Value vs Glamour: The Case for Fairfax Media Over REA Group

Frost and Sullivan, a market research firm, estimate that Australians spend between $1.1 and $1.3 billion each year on real estate classified advertising, of which approximately two thirds is spent online. This is a small cost relative to the price of a house as well as agent commissions and stamp duty. In addition, companies such as banks and utility companies spend money to display their brands and products on real estate websites. As most readers would be aware, realestate.com.au and domain.com.au represent the majority of this market with approximately 60% and 30% market share respectively.

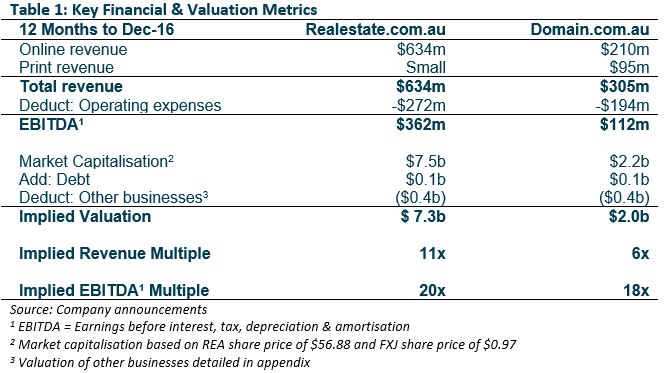

In the table below we present key financial information and valuation metrics for the two businesses. As value investors, perhaps the most interesting point to note is that he market is valuing realestate.com.au on a revenue multiple almost double that of domain.com.au.

Reasons to be Cautious

A key tenant of Merlon’s investment philosophy is that markets are mostly efficient and that cheap stocks are always cheap for a reason. We are focused on understanding why cheap stocks are cheap. To be a good investment, market concerns need to be priced in or deemed invalid. We incorporate these aspects with a “conviction score” that feeds into our portfolio construction framework.

In the case of Domain.com.au, there are many reasons for caution:

- Domain.com.au has material exposure to the print advertising market. Excluding this revenue from the above calculations would bring the implied revenue multiple up to 9x, a more modest discount to realestate.com.au;

- Domain.com.au’s market position is inferior to realestate.com.au generating half the revenues and (according to REA Group) half the number of site visits;

- Domain.com.au is less profitable than realestate.com.au generating an EBITDA margin of 37% during the period compared to Realestate.com.au’s margin of 57%. Adjusting for this difference by focusing on earnings multiples rather than the revenue multiples again yields a much more modest valuation discount;

- Domain.com.au’s digital revenues are growing more slowly than realestate.com.au posting digital growth of 16% relative to the prior year compared to the 22% growth delivered by realestate.com.au. If this growth differential persists it would justify a lower multiple for domain.com.au; and

- Domain.com.au has an equity sharing model with real estate agents that is not accounted for in “advertised” earnings but rather treated as a “minority interest”. This is immaterial at present but could become meaningful as the business grows.

Taking these arguments – along with the fact that Fairfax Media’s traditional print businesses are in rapid decline and could be worth less than zero – it is easy to write-off Fairfax Media and certainly easier for professional fund managers to justify holdings in REA Group to their clients. But long term investing is not a popularity contest.

The Pitfalls of Chasing the Latest Growth Story

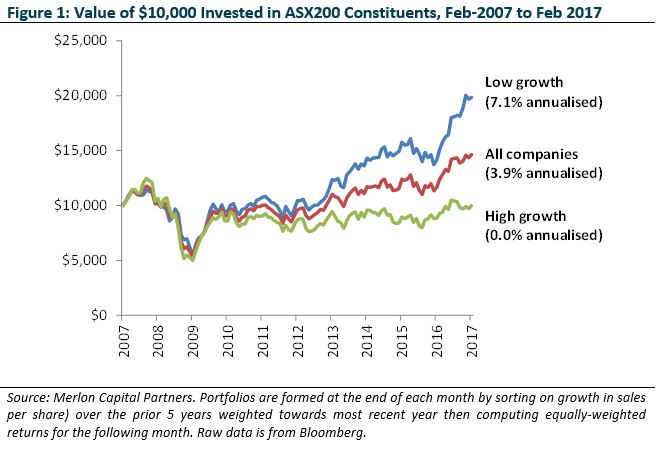

To illustrate why we think chasing the latest fads is generally a bad idea, we went back 10 years and sorted all ASX200 constituents according to their sales growth over the preceding five years. We placed higher weight on more recent sales to reflect investors’ tendency to put more weight on short term results and divided sales by the number of shares on issue to adjust for companies that had grown revenues through acquisitions or heavy investment.

From this sorted list we created three portfolios representing companies ranking in the top third, middle third and bottom third for prior growth in sales. We rebalanced these portfolios on a monthly basis, adjusting index constituents and updating the sales growth calculations each time companies reported.

The results highlight that systematically purchasing stocks with deteriorating sales growth would have outperformed the market by around 3 percentage points per annum over the last decade and outperformed stocks with accelerating sales growth by around 7 percentage points per annum. These stocks are often the most difficult to justify to clients and marketing departments. It is for this reason that we believe this anomaly is likely to persist.

Mitigating Factors

There is no doubt that Fairfax Media falls into the low growth basket of companies that, statistically, suggests that the market may have become too pessimistic. Through our own research, we have formed the following opinions that mitigate many of the concerns raised earlier:

- Domain.com.au operates under an umbrella of a good industry structure (i.e. an oligopoly) and REA Group is a rational competitor. Both players have more to gain from growing the market than shrinking industry profits;

- Real estate classifieds are different to jobs and cars and can support two players. Alan Kohler – a journalist and media entrepreneur – summed this up nicely: “Because houses are expensive, the marketing budget for selling them is much larger than it is for cars or jobs, which means there is easily enough money to advertise on two websites. Simple as that.”

- Domain.com.au’s competitive position is improving evidenced by its rising share of listings (currently around 90% of the market), growing site visits (particularly in mobile) and support from the real estate agent community who are fearful of realestate.com.au’s dominant market position. These outcomes reflect ongoing management focus and investment in the business.

Our long term view is that domain.com.au will sustain and possibly improve its market position. That said, we think that realestate.com.au’s superior scale probably means the business will continue to enjoy a margin premium.

Valuation Scenarios – Preparing for the Worst

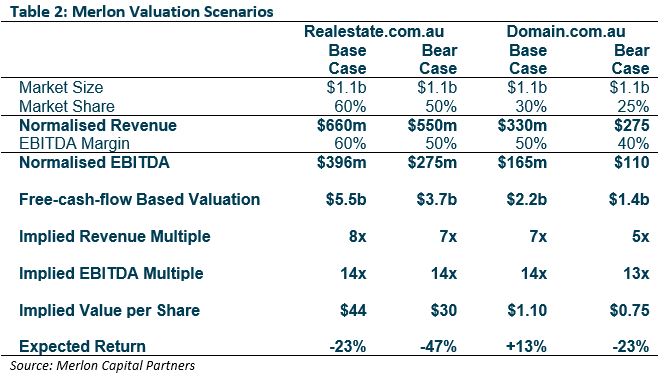

From a valuation perspective we assess Fairfax and Realestate.com.au under a range of scenarios with a particular focus on potential downside outcomes. This is standard procedure at Merlon with “bull case” and “bear case” valuations prepared and considered for all companies under coverage.

Downside risk scenarios are another critical consideration in developing a “conviction score” that combines with our free-cash-flow based valuations to determine whether we include a stock in our portfolios.

In the case of Fairfax, our downside scenario incorporates both a loss of market share and a permanently lower margin for domain.com.au when compared to realestate.com.au. This scenario yields a valuation for Fairfax of around 25% below the current share price. Certainly enough to temper our enthusiasm but vastly superior to the circa 50% downside to our bear case scenario for REA Group.

Concluding Remarks

Fairfax Media is a good style fit for Merlon showing high level value characteristics and falling into a group of lower growth companies that are typically associated with excessive levels of investor pessimism. Conversely, REA Group is expensive but easy for other investors to justify holding because of its market leadership position, absence of traditional print assets and strong growth.

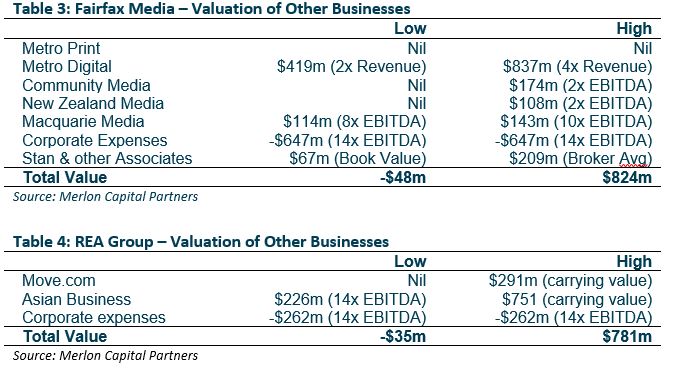

Our detailed review of Fairfax Media has focused on domain.com.au where we believe the industry backdrop is highly supportive and the company’s competitive position is both sustainable and improving. We ascribe very little value to Fairfax’s traditional print assets.

As such, we continue to hold Fairfax Media in our portfolios.While there are valuation scenarios that pose some risks to our clients’ capital, we view these risks against the backdrop of what we think is an overvalued equity market; an excessively valued peer (REA Group); and, a view that our long term assumptions are more likely to prove conservative than optimistic.

Appendix: Valuation of Other Businesses

Author: Hamish Carlisle, Analyst/Portfolio Manager