Rethinking Post Retirement Asset Allocation

Investors today face unique and significant challenges, especially in the post retirement phase.

Record low interest rates have heightened demand for income producing investments.

At the same time, the GFC still lingers in memory, with many investors under-exposed to growth assets and overweight defensive assets. This is despite the fact that, according to the ABS, the average life expectancy for a 65 year old woman and man to be 22 and 19 years respectively.

And within equities, there has been a rush to so called ‘low vol’ equities with little regard for valuation risk. To highlight this, while the overall PE ratio of the US market looks fair value relative to its post 1990 average, the PE ratio of the 100 least risky stocks in the S&P 500, as measured by share price volatility, is 44% above its long-term average. Expensive stocks in this category include infrastructure, property trusts and healthcare companies, among others. We wrote an in-depth paper on this topic in our March quarterly (Some thoughts on asset prices).

Another concern within equities is the rush to index funds, despite concentration risks such as large weightings to financials, miners or technology stocks. Furthermore, many investors hold direct shares also concentrated in the largest listed companies, creating double-up alongside index funds.

The out-working of all of this is many investors have taken on unnecessary risks, such as disregarding valuation, being overly concentrated and in some cases having insufficient exposure to growth assets.

With this backdrop, this paper examines 20 years of actual returns to present an alternative approach to generating sustainable income in post-retirement. This approach allocates a higher weighting to equities than typically considered and adopts a concentrated value approach rather than passive investing, all without taking on additional risk.

Accumulation strategies have delivered over the long term

During our working lives, investment strategies are typically aimed at accumulating wealth and are less concerned with year to year return fluctuations. During this phase – in order to maximise the final value of a portfolio – it usually makes sense to skew portfolios towards growth assets such as shares. While annual returns can be quite volatile, over longer term periods the volatility is less pronounced, particularly when inflation is taken into account.

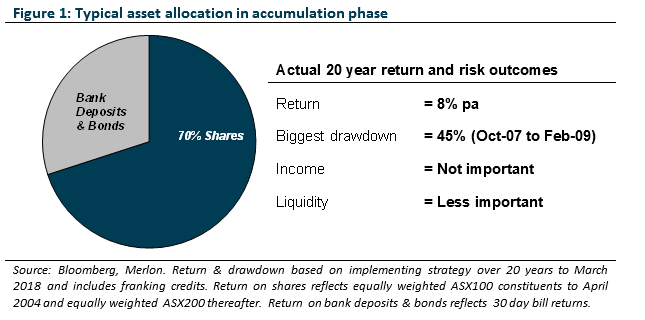

The diagram below shows a typical asset allocation for an investor in the accumulation phase.

Over the 20 year period between 1998 and 2018, an approach of holding 70% Australian shares and 30% cash would have provided an annual average return of around 8 per cent, beating inflation by around 5 per cent. This is a strong result and highlights the merits of allocating a substantial part of the portfolio to growth assets during the accumulation phase.

Investors needed to stay the course, however, as the largest drawdown was a 45% loss between October 2007 and February 2009, albeit an unrealised loss that was subsequently recovered provided investors rebalanced to maintain the target growth asset exposure.

Traditional post retirement strategies fail to deliver sustainable income

In contrast, retirees have different objectives – they need more income, can tolerate less risk and also need to preserve capital to ensure income streams keep pace with inflation. Such objectives can be conflicting with higher levels of income typically associated with higher risk and/or lower levels of capital return.

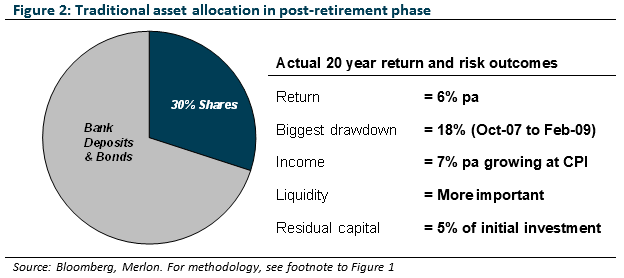

In practice, the growth-biased portfolio when accumulating wealth is more defensive in retirement, which we represent below as 30% Australian shares and 70% cash.

Over the past 20 years, our case study highlights the classic trade-off – returns reduced from 8% pa to 6% pa but the largest unrealised capital loss was 18% during the GFC.

The Holy Grail for retirees in an investment context is “sustainable income”, which, in our view, means:

- The income lasts 20+ years in-line with life expectancy,

- the income grows with inflation each year, and

- most importantly, the capital is largely preserved at the end of the 20 year period.

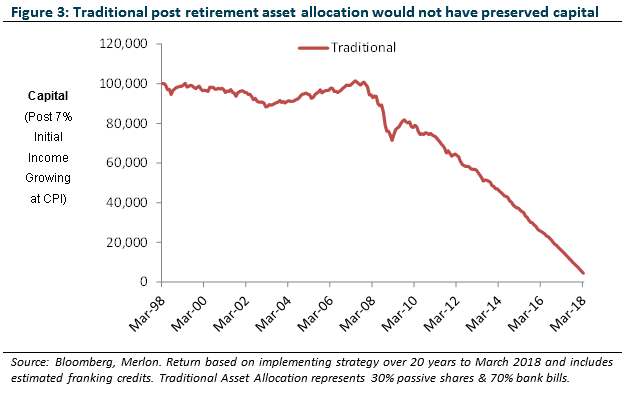

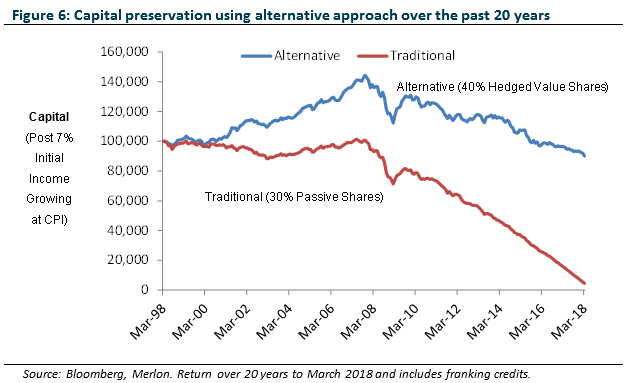

To replicate a retiree’s actual investment experience over the past 20 years, we withdrew $7,000 or 7% income from an initial $100,000 portfolio in 1998 and grew this income requirement by CPI each year. By the end of the 20 year period, the annual income requirement had increased to $11,800.

Because the actual yield of this asset allocation is less than 7%, retirees would have had no choice but to draw on their capital to supplement their income needs. The end result is only $5,000 or 5% of the original capital would have been preserved after 20 years, using actual returns experienced. This is illustrated in the chart below which highlights this typical approach would not have delivered “sustainable income” over the past 20 years.

To make matters worse, the average interest rate used in this 20 year period was 4.4% but is only 1.8% at the current point in time while inflation is running at 1.9%.

The key message from this analysis is investors should consider a higher exposure to income producing equities in a low rate environment.

Introducing a non-benchmark value investing approach

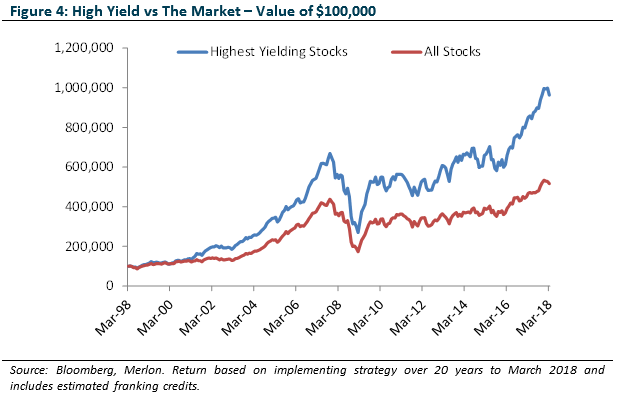

Extending our case study, we compared the performance of passively buying the 200 biggest stocks used in the previous analysis (represented in Figure 4 as ‘All Stocks’) with only buying the top third cheapest based on free cash flow yield (‘Highest Yielding Stocks’). After all dividends are only sustainable if paid out of free cash flow.

This portfolio has outperformed handsomely relative to the passive strategy of buying all stocks, and generated superior yield and franking credits.

We wrote several papers on this free cash flow based approach to value investing (Value Investing: An Australian perspective) which aligns with Merlon’s value-based investment philosophy. The main difference of course is Merlon’s fundamental approach focusing on sustainable free cash flow rather than the quantitative approach used in this analysis, which is based on last year’s reported cash flow. The Merlon share portfolio is also more concentrated at 25-30 stocks compared to 60 used in this analysis.

The key message from this analysis is a non-benchmark value approach has generated superior returns to passive share investing.

But what about risk? Unrealised losses impact a retiree’s financial well-being and lifestyle.

Overlaying downside protection while preserving fully franked income

Extending our case study further, we introduce a hedge overlay using derivatives to remove 30% exposure or risk while preserving 100% of the underlying dividends and franking credits from the share portfolio. This hedge overlay targets stock specific holdings at greater risk of short-term price declines using a tried and tested momentum strategy. This reduced the drawdown of the unhedged share portfolio by a third.

This approach simulates the downside protection applied to Merlon’s equity income strategy. In practice, and in this case study, we buy downside protection (or put options) on one third of the stocks, funded by selling the upside potential (call options) we don’t think exists in the short-term. The call options reduce returns in stronger markets but, importantly, the put options protect capital in weaker markets.

The key message is it is possible to reduce risk within an equity portfolio using derivatives.

Pulling it together – equity income and post retirement asset allocation

Up to this point, our 20 year case study using actual returns between 1998 and 2018 has highlighted the need for more exposure to income producing equities and the benefits of a non-benchmark value investing approach with downside protection.

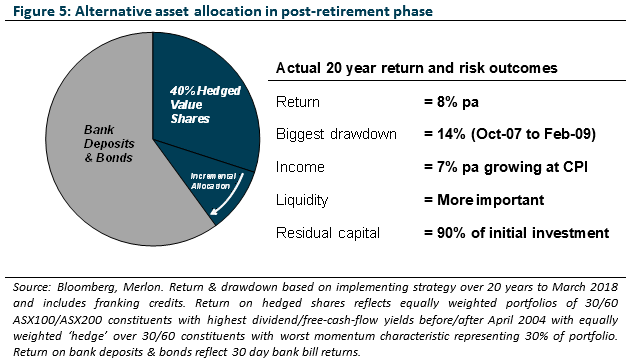

The final iteration of the case study incorporates a higher 40% weighting to hedged value shares (equity income) compared to the traditional 30% passive equities highlighted previously.

The combination of a higher equity allocation and concentrated value outperformance delivered an 8% pa total return, matching the accumulation strategy despite having much lower equity exposure. Importantly, thanks to the 30% hedge overlay, the risk profile, as measured by maximum drawdown, was no worse than the traditional 30% equity allocation in post-retirement. Income is also boosted from the additional equities and tilt towards high yielding undervalued shares with additional franking credits.

After withdrawing the same or $7,000 initial income (7% yield) growing to 11,800 over 20 years, the traditional approach only preserved $5,000 of the initial $100,000 capital whereas the proposed alternative approach preserved $90,000. This capital preservation is consistent with the definition of sustainable income described earlier.

The key conclusion from this paper is to highlight the role equity income (defined as hedged value shares) should continue to play in post-retirement allocations. Modestly increasing the allocation to growth assets, tilting equities towards undervalued companies, generating valuable franking credits and managing risk through a hedging overlay, all combine to provide a more tailored investment approach for retirees’ sustainable income needs.

Merlon approach aligned with case study

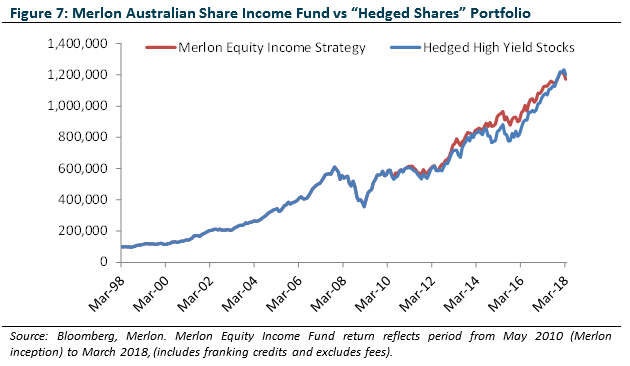

The chart below maps Merlon’s equity income actual returns with the case study. It highlights similar returns, as expected given Merlon’s cash-flow based value philosophy, benchmark unaware approach and 30% hedge overlay to deliver sustainable income.

Author: Neil Margolis, Lead Portfolio Manager