The key criteria for sustainable equity income (and Merlon’s top 3 picks)

This article was published by Livewire Markets, 20 June 2023

There are whispers of dividend cuts this year, but Merlon’s Andrew Fraser believes defensive equity income comes down to the right focus.

Andrew Fraser, portfolio manager for the Merlon Australian Share Income Fund, argues unequivocally yes.

“Inflation is the biggest risk that investors, particularly retirees, face. Investing in Australian shares is a great way to offset that risk given the long-term profile that Australian shares offer,” he says.

When it comes to income after all, that 5% guaranteed return leaves you behind when inflation is at 7%. But given the market uncertainty, where do investors find defensive equity income?

The answer might surprise you – it’s not just tried and true supermarkets or even dividend darlings like the banks or Telstra.

In this interview, Fraser shares his expectations for equity markets (and dividend payouts) going forward, how to identify sustainable, long-term income, and his top conviction picks for defensive equity income in this environment.

Topics discussed

- 0:29 – The current environment and Australian equities

- 1:42 – Identifying sustainable income

- 2:23 – Which companies are best positioned for the environment

- 2:51 – Merlon’s approach to downside protection

- 4:00 – The equity returns investors should expect from the market

- 4:49 – Three high-conviction defensive income picks

- 5:43 – Why investors should still pick equities rather than just term deposits

- 6:55 – Using equities in retirement

Edited transcript:

What impact has the inflationary, high interest rate environment had on Australian equities?

I think the biggest impact has been the underperformance of those companies and sectors that disproportionately benefitted from a trend to zero or below-zero interest rates leading into the COVID pandemic.

The companies that generate little to no cash flow, bond-proxy companies like property trusts and infrastructure, have significantly underperformed over the last while.

Conversely, this environment has been good for Merlon’s approach to investing in companies that generate sustainable free cash flow and contrarian investment in companies that the market has become overly pessimistic about.

How do you expect this to affect dividend income in the coming August reporting season?

There are risks of a slowing economy due to the effect of rate rises on consumer demand. Company boards will probably be quite conservative in their approach to dividends and look to preserve capital or pay down debt leading to a more uncertain environment.

How does Merlon ensure it is selecting companies with sustainable income? Are there any levers you can access to influence dividends?

We like to invest in companies that have a long-term track record of free cash flow generation. We like to understand how those companies generate those cashflows through different market cycles. We want to be careful not to overcapitalise on peak cycle conditions. We also have a focus on trying to understand what the sustainable level of capital expenditure is for those businesses. We invest in a portfolio of undervalued companies, which is the best form of protecting yield through multiple different market cycles.

Can you share a few companies you see as being well-positioned for the rest of the year?

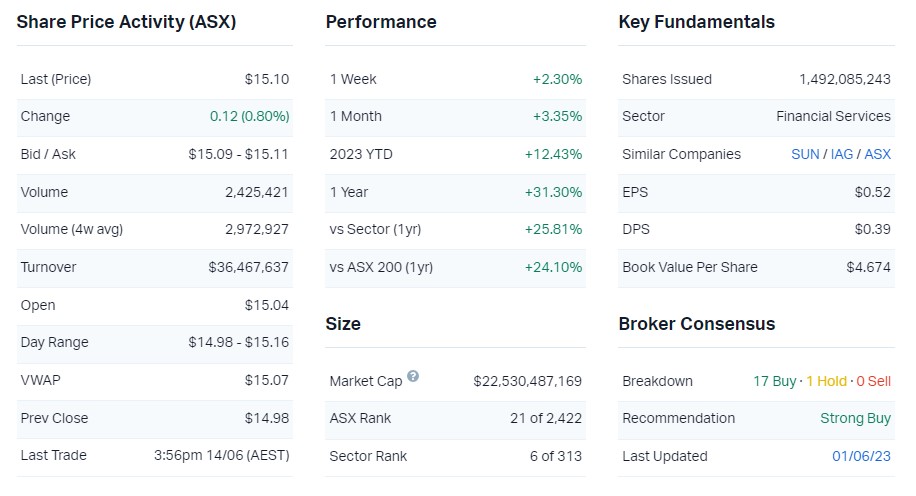

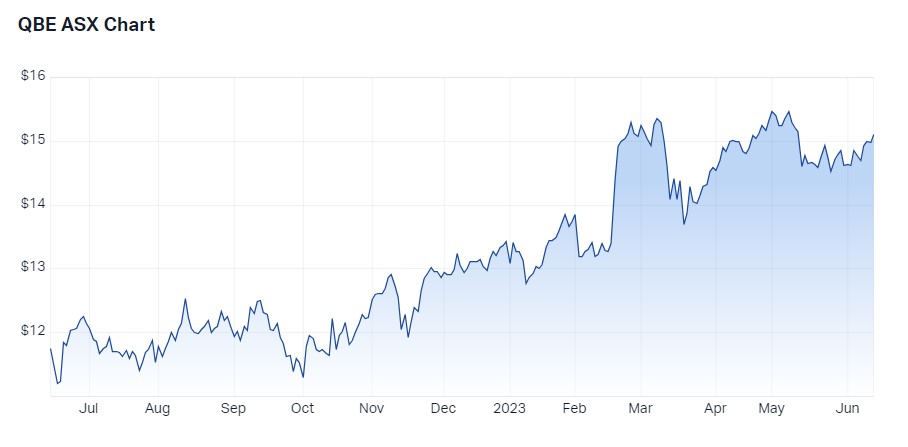

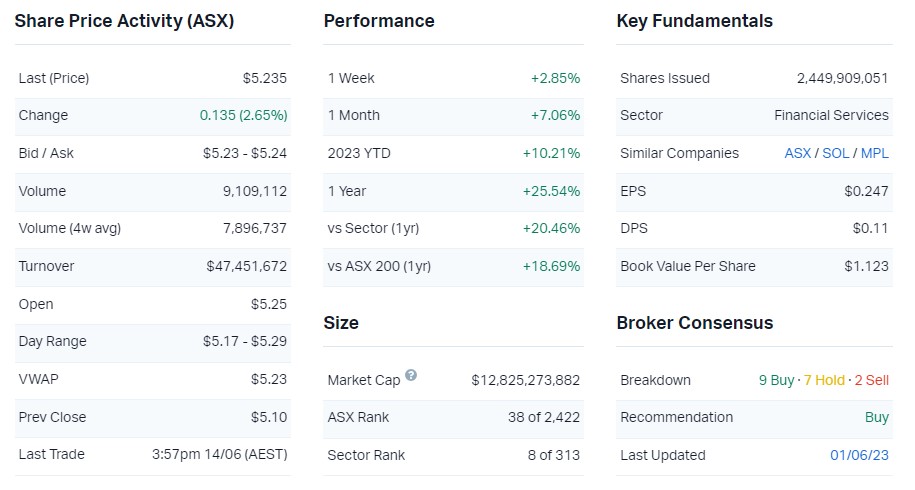

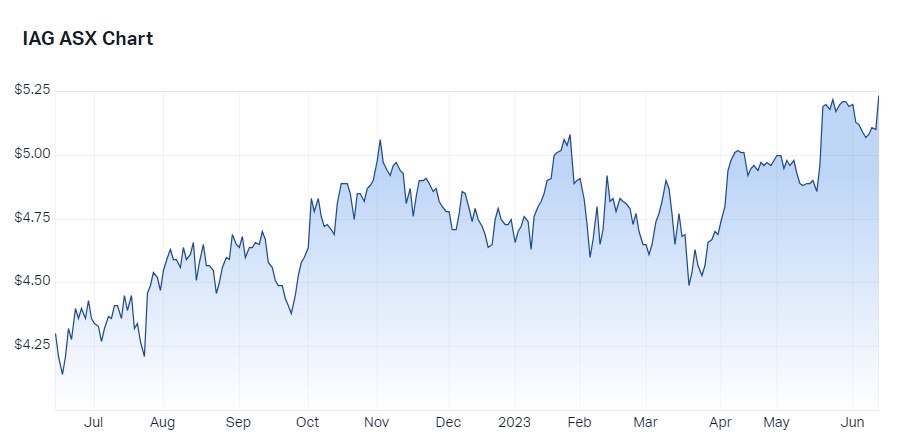

We think the general insurers like QBE (ASX: QBE) and IAG (ASX: IAG) are really well positioned at the moment. There’s a backdrop of rising insurance premiums that they’re benefitting from. They’re actually generating decent returns off their investment earnings for the first time in many years due to the normalisation of rates. We think they’re actually well placed in this rising interest rate and inflationary environment.

You use downside protection to offset about 30% of market exposure in the portfolio. How does this manifest in the strategy? Have you had to change that level across the past year?

We’ve applied a consistent reduction of 30% equity exposure to protect the fund during periods where markets are volatile or falling since inception. That hasn’t changed. We don’t expect it to change going forward. The way the fund is designed to be used is to provide a more structural defensive allocation to Australian shares in portfolios. Or alternatively, to allow advisers to increase their allocation to Australian shares to generate more income and franking credits without taking on more risk.

What do you expect your downside protection to look like in the coming year?

It’ll look like it has done in the 15-odd years since we started the fund. It’s important for those investors investing in our fund to be comfortable that the reduction is in place at all times. Markets are uncertain and the way the fund is designed to be used, investors need comfort that we don’t deviate from that.

What sort of equity returns do you think investors should be looking at now compared to what you might see in a year’s time?

The last decade of structurally declining interest rates has inflated asset prices across the board. You haven’t been rewarded for taking an active approach so passive investing has been the flavour of the month in that environment.

Equity investors should know not to expect the same level of returns as rates normalize. Having said that, no matter what asset class you are looking at and particularly for shares, taking an active approach will be the key to providing superior returns for investors.

What are your three highest conviction positions in the portfolio at the moment?

We’re quite confident on the general insurers at the moment. QBE and IAG represent a decent allocation within our portfolio. Those rising premiums and increased earnings on their investment books are key to them thriving and paying good dividends over the coming year or two.

Market fundamentals and 1-year share prices for QBE

Source: Market Index, 14 June 2023

Market fundamentals and 1-year share prices for IAG

Coles (ASX: COL) is another company that is well positioned in the slowing economy. It is less susceptible to massive changes in consumer spending patterns. It has a good market position and can increase prices as its own costs increase. We’re seeing now as we get through the covid pandemic, those related costs should start to ease and decline.

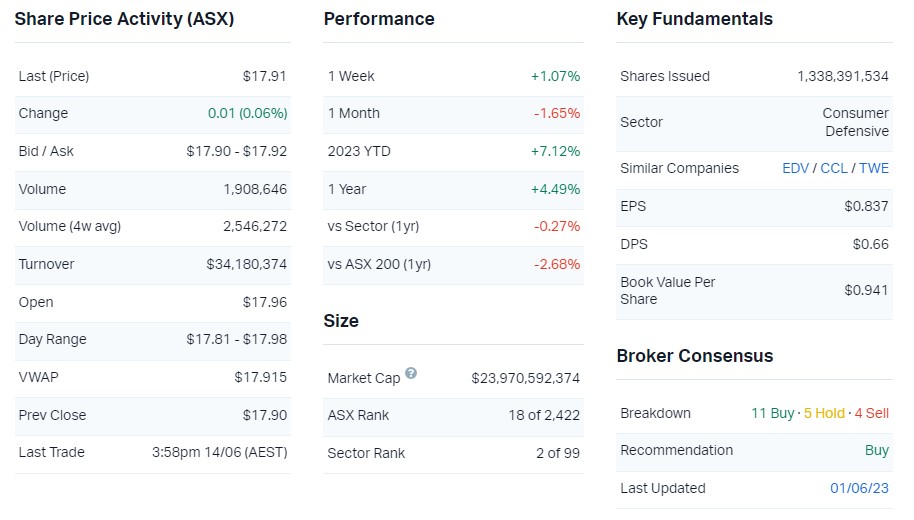

Market fundamentals and 1-year share prices for Coles

The markets are volatile, fixed income is offering the best return it has in years. So why should investors take on the risks of equities over, say their guaranteed 5% return of a term deposit?

Using cash in the short term has a role to play if you’re worried about where markets might go in the next three to 12 months. Having said that, inflation is the biggest risk that investors, particularly retirees, face. Investing in Australian shares is a great way to offset that risk given the long-term profile that Australian shares offer.

We’ve just been around the country meeting advisers. One of the key concerns that they’ve said their clients are facing is changing their spending patterns in response to elevated levels of inflation. There’s a real risk for retirees around inflation. You need to invest on the basis of beating inflation.

We’re living longer and we’re spending longer in retirement. Actually beating inflation is a key challenge to preserving income in real terms throughout retirement.

What portion of a portfolio would you typically see retirees allocate toward equities?

Every client is different. Every client has a different risk profile. To answer that question would require a focus on the specific circumstances of an individual or a couple. What I would say is that inflation is a real challenge for retirees over the long term.

Having a meaningful allocation to Australian shares that deliver one of the best dividend yields in global markets, along with the valuable franking credits, makes a lot of sense.

The portfolio consists of what we consider to be undervalued companies constructed without regard to index weights, delivering monthly income with downside protection.