have on US production.

Figure 4: Oil and natural gas liquids production (mmbbl/day)

Source: BP. Calculations / estimates: Merlon

Demand factors

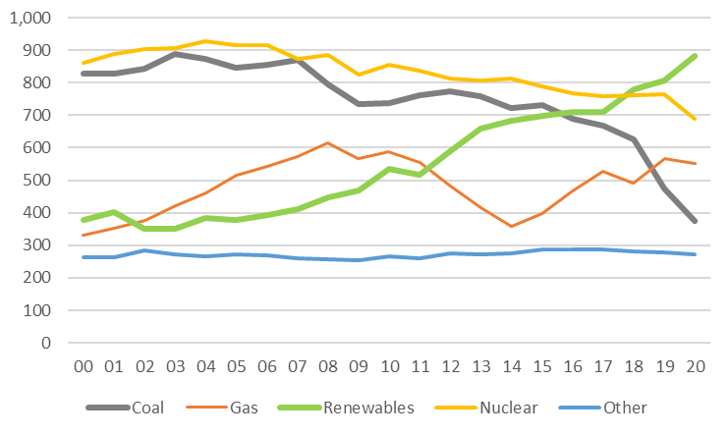

Globally, as in Australia, we have seen a growing reliance on renewable energy sources. Yet, recent months have demonstrated that this growing reliance on renewable energy, when backed by relatively immature storage technology can come with greater susceptibility to more variable levels of generation inherent to renewables, when compared with traditional forms of baseload energy.

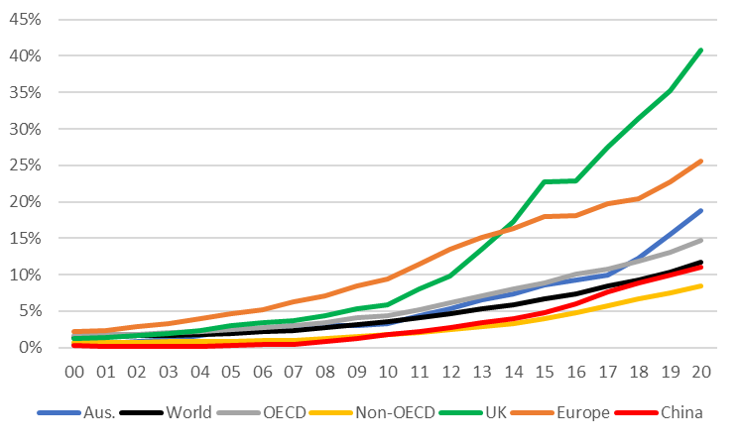

Figure 5: Renewable energy electricity generation % total

Source: BP. Calculations: Merlon

These risks to variable output have increased globally, albeit most pronounced across Europe, where the reliance on renewable sources of power has risen strongly to accelerate the retirement of traditional baseload power.

Figure 6: Electricity generation by type – European Union

Source: BP. Calculations: Merlon

This increased susceptibility to a ‘poor season’ for renewable generation, as opposed to the shorter duration intermittency, as recent months have shown, has seen demand for readily available alternative sources of electricity, such as gas and coal.

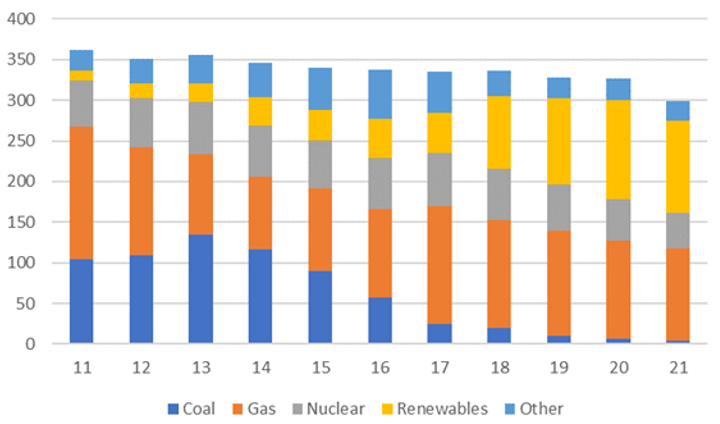

Most pointedly in the case of the UK, coal-fired baseload generation has been entirely replaced by renewable energy sources.

Figure 7: UK electricity generation by source

Source: Department for Business, Energy & Industrial Strategy. Calculations: Merlon as at 30 June 2021

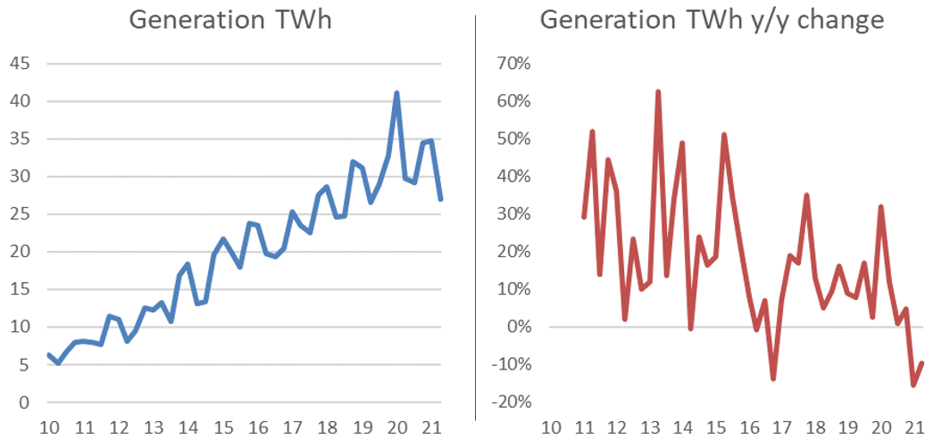

So, when the wind fails to blow when expected, and cloud cover is more pronounced than usual, output is affected, with UK renewables generation down 10% in the June quarter relative to the prior comparable period.

Figure 8: UK renewable energy capacity vs generation growth

Source: Department for Business, Energy & Industrial Strategy. Calculations: Merlon as at 30 June 2021

While Europe has seen what is referred to as a ‘wind drought’, as well as poor solar conditions, other regions have also been similarly impacted. South America as well as China have seen a poor season for hydroelectricity generation. All of which have served to increase demand for flexible, traditional fuels to above pre-COVID levels, as these nations seek to backstop their electricity grids. Of course, this has flow-on effects to gas supplies used for heating and other industrial purposes.

Solutions

While battery storage as well as hydrogen are considered ways to solve the inherent variability of renewable electricity, they remain in relatively early stages of development and are not currently economic, nor capable in providing adequate grid security. This is especially the case in regions that have effectively removed baseload capacity, relative to nations who have available indigenous gas, as we have seen to date in Australia and the United States.

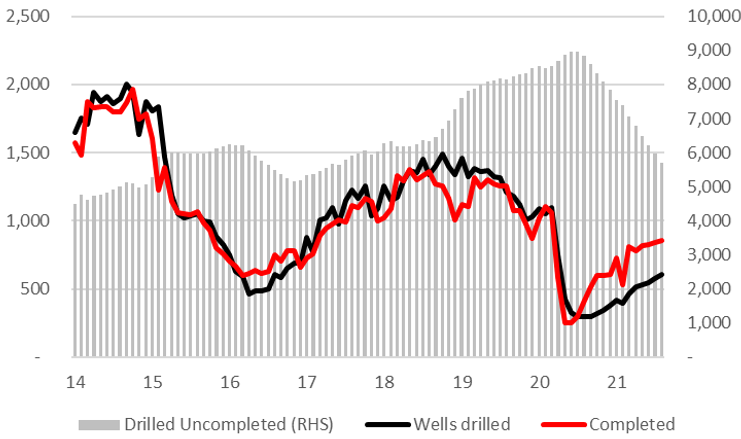

Yet even the relatively privileged situation experienced in the United States may be unsustainable, with the traditional price-led recovery in oil and gas rig activity yet to be realised. As we have signalled in prior papers, we believe a sustained period of low drilling activity will see the excess decline rates associated with unconventional oil and gas to manifest in more rapid production declines.

Figure 9: Oil and gas rig activity (US)

Source: Baker Hughes. Calculations: Merlon

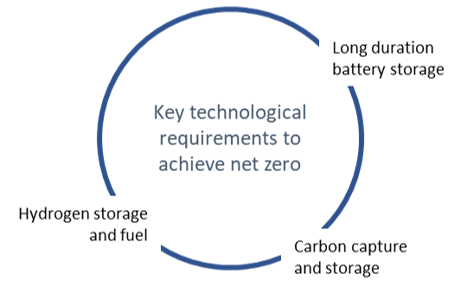

Of course, we do believe the high levels of commitment to the development of these forms of storage will result in their success. We also believe other technologies will be successfully developed, namely carbon capture and storage (CCS), resulting in some level of existing coal and gas fired generation to remain in generation fleets. CCS remains at a similar level of development yet the fears of long duration power outages for fuel import dependent nations such as Japan, Korea and Taiwan see a desire to maintain some level of traditionally fired generation.

It is also likely the energy scare currently being experienced will lead to additional government demand for “strategic storage traditional fuel reserves.” Such a move would be designed to avert looming political instability from rising income inequality and higher power prices. If this occurs, it will only serve to exacerbate the near-term supply demand imbalance.

Outlook

Structural trends

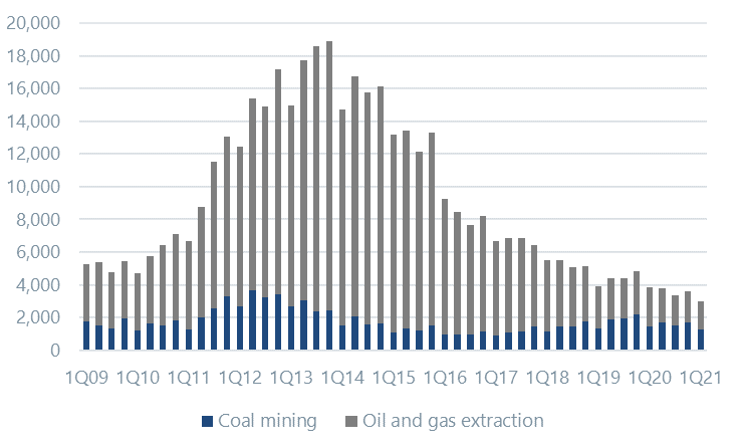

Structurally, we expect traditional energy markets to remain tight – albeit not as extreme as is currently being experienced – for some time. A recent global capital expenditure survey from S&P, indicates energy investment in 2021 will likely be 17% below pre-COVID levels (S&P, 2021). This appears to be simply a continuation of a trend seen since peaks in the middle of the prior decade, with oil and gas investment this year roughly half the USD1 trillion seen less than a decade ago. In Australia, this decline in investment is even more pronounced, with recent investment roughly 80% below peak levels.

Figure 10: Capital expenditure in Australia: oil and gas AUDm

Source: Department of Industry, Science, Energy and Resources. Calculations/forecasts: Merlon

In contrast to this trend of ever decreasing levels of investment in traditional fuel sources, the key users of energy, namely power utilities, are forecast to invest at levels 22% more than those seen before COVID. The combination of these two investment trends may result in continued tightness in global energy markets.

A potentially compounding issue is whether the transition to renewable forms of electricity can keep pace with the degree to which electricity demand will increase for reasons including:

- A growing prevalence of electric vehicles on the road;

- transitioning from gas-fired kitchens and heating systems to electrified systems; and

- the electricity-intensive (not to mention highly water intensive) electrolysis process involved in creating hydrogen.

Industry impact

On a shorter-term basis, the current tightness in electricity and gas markets (amongst others) are seeing demand rationed across many industries:

- Fertilisers – Nitrogen-based fertilisers are manufactured using natural gas. With the extreme gas pricing in Europe, we are seeing producers reducing production as it becomes uneconomic to operate. This is advantaging those producers with relatively cheap gas, such as those in the United States and Australia. The effects of this may also flow into prices of foods, as high fertiliser prices are factor in, and / or reduced usage of fertilisers result in lower crop yields and hence lower output.

- Aluminium – Aluminium production is highly electricity intensive, and we are seeing similar effects to fertilisers in reduced aluminium production responses in China, Europe and elsewhere in response to high electricity prices.

- Electricity – In generation of electricity itself, we are likely to see a degree of switching away from both coal and gas, in favour of burning fuel oil to generate electricity, given it has become relatively cheaper as a source of energy.

Supply outlook

- Coal – The underperformance of China’s hydroelectric generation, coupled with nervousness in the lead up to China’s winter heating season and the lack of response evidenced in the seaborne market has seen China order its domestic coal mining companies to produce at maximum capacity for the remainder of the year. Further, China’s growing power shortages have seen rationing impacting industrial output, and further weakening the economy’s ability to withstand the potential fallout from Evergrande and other property developers. India, too, has seen dwindling coal stocks as industrial activity grows, further tightening the seaborn coal trade. Unless China’s coal volumes recover, and / or Indonesian export volumes normalise, the coal market could remain tight throughout the northern winter.

- Gas – The elevated outages witnessed in the LNG industry are likely to reduce as deferred maintenance activity is completed, and other outages are resolved. The response of the United States, as the world’s swing LNG (and oil) producer, is likely to depend in part on the duration of low rig activity, as latent inventory in the form of drilled but uncompleted wells, is quickly being drawn down.

Figure 11: US drilled, uncompleted well inventory

Source: US Energy Information Administration. Calculations/forecasts: Merlon

- Oil – In addition to the inventory run down noted above, high gas and coal prices are likely to result in electricity generators switching to fuel oil to fire turbines to generate electricity. This is also likely to occur at lower levels, with manufacturers potentially switching to diesel fired generators as their source of stationary power. This trend, if pronounced, could result in oil prices appreciating further, reducing the spread to gas and coal prices. For Australian LNG producers, this would yield far greater profitability given the majority of their cargoes are priced off oil. The OPEC+ alliance remains disciplined in its supply normalisation profile, which is supporting pricing, while restraining US investment (in the form of rig activity) for fear of competing with low cost OPEC+ volume growth.

Conclusions

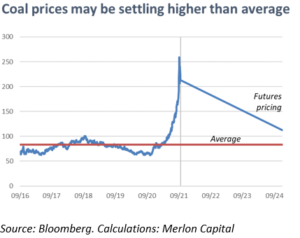

While we expect the elevated prices in coal and gas to decline, as disrupted volumes are recovered, it is possible that they will revert to higher than prior averages, with pricing supported by continued underinvestment. The lack of investment is a function of lower confidence in future demand, coupled with ESG-driven capital scarcity. It is also worth noting that the visibly difficulties faced by nations that have aggressively reduced traditional forms of generation, could result in other nations taking a more measured pace of coal-fired generation retirements, as nervousness following the current period of price spikes will likely linger for some time.

Implications for equities

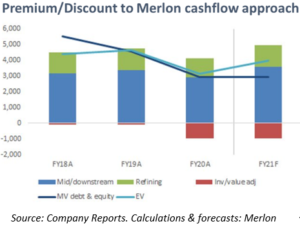

In commodity markets, we look for situations where underinvestment and / or likely supply cuts leave markets vulnerable to even relatively minor demand changes. In line with this focus, we have been invested in coal and gas producers, as we anticipated their underlying fundamentals would leave markets susceptible to demand shocks and hence an upward risk bias to prices.

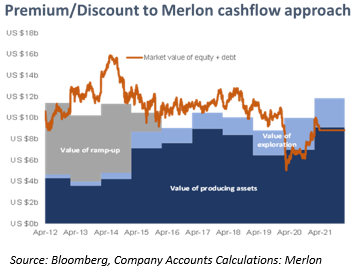

In contrast, equity markets had been, and continue to undervalue the cashflow generation of these businesses, with capital markets pricing more on the basis of an immediate 2050 scenario, rather than more fully assessing the likely cashflows in the ~30 years leading up to this date.

Net zero considerations

We also remain focused on the longer-term energy transition. Some of our considerations regarding the transition to net zero are as follows:

- We have observed that growth in renewable energy sources have come, to date, without equivalent investment in the means to address their intermit

tency and their exposure to longer term weather patterns. Conditions in the UK, continental Europe, South America and China are demonstrating the need for backup power which gas is likely to fill, until battery technology enables longer duration storage.

tency and their exposure to longer term weather patterns. Conditions in the UK, continental Europe, South America and China are demonstrating the need for backup power which gas is likely to fill, until battery technology enables longer duration storage. - We believe net zero will ultimately be achieved in a number of ways and using a range of technologies. Some of these technologies include large scale, long-duration storage batteries (to reduce the effects of intermittent renewable energy sources); carbon capture and storage (to significantly reduce or eliminate carbon emissions from being released into the atmosphere); and hydrogen fuel and storage (to drive electricity generation as well as storing energy).

- The underinvestment in incumbent forms of energy may result in future market volatility as seen currently, as the standard capital cycle framework – whereby high prices incentivise increased production – has been impaired. In short, the pathway to net zero is a transition, and coal and gas are likely to represent a transitional fuel over the course of this process. The underinvestment in these baseload and peaking generation capacity may risk access to affordable and reliable energy for many nations.

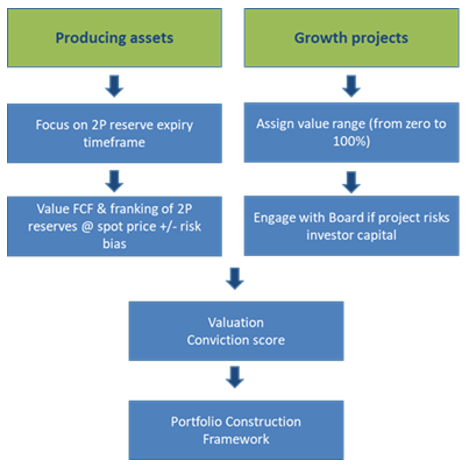

Merlon process

At Merlon, our process is aimed at ensuring we minimise our exposure to behavioural biases and exploit misperceptions about risk and future growth prospects.

The first step in our process is determining sustainable free cash-flow. Commodity exposed stocks generally fare poorly in terms of undifferentiated product, steadily depleting reserves, high capital intensity to replenish reserves and pro-cyclical capital allocation. However, opportunities can arise when commodity prices are low, and industry investment is also low, as supply ultimately tightens and prices normalise, and potentially overshoot.

The second step is to determine an unbiased and consistent measure of value based on sustainable free cash flow and franking, net of debt and remediation provisions. This allows us to determine whether other investors have become too concerned (or too complacent) about risks and growth.

We then set conviction, which recognises that to be a good investment, we need evidence the market’s concerns are either priced in or invalid. One way we determine whether the market is overly pessimistic is to produce valuation scenarios focused on the risk of permanent capital loss (bear case) relative to the upside scenario (bull case).

How do we apply this process in the context of the transition to net zero?

Mining and energy companies have finite resources, and as such, we value the proven and probable component of these resources based on an estimate of a sustainable operating and capital costs, at current prices, with a positive or negative risk bias applied to this price. We then provide an estimate of the value of any growth projects and remediation required on existing projects.

Reserves: In the case of coal miners, such as Whitehaven and New Hope we see the duration of these reserves as being within the net zero timeframe outlined under the Paris agreement. Importantly, their core customer base of Japan, Taiwan and Korea are increasingly likely to incorporate technology to reduce / capture carbon emissions from their coal fired generation assets, hence supporting demand for their products over the course of their reserve extraction. Therefore, we view stranded asset risk as low.

Price: With regard to the price we apply, we see underinvestment in supply due to ESG pressures increasing the likelihood of higher rather than lower prices, as the effects of decarbonisation of demand for thermal coal is likely to be slower than is currently expected, for reasons outlined above.

Projects: We also estimate a value of their non-producing growth projects. As an example, Whitehaven has two large growth projects to which we currently ascribe zero value. Further, due to the growing uncertainty as to whether these projects will be commissioned into an environment of satisfactory demand, and hence increasing risks to investor capital, we have engaged with the company outlining these concerns.

Diagram: valuing companies with finite reserves

Merlon positioning

We are currently holding upstream positions in Woodside Petroleum, Origin Energy and Oil Search, established based on an expected tightening of global oil markets over the medium term. We also hold upstream positions in Whitehaven and New Hope. The current price environment is the result of prior price and capital rationing from investors concerned with the supply of traditional fuel sources.

We hold downstream positions in Ampol and Viva Energy, based on a favourable industry structure, and upside to refining margins given historic cyclicality of this industry. We also have a position in downstream exposed Alumina Limited, benefiting from relatively cheap gas and non-freight exposed bauxite deposits; and in Incitec Pivot, which is benefiting from elevated ammonia pricing (the key ingredient to making nitrogen-based fertilisers).

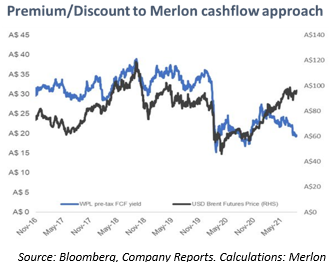

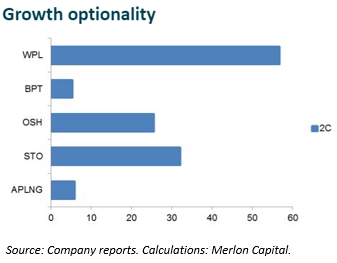

Woodside Petroleum (WPL)

Woodside is the leading Australian LNG producer, with significant Western Australia-based conventional oil and gas operations. The company has generated strong cash-flows since the commissioning of Pluto in 2012. The company has significant growth potential, as evidenced by its undeveloped reserve position, via key projects such as Browse and Scarborough, in anticipation of continued growth in demand for cleaner gas fuels, as well as its conventional oil Sangomar field in Senegal.

We believe Woodside remains undervalued relative to our assessment of value, and despite the rally in oil prices. The market is currently undervaluing the value of Woodside’s cash-generative operating asset base, in addition to its large undeveloped reserve profile.

We expect oil prices to continue to strengthen as demand recovers to pre-COVID levels, while the underinvestment in conventional and now unconventional oil supply should further support prices over the medium-term.

COVID levels, while the underinvestment in conventional and now unconventional oil supply should further support prices over the medium-term.

The proposed BHP oil merger is roughly neutral to our valuation and conviction yet provides access to capital to commercialise its Scarborough field, amidst what is an increasingly favourable contract-pricing environment. In this way, Woodside is more able to unlock its superior growth optionality relative to peers

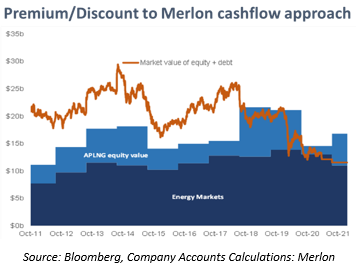

Origin Energy (ORG)

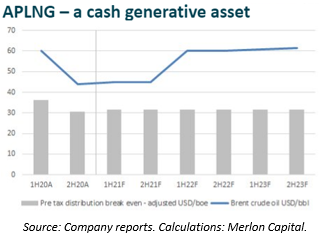

Origin is the leading Australian east coast energy retailer, with four million customers, supported by upstream coal and gas generation, as well as owned and contracted renewables generation. The company has been operating its LNG facility on Curtis Island (QLD) since 2016, having received more than $2.3b in distributions, and which is expected to contribute further significant cash flows as oil prices normalise.

Origin Energy is remains cheap despite the rally in oil prices, as the market is concerned by the effect of low electricity pricing on Origin’s wholesale and retail electricity businesses. We see low electricity prices as having been driven by 1. the effect of low gas prices, 2. an unseasonably cool summer, and 3. the growth in renewables supply.

In addressing these points, we expect gas pricing to normalise as onshore demand recovers; the Bureau of Meteorology has fo

recast a return to more ‘normal’ summer weather patterns, while a post-COVID demand recovery should enable a continued recovery of electricity prices. Further out, the ACCC has noted recently that it expects to see an East Coast gas supply deficit, which we expect to be resolved via LNG import terminals, albeit at higher prices.

In addition, Origin’s 37.5% interest in the APLNG project is delivering high and growing cashflows to Origin. At current oil prices, the investment should receive up to AUD1 billion in the form of a distribution.

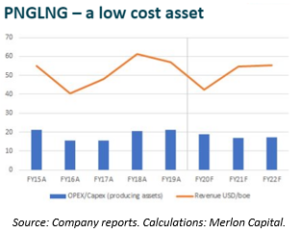

Oil Search (OSH)

Oil Search, in partnership with ExxonMobil, is the leading Papua New Guinea LNG producer. The company has generated nearly USD2b in free cash-flow since the commissioning of its large-scale conventional gas and condensate PNGLNG project in 2015. The company has large growth opportunities both within PNG and Alaska, in order to take advantage of a shift toward less carbon-intensive sources of electricity generation.

As with others in the sector, Oil Search remains undervalued relative to our assessment of value, and despite the rally in oil prices. The market is currently discounting the value of the company’s low cost, conventional core operating asset base, in addition to its large undeveloped reserve profile.

Like with Woodside, we expect oil prices to continue to strengthen as demand recovers to pre-COVID levels, while the underinvestment in conventional and now unconventional oil supply should further support prices over the medium-term.

The merger with Santos (STO) is appealing as it introduces the potential to create common interests across the existing PNGLNG facility, and the Papua LNG project, thereby increasing the probability of it being commercialised. As with Woodside, the pricing environment for determining new projects is strong. And underpinning the company’s ability to monetise growth projects, as well as its appeal to Santos, is its highly cash-generative PNGLNG project.

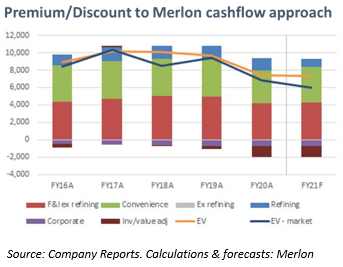

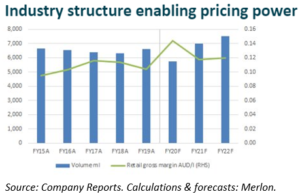

Ampol (ALD)

Ampol is the leading Australian supplier of petrol and diesel product. The company has a sizeable commercial business, accounting for 50% of total volumes, combined with a one-third retail market share position, via 700 company owned and operated sites, and supply agreements to non-owned Ampol-branded sites. The industry structure is highly favourable with the top three operators supplying or retailing more than 80% of total volumes. Over time, the company has reduced its exposure to the more capital-intensive refining segment, focusing on its marketing division, with an integrated cash return on invested capital above 10%.

Volumes are clearly impacted by COVID-19 related disruptions, but the company is in a strong position to gain share with downside risk mitigated by hard property assets. Other developments include the Government underwriting the viability of domestic refining (important for Viva Energy, which the fund also holds), which we expect to see upside from due to the recovery in volumes, coupled with decommissioning of refineries through the COVID period.

We also like the company’s value accretive takeover of Z Energy (ZEL) in New Zealand, which increases the company’s regional market share – and hence buying power – and its highly valuable supply chain infrastructure utilisation.

While the market is concerned about longer term declining fuel volumes from growing Electric Vehicle penetration, we have factored this into our central valuation, with the company remaining compelling value despite this.

Viva Energy (VEA)

Viva is a large-scale Australian supplier of petrol and diesel product. The company has an attractive retail model, with Coles Express operating the shop, and Viva retaining control over retail pricing and margins. Viva also has a large commercial business, accounting for 45% of total volumes, combined with a 20% retail market share position. The industry structure is highly favourable with the top three operators supplying or retailing more than 80% of total volumes.

As noted for Ampol (above), volumes are clearly impacted by COVID-19 related disruptions, but the company is in a strong position to gain share with downside risk mitigated by hard property assets. The agreement with the Federal Government to underwriting the viability of domestic refining, which we expect to see upside from due to the recovery in volumes, coupled with decommissioning of refineries through the COVID period. The company is also developing its Geelong terminal to incorporate growth in renewables energy via potential LNG imports, hydrog en and battery storage concepts.

en and battery storage concepts.

VEA has rallied and is now trading more closely with our central case valuation, with the market more appropriately factoring in the value of its retail model, as well as the latent value of its physical asset base (including the property value of its Gore Bay terminal in harbour-front Sydney, should this be converted).

Whitehaven (WHC)

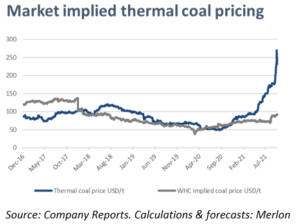

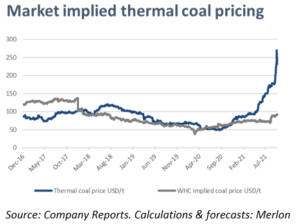

Whitehaven is a large-scale Australian miner of thermal and semi-soft metallurgical coal. The company is a mid-range cost operator, albeit with a higher proportion of its sales into the met coal market. While exposed to longer term decarbonisation trends, the company’s operating asset base is generating strong cash flows, enabling a rapid pay down of debt.

While the company has rallied strongly from its mid-2020 levels, it is factoring in a lower thermal coal price than it was du ring prior peaks. While we can’t forecast when the price will peak, it is reasonable to expect them to revert once northern hemisphere renewable generation recovers, and/or some degree of demand destruction occurs.

ring prior peaks. While we can’t forecast when the price will peak, it is reasonable to expect them to revert once northern hemisphere renewable generation recovers, and/or some degree of demand destruction occurs.

Having rallied strongly, the company is now trading more closely with our central case valuation, albeit well below a more bullish case scenario. We believe it is likely prices will ultimately settle at higher-than-average levels than previously due to the pronounced underinvestment in coal reserves seen over a number of years, rendering the market more susceptible to traditional energy shortages as we are currently witnessing.

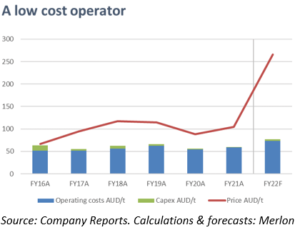

New Hope (NHC)

New Hope is a large-scale, low cost Australian miner of thermal coal. The company’s main asset is the Bengalla thermal coal mine in the Hunter Valley. The asset is a low-cost operator, selling into the high calorific value coal market. While exposed to longer term decarbonisation trends, the company’s operating asset base is generating strong cash flows.

Similar to peers in this space, the company has rallied strongly from its mid-2020 levels.

Yet it is factoring in a lower thermal coal price than it was during prior peaks. While w e can’t forecast when the price will peak, we expect them to revert once northern hemisphere renewable generation recovers.

e can’t forecast when the price will peak, we expect them to revert once northern hemisphere renewable generation recovers.

Having rallied strongly, the company is now trading more closely with our central case valuation, albeit well below a more bullish case scenario. As with Whitehaven (noted above), we believe it is likely prices will ultimately settle at higher-than-average levels than previously due to the pronounced underinvestment in coal reserves seen over a number of years, rendering the market more susceptible to traditional energy shortages as we are currently witnessing.

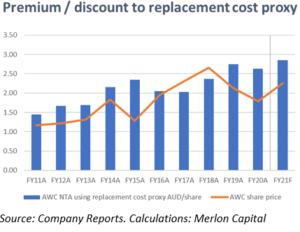

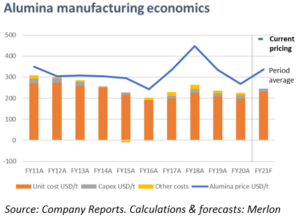

Alumina Limited (AWC)

Alumina is the world’s largest independent producer of alumina, the feedstock used in the manufacture of aluminium. In addition to its size, the company’s operations operate in the bottom of the global alumina cost curve, ensuring resilience through commodity cycles.

W e invested in Alumina Limited during COVID-impacted 2020, with alumina prices trading below USD300/t. We thought such pricing would ultimately see some level of production reduced, and global pricing tighten. We also assessed that at the time, we were able to invest at a price below the replacement cost of its assets. And with the demand for aluminium expected to grow, and new alumina assets required, that the market would ultimately recognise this value.

e invested in Alumina Limited during COVID-impacted 2020, with alumina prices trading below USD300/t. We thought such pricing would ultimately see some level of production reduced, and global pricing tighten. We also assessed that at the time, we were able to invest at a price below the replacement cost of its assets. And with the demand for aluminium expected to grow, and new alumina assets required, that the market would ultimately recognise this value.

With alumina prices trading well above USD400/t, there are material upgrades to earnings from where

market estimates currently sit. While prices began to rally upon news of a fire and extensive damage to the large Jamalco refinery, further appreciation came upon news of a military coup in Guinea, the world’s largest supplier of seaborne bauxite (the feedstock to refine into alumina). And now, with China’s power shortages, there is increasing pressure for supply of seaborne tonnes into China.

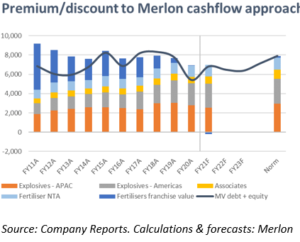

Incitec Pivot (IPL)

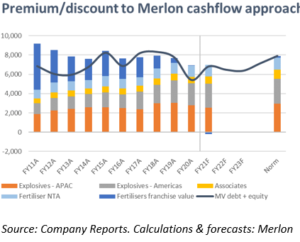

Incitec is a top-two global explosives company, and a leading Australian fertiliser manufacturer and distributor. The global explosives industry structure is favourable with the top two operators supplying or delivering more than two-thirds of total volumes. Over time, the company has seen declining returns in its Australian fertiliser manufacturing, due to rising domestic gas prices and poor trading conditions. Our original investment in the company was premised on the market attaching close to zero value on its fertilisers business, despite its industry position.

We invested in the company when it was trading at a low multiple relative to its history and during a period when its earnings were impacted by fertiliser underperformance. Since this time, Incitec has rallied and is now trading more closely with our central case valuation, as the company’s interrupted plant maintenance at its Louisiana-based ammonia plant was resolved, while the company has also benefited from the rally in global ammonia prices, including its nitrogen-based fertiliser products.

The current energy-disrupted environment has seen high gas cost exposed operators in Europe and Asia reducing output / shutting capacity, thereby seeing global fertiliser prices rally. This benefits those producers with access to lower priced gas such as in the United States and Australia, both of which Incitec has a manufacturing footprint in. While we do see current pricing as unsustainable, it is possible global pricing for traditional fuels, including gas, revert to above average prices for a longer period.

Author: Ben Goodwin, Analyst/Portfolio Manager