Buy Hold Sell: Where to hunt for dividends in 2021 and beyond

This article was published on Livewire Markets, 9 August 2021

If income investing was an Olympic sport, Australia would hold a silver medal, ranking second highest in the world for its dividend yield. And you can thank our world-beating and near-unique franking credit regime for this.

Of course, we also saw dividends slashed more severely than almost anywhere else last year, in the depths of the pandemic-driven market rout.

But – at the risk of labouring the sporting metaphor – Aussie dividends are making another sprint for the line.

In this episode of Buy Hold Sell, Plato’s Dr Don Hamson and Merlon Capital’s Neil Margolis join Livewire’s Ally Selby in a deep dive into income stocks.

Alongside their medium-term outlook for the resurgence in buybacks and other capital management initiatives, they also reveal their thoughts on whether COVID has permanently distorted Aussie dividends, under-appreciated sectors, as well as their favourites among the Big Four banks.

Plus, they also share the stocks they are pinning their highest dividend hopes on this reporting season, as well as two dividend champions for the months to come.

Note: This episode was filmed using Zoom on the 4th of August 2021. You can watch or read an edited transcript below.

Edited Transcript

Ally Selby: Hello, and welcome to Livewire’s Buy Hold Sell. I’m Ally Selby, and today we’ll be getting into the Olympic spirit and putting Aussie dividends to the test.

While they suffered a major blow during 2020, dividends and other capital management initiatives such as buybacks are well and truly back. Today, I’m joined by Neil Margolis from Merlon Capital, and Don Hamson from Plato for this deep dive into income. Plus, they’ll also be sharing two dividend champions for the months to come.

First up, let’s talk about COVID-19. It’s the reason why we’re filming from home today, but it’s also completely changed the dividend landscape. Investors traditionally relied on the big four banks and the likes of Telstra. Now iron ore is the talk of the town. Don, I might start on you. Is this a permanent change in the dividend landscape?

Don Hamson: Not really. The banks are coming back quite strongly this year. So on our numbers, three banks and three ore miners are the top six dividend payers, and that’ll probably continue for a while. But I think Westpac will probably try and push its way back into the top again. So, last year was just a temporary dip in dividends for the banks, and they say they are coming back very strongly.

Ally Selby: Neil, do you agree, is this a temporary change in the dividend landscape? And do you see this as an opportunity or a risk?

Neil Margolis: I think it’s a temporary change, and whenever one or two sectors dominate the dividends, it’s normally a sign that it’s not sustainable. I had a quick look today.

I agree with the top six, but if you look at the top seven, the four banks and the 3 iron ore miners is actually 56% of the dividends that the stock brokers expect the markets to pay, of which 31% are coming from three iron ore companies, which is obviously fantastic. But they were only 3% five years ago.

I think this points to some potential risk on how sustainable the dividends are because those seven stocks are all very heavily dependent on factors outside their control. The banks being unemployment, and the iron ore miners being the iron ore price.

Ally Selby: Reporting season has just kicked off. Neil, is there a sector in particular that you think we’ll see substantial dividend growth?

Neil Margolis: Well, the miners, we’ve already discussed. The retailers, I think will do very well. Obviously, they’re getting a one-off boost from stay-at-home, from limited travel, closed borders and government stimulus. A lot of them are taking the opportunity to pay off debt. And of course, a lot of them are in market leadership positions, so they’ve actually gained market share. And the likes of JB Hi-Fi, Harvey Norman, Super Retail have actually gained market share through the pandemic. They had stronger balance sheets, better online offerings and some of the independents. We often see this, and they came in quite cheap. It’s probably one sector that could do quite well.

Ally Selby: Don, do you agree? Are there any sectors, in particular, that could really benefit over reporting season?

Don Hamson: I agree with Neil. Actually, we like the retailers, but we really do like the iron ore miners. You’ve already seen Rio’s result, which was a 260% increase in dividends if you count the special. So, we think there’ll be some really big increases from Fortescue and BHP as well. So, they’re at the top of the list, and I know that there’s clearly risk with iron ore prices, but these dividends are pretty much in the bag given that iron ore prices are currently still staying very high and were very high last half.

Ally Selby: Don, staying on you. Are there any areas of the market where you think expectations are not in line with the dividends that could come through?

Don Hamson: Well, clearly travel stocks are still under pressure, but people aren’t expecting any from them. So, I think the areas that are under real pressure though are actually shopping centres, and to a lesser extent office trusts. So, I think you’ll find continuing rent problems there, closed stores, etc. And some of the retailers aren’t doing as well, but we like the ones Neil likes as well. So, I think that’s an area that could come under quite a bit of pressure in the next few months.

Ally Selby: Is that from the extended lockdowns that we’re seeing at the moment?

Don Hamson: I think it’s both the lockdowns, but also the fact that people who never bought things on the internet are now using the internet a lot. And so, we’ve seen the structural change from shopping in shopping centres to shopping at home, which has been rapidly encouraged by COVID-19. So, that’s a structural trend that’s just been heightened by the pandemic.

Ally Selby: Neil, over to you. Are there any areas of the market where you think dividend growth has been undervalued by investors?

Neil Margolis: You can look at one option, which is where surplus franking credits exist in the market. We quite like the fuel retailers, Ampol and Viva. Ampol in particular has $800 million in surplus franking. They were the subject of a takeover offer just before COVID. They had been selling some properties. Obviously, they are affected by the lockdowns, so they might be a little cautious, but we think – if it’s not this season, in the next season or two – we could see some good dividends out of them. You’ve got the demand recovery as well. We quite like the health insurers, which is a sector that’s also benefiting from lower claims, less elective procedures, very low-risk insurers. And of course, they also had a windfall. We discussed the retailers. I agree, property trusts, they also have lots of debt. So not only do they have some rent issues, but they also have lots of debt, which could constrain their ability. That’s on the negative side.

Ally Selby: Let’s talk about Commonwealth Bank. It’s one of the largest dividend payers in the market. What are your expectations around its capital management initiatives in August?

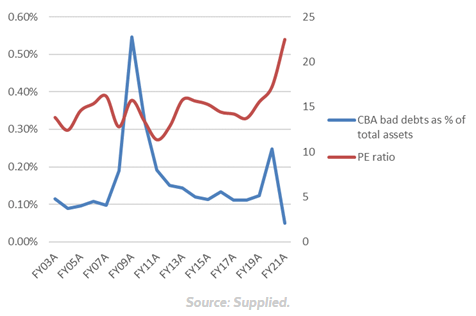

Neil Margolis: It’s very well flagged. They’ve got about $10 billion of surplus capital and $2 billion of surplus franking. So, it’s speculated they could return maybe $9 billion. I just want to remind listeners that the market value of Commonwealth Bank is $180 billion. So, $9 billion is only 5%. So, it is good, but it’s probably been a little bit overhyped. Banks are very leveraged. If their bad debts had to go from 0.3% of loans to 1% of loans, their earnings would halve, and so would the dividends. So, I just want to remind everyone that we’re in a very good macro environment. It wasn’t so long ago that people were reminded that they are quite risky. And the last thing I’d say on buybacks from banks is that National Australia Bank does take the cake where they’re buying back $2.5 billion now at $28. But a year ago, they raised $5 billion at $14. So, you don’t need to be very good at maths to realise how many extra shares are lying around on that transaction.

Ally Selby: Don, over to you. Is there a different bank that you think that we should be paying attention to?

Don Hamson: Well, I think there’s also a potential for an off-market buyback from Westpac as well because they also have excess franking. So everyone’s talking about CBA, but Westpac also has excess capital, and it’s only CBA and Westpac that really have the franking to be able to do an off-market. So, Westpac may be in a position to do one as well.

Ally Selby: We talked about the Big Four banks. Are there any other companies that you think are likely to introduce any capital management initiatives this reporting season?

Don Hamson: Well, we’ve already seen Metcash do an off-market buyback. Maybe Woolworths as well, they’ve obviously been selling Endeavour. And we’ve already seen Telstra sell its towers for a good price and is going to return some of that to shareholders. So, we expect an announcement there pretty soon. So, in those areas that are doing well, particularly if they’ve sold things, then there’s the potential for capital management.

Ally Selby: Okay Don, we asked you to bring along one dividend champion for us today. What have you brought for us?

Don Hamson: It’s an interesting stock, CSR, you don’t think of it as a dividend champion, but it’s one of our top-rated stocks. The building cycle is obviously very strong, and it’s pretty cheap. So, we think a combination of good business momentum and a reasonable valuation and a reasonable dividend. So, that’s the stock I brought today.

Ally Selby: Neil, can you beat CSR? What’s the stock you’ve brought for us today?

Neil Margolis: Well, as I said, we do like Ampol. The surplus franking is more than 10% of their market value at $800 hundred million. It’s a very good industry structure. It used to be quite competitive, but the supermarkets have exited fuel retailing. So, demand’s a bit weak now, but we know it will recover. And then, they’d been losing money with their refining business, but only two months ago, the government basically agreed to backstop both their refinery and Viva’s refinery business, remove the losses and underwrite some profits just to ensure fuel security. So one of the risks there was the refining business was losing money on the international stage, and that’s been taken away. They’ve got the surplus franking, they’re selling properties and if they don’t return that surplus capital, someone else will. And I recall that takeover back in December ’19. That Canadian company was actually using Ampol’s own franking credits to pay for it, which I thought was quite clever.

Ally Selby: Well, that is all we have time for today. We hope you enjoyed this thematic episode of Buy Hold Sell. If you did, why not give it a like? Remember to subscribe to our YouTube channel, so you never miss an update.