Oil – Pricing in a More Realistic Recovery

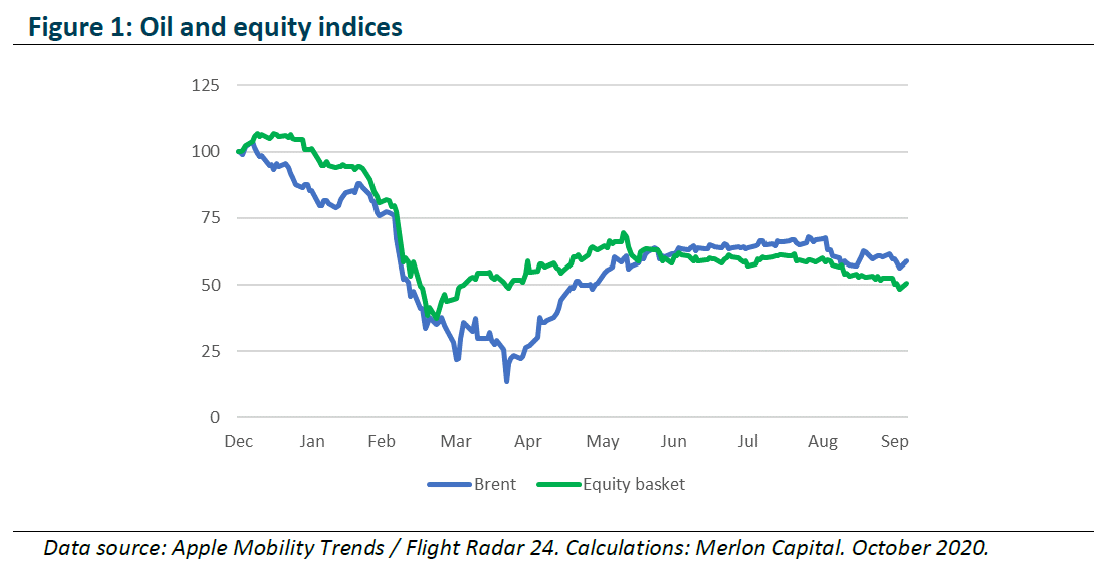

Oil remains in a holding pattern between USD40-45/bbl as the 7.7mbpd OPEC+ supply reductions balance demand, which is currently ~10% below pre-COVID levels. In comparison, oil exposed equities are currently 40-50% lower than pre-COVID levels. Should a vaccine be developed, an outcome we consider likely, then we would expect to see a normalisation of demand, implying equities return to pre-COVID levels. Should the current cuts to capital expenditure result in a decline in supply, then we would expect to see prices rise above pre-COVID levels.

We explore the outlook for oil and related equities in this paper, with the key points being:

- The recovery in demand has continued cautiously, despite second waves, with a normalisation of demand considered likely in the event of a successful vaccine.

- Prices have been supported in the current demand environment by OPEC+ discipline

- The longer oil remains below USD50/bbl, the larger the supply impact from the US is likely to be, given rig counts at historic lows and a high decline rates.

- Any reduction in US supply is likely to be exacerbated following years of underinvestment outside the US, as the US growth disincentivised investment elsewhere.

- Oil-exposed equities are trading at levels roughly half of pre-COVID levels – we believe it is increasingly likely they will ultimately trade at levels above these levels for the above reasons.

As written by Fama and French in 2015, investment at the firm level is inversely correlated with future returns. We believe this is a function of low returns driving capital out of a company / industry, driving low investment and in turn reduced supply, thereby increasing future returns. We believe the oil market, and associated equities, is no different.

1. Demand recovery – auto lags, diesel steady, jet lags

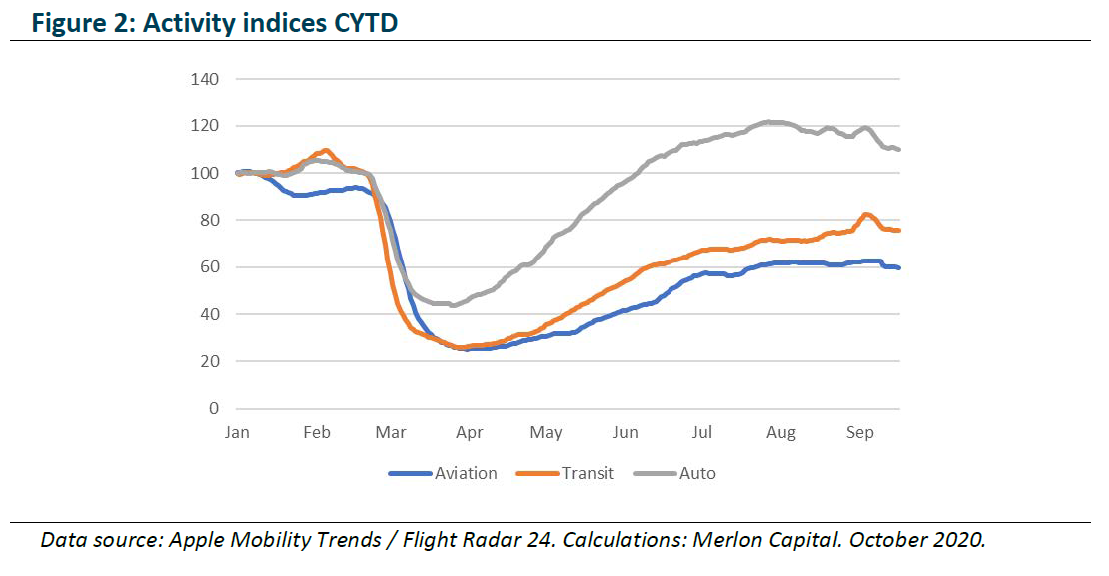

Following the trough in demand experienced in April, roughly 25% below normal levels, we have seen a recovery back to less than 10% below normal. While social-distancing has seen a marked reduction in public transport usage, this has been offset by personal auto usage, enabling ‘socially-distanced transport’. This leaves aviation as the major source of oil demand decline still evident. A recovery in this sector will be largely vaccine dependent.

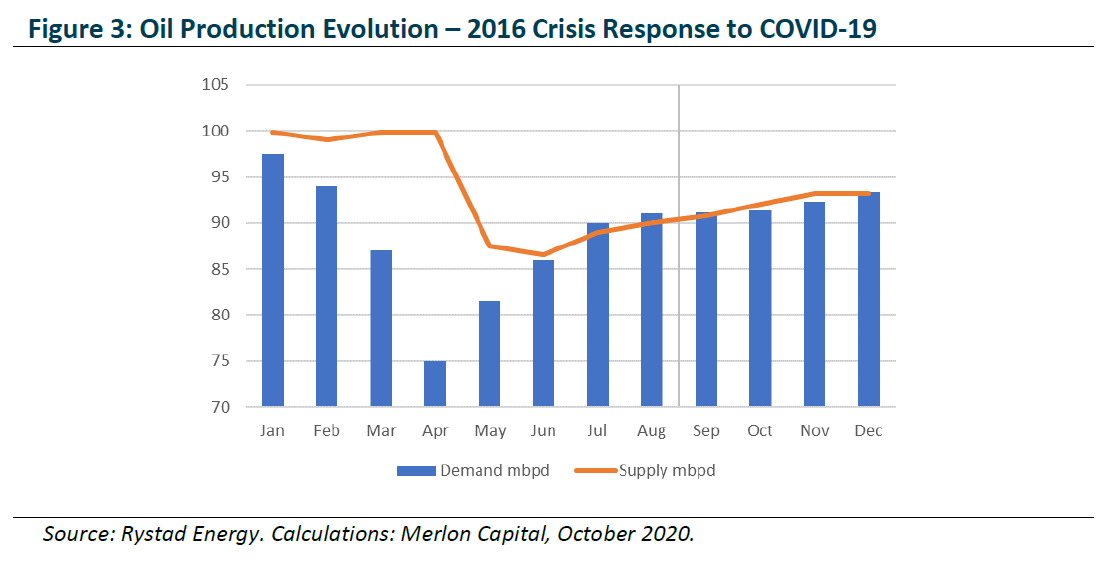

2. Supply discipline – OPEC+ steadies the market

While demand troughed in April, supply took an additional month to be fully implemented, driven largely by the efforts of the OPEC+ cartel. The increase in supply that has followed this trough has come predominantly from the OPEC+ agreement loosening, which saw an additional 2mbpd added to supply. These efforts have seen the supply / demand balance largely restored, albeit not at a level sufficient to drain the ~1.3 billion barrels of oil stockpiles built during the crisis.

Given the market has been stabilised, notwithstanding any outsized ‘second-wave’ effects, the focus is to work off inventories, which stand at more than three-times 2014-16 levels. We expect the OPEC+ production agreement will be extended, albeit not at a level that would see prices rally quickly enough to re-incentivise US onshore production (see below).

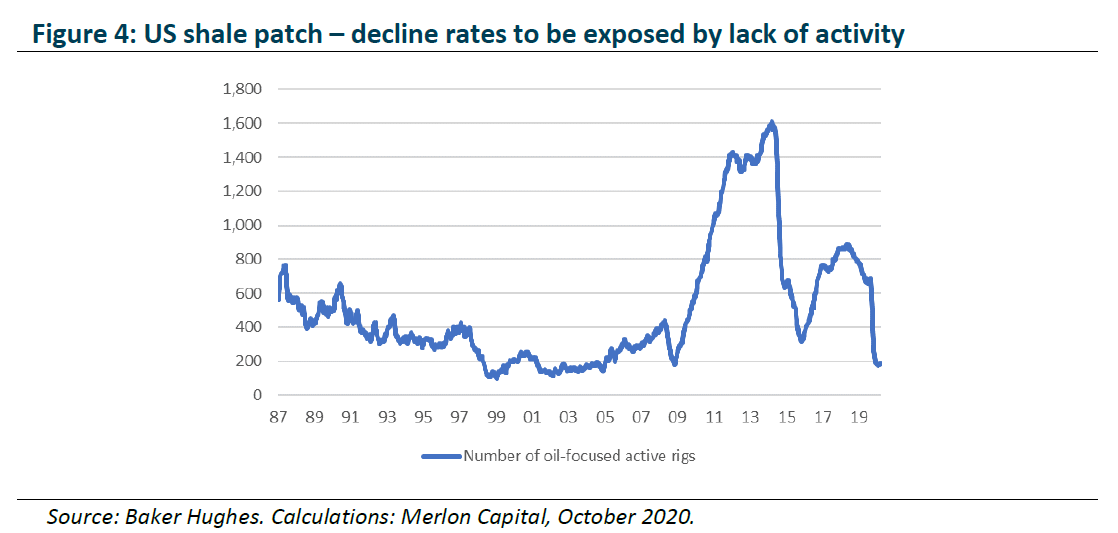

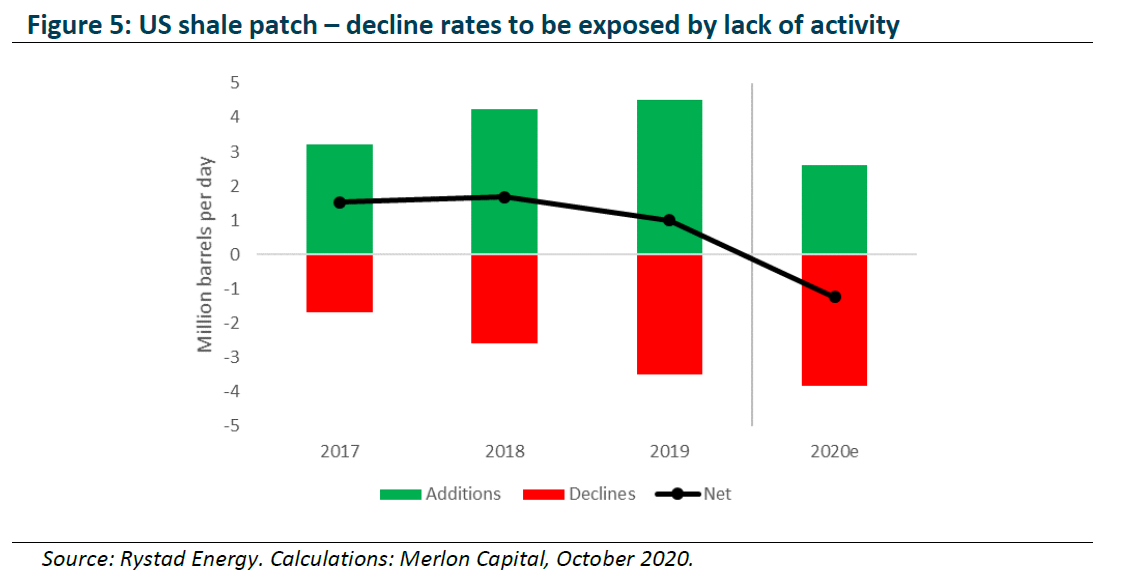

3. Unconventional: shale’s excessive decline rates may finally be revealed

The market share of US oil and associated liquids production has risen from 8% to 17%, driven by aggressive horizontal drilling and fracking across onshore fields. Yet this activity, while delivering stellar growth in production, has always lost cash as an industry – a function of the high decline rates in the sector. To date, these decline rates have been hidden behind growth in drilling activity, combined with concentration on higher grade deposits. Yet at current prices, there is little incentive to drill, with a survey by the Dallas Federal Reserve showing 1% of producers looking to increase drilling activities from current low levels at today’s prices, and only 10% should prices reach USD50/bbl. This price-disincentive has seen the rig count plummet. Perhaps more importantly, while the intention to drill may grow on higher prices, access to capital may be limited, with the negative oil prices seen in early 2020 still fresh in the minds of financiers.

Yet, the US needs significantly more activity to at least offset declines (ie to maintain production). Rystad Energy estimates the need for an additional 100+ rigs just to avert declines. While small in the context of prior peaks in activity, it represents a greater than 50% increase from current levels, where current pricing is only incentivising 1% of producers to invest.

Yet, the US needs significantly more activity to at least offset declines (ie to maintain production). Rystad Energy estimates the need for an additional 100+ rigs just to avert declines. While small in the context of prior peaks in activity, it represents a greater than 50% increase from current levels, where current pricing is only incentivising 1% of producers to invest.

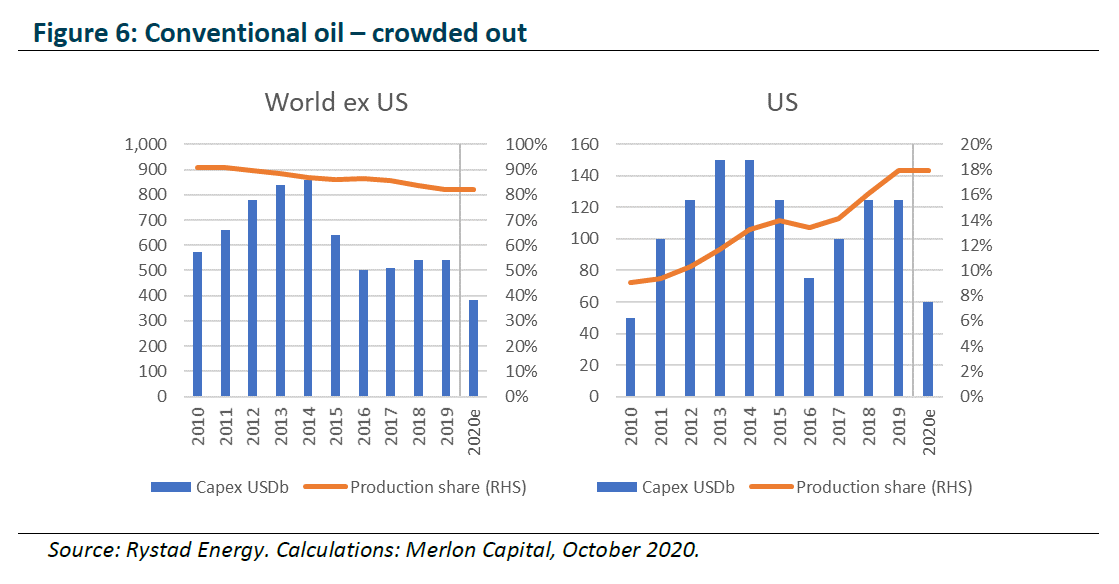

4. Conventional: from underinvestment, to disinvestment and energy pivots

Investment in conventional oil supply, which still accounts more than 80% of total supply, has suffered from a period of underinvestment. Capital expenditure from 2015 to 2019 was roughly 25% below that of the prior five-year period. With 2020 investment likely to be significantly below these already-low levels, the effects of this underinvestment is increasingly likely to worsen. Combined with subdued US volumes, this underinvestment could further limit any supply response to higher prices, with the potential for sharply higher prices as demand recovers.

5. Equities: Upside from demand recovery enhanced by supply constraints

Merlon process: At Merlon, our process is aimed at ensuring we minimise our exposure behavioural biases and exploit misperceptions about risk and future growth prospects.

The first step in our process is determining sustainable free cash-flow. Commodity exposed stocks generally fare poorly in terms of undifferentiated product, high capital intensity and pro-cyclical capital allocation. However, opportunities can arise when commodity prices are low, and industry investment is also low, as supply ultimately tightens and prices normalise.

The second step is to determine an unbiased and consistent measure of value based on sustainable free cash flow and franking, net of debt. This allows us to determine whether other investors have become too concerned (or complacent) about risks and growth.

We then set conviction, which recognises that to be a good investment, we need evidence the market’s concerns are either priced in or invalid. One way we determine whether the market is overly pessimistic is to produce valuation scenarios focused on the risk of permanent capital loss (bear case) relative to the upside scenario (bull case).

Merlon positioning: We hold upstream positions in Woodside Petroleum, Origin Energy and Oil Search, established based on an expected tightening of global oil markets over the medium term. The current price environment is pressuring the conventional and unconventional oil and gas businesses, leading to lower investment in future supply. We expect this, in conjunction with a vaccine-led normalisation of demand, to lead to higher prices for oil and gas.

Even if we are wrong and oil prices do not recover to the extent we expect, we see the downside in these names as limited given their low cost of production and improved balance sheets. As such, the risk / reward is skewed to the upside. We also hold downstream positions in Ampol and Viva Energy, based on a favourable industry structure, and upside to refining margins given historic cyclicality of this industry.

Woodside Petroleum (WPL)

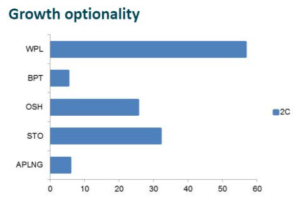

Company overview: Woodside Petroleum is the leading Australian LNG producer, with significant Western Australia-based conventional oil and gas operations. The company has generated strong cash-flows since the commissioning of Pluto in 2012. The company has significant growth potential, as evidenced by its undeveloped reserve position, via key projects such as Browse and Scarborough, in anticipation of continued growth in demand for cleaner gas fuels, as well as its conventional oil Sangomar field in Senegal.

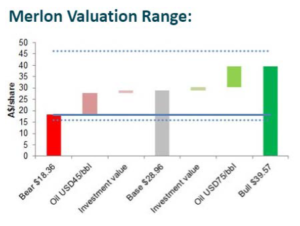

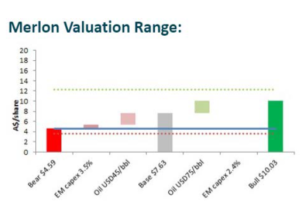

Valuation & market reasoning: We value Woodside at AUD29.96 per share, within a range of AUD18-40/share, based on its sustainable free cash flow under a range of scenarios. The company has underperformed due to concerns over its declining production profile, coupled with the demand interruption driven by COVID-19. At USD42 spot oil, WPL is cash-flow positive, yielding 4%, rising to 11% should oil demand recover, and 18% if supply declines. Our bull case reflects under-investment outside of the US and ironically becomes more likely the longer prices stay low. On this basis the risk/reward skew is very favourable even if oil prices drift lower in the short-term.

Valuation & market reasoning: We value Woodside at AUD29.96 per share, within a range of AUD18-40/share, based on its sustainable free cash flow under a range of scenarios. The company has underperformed due to concerns over its declining production profile, coupled with the demand interruption driven by COVID-19. At USD42 spot oil, WPL is cash-flow positive, yielding 4%, rising to 11% should oil demand recover, and 18% if supply declines. Our bull case reflects under-investment outside of the US and ironically becomes more likely the longer prices stay low. On this basis the risk/reward skew is very favourable even if oil prices drift lower in the short-term.

Merlon view: We believe the market is underappreciating the long dated value of its growth optionality in light of recent acceleration in China’s pollution-driven demand for gas fired generation, coupled with an expected long term crude oil price, which forms the basis of its LNG contract pricing, being supported at USD60-70/bbl. We see upside to this price from a phase of underinvestment in conventional oil and gas globally, and more recently across US unconventional oil and gas activity.

Merlon view: We believe the market is underappreciating the long dated value of its growth optionality in light of recent acceleration in China’s pollution-driven demand for gas fired generation, coupled with an expected long term crude oil price, which forms the basis of its LNG contract pricing, being supported at USD60-70/bbl. We see upside to this price from a phase of underinvestment in conventional oil and gas globally, and more recently across US unconventional oil and gas activity.

Origin Energy (ORG)

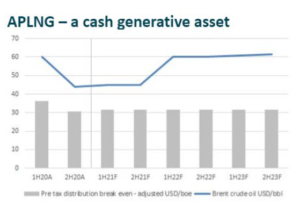

Company and quality overview: Origin Energy is the leading Australian east coast energy retailer, with four million customers, supported by upstream coal and gas generation, as well as owned and contracted renewables generation. The company has been operating its LNG facility on Curtis Island (QLD) since 2016, having received more than $2.3b in distributions, and which is expected to contribute further significant cash flows as oil prices normalise.

Valuation & market reasoning: We value ORG at $7.63 per share, within a range of $4.50-$10 per share, based on its sustainable free cash flow under a range of sensible scenarios. Currently trading at the bottom of this range, the market is concerned about low near-term oil prices due to COVID demand impacts and long-term headwinds for oil demand. The market is also concerned about low electricity prices, a function of renewables growth as well as the pandemic, as well as some loss of market share as the company sought to maintain margins .

Valuation & market reasoning: We value ORG at $7.63 per share, within a range of $4.50-$10 per share, based on its sustainable free cash flow under a range of sensible scenarios. Currently trading at the bottom of this range, the market is concerned about low near-term oil prices due to COVID demand impacts and long-term headwinds for oil demand. The market is also concerned about low electricity prices, a function of renewables growth as well as the pandemic, as well as some loss of market share as the company sought to maintain margins .

Merlon view: The market is attributing minimal value to APLNG despite the significant cash distributions it provides Origin under a normal oil price environment, and despite the cash generative nature of its dominant east coast energy markets business. We believe there is upside risks to our central case, as the longer oil prices remain at current levels, the longer US oil and gas rigs will remain at historic lows, and hence, the greater the impact on future oil supply. Similarly, current electricity prices, coupled with energy policy uncertainty, threaten private sector investment in generation, and hence risk a tighter future market.

Merlon view: The market is attributing minimal value to APLNG despite the significant cash distributions it provides Origin under a normal oil price environment, and despite the cash generative nature of its dominant east coast energy markets business. We believe there is upside risks to our central case, as the longer oil prices remain at current levels, the longer US oil and gas rigs will remain at historic lows, and hence, the greater the impact on future oil supply. Similarly, current electricity prices, coupled with energy policy uncertainty, threaten private sector investment in generation, and hence risk a tighter future market.

Oil Search (OSH)

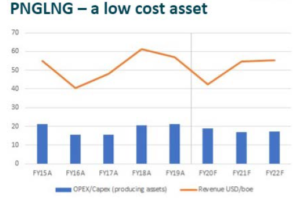

Company and quality overview: Oil Search, in partnership with ExxonMobil, is the leading Papua New Guinea LNG producer. The company has generated nearly USD2b in free cash-flow since the commissioning of its large-scale conventional gas and condensate PNGLNG project in 2015. The company has large growth opportunities both within PNG and Alaska, in order to take advantage of a shift toward less carbon-intensive sources of electricity generation.

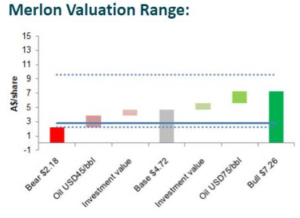

Valuation & market reasoning: We value OSH at AUD4.72/share, within a range of AUD2.18-7.26 per share, based on its sustainable free cash flow under a range of scenarios. The stock is trading towards the bottom end of this range, with the market concerned about the impact of COVID on near-term oil prices (via weak demand) and political uncertainty in PNG. OSH also has reasonably elevated debt, despite raising capital earlier in the year.

Valuation & market reasoning: We value OSH at AUD4.72/share, within a range of AUD2.18-7.26 per share, based on its sustainable free cash flow under a range of scenarios. The stock is trading towards the bottom end of this range, with the market concerned about the impact of COVID on near-term oil prices (via weak demand) and political uncertainty in PNG. OSH also has reasonably elevated debt, despite raising capital earlier in the year.

Merlon view: Lower oil prices in the short-term typically lead to deferred investment in production capacity, resulting in a decline in supply, and price normalisation. We see upside to this price from a phase of underinvestment in conventional oil and gas globally, and more recently across US unconventional oil and gas activity. At current oil prices, OSH continues to generate positive cash-flows, as at USD21/boe, OSH costs are highly competitive.

Merlon view: Lower oil prices in the short-term typically lead to deferred investment in production capacity, resulting in a decline in supply, and price normalisation. We see upside to this price from a phase of underinvestment in conventional oil and gas globally, and more recently across US unconventional oil and gas activity. At current oil prices, OSH continues to generate positive cash-flows, as at USD21/boe, OSH costs are highly competitive.

Ampol (ALD)

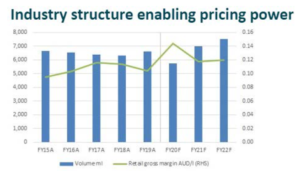

Company and quality overview: Ampol is the leading Australian supplier of petrol and diesel product. The company has a sizeable commercial business, accounting for 50% of total volumes, combined with a one-third retail market share position, via 700 company owned and operated sites, and supply agreements to non-owned Ampol-branded sites. The industry structure is highly favourable with the top three operators supplying or retailing more than 80% of total volumes. Over time, the company has reduced its exposure to the more capital-intensive refining segment, focusing on its marketing division, with an integrated cash return on invested capital above 10%.

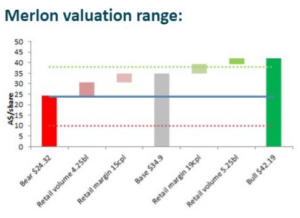

Valuation & market reasoning: We value Ampol at between $25 and $42 per share ($35 central case), with the stock currently trading towards the bottom of this range as the market is concerned about the impact of COVID on retail volumes, longer term declining fuel volumes (including the effect of electric vehicles), the sustainability of premium fuel margins, the ability to extract value from convenience sites, and weak refining margins.

Valuation & market reasoning: We value Ampol at between $25 and $42 per share ($35 central case), with the stock currently trading towards the bottom of this range as the market is concerned about the impact of COVID on retail volumes, longer term declining fuel volumes (including the effect of electric vehicles), the sustainability of premium fuel margins, the ability to extract value from convenience sites, and weak refining margins.

Merlon view: ALD is trading at nearly 50% below our central case. We believe historically cyclical refining margins, currently 40% below mid-cycle, will revert to normal levels. More importantly, the industry structure has enabled retail fuel margins more than offset COVID driven volume declines (1H20 retail earnings before interest and tax was higher than pre-COVID levels). Further, we believe the market is not factoring in the growth in premium fuels consumption, the recently announced Woolworth’s Metro-branded and supplied convenience strategy, or the company’s superior infrastructure position and regional sourcing scale.

Merlon view: ALD is trading at nearly 50% below our central case. We believe historically cyclical refining margins, currently 40% below mid-cycle, will revert to normal levels. More importantly, the industry structure has enabled retail fuel margins more than offset COVID driven volume declines (1H20 retail earnings before interest and tax was higher than pre-COVID levels). Further, we believe the market is not factoring in the growth in premium fuels consumption, the recently announced Woolworth’s Metro-branded and supplied convenience strategy, or the company’s superior infrastructure position and regional sourcing scale.

Viva Energy (VEA)

Company and quality overview: Viva Energy is a large-scale Australian supplier of petrol and diesel product. The company has an attractive retail model, with Coles Express operating the shop, and Viva retaining control over retail pricing and margins. Viva also has a large commercial business, accounting for 45% of total volumes, combined with a 20% retail market share position. The industry structure is highly favourable with the top three operators supplying or retailing more than 80% of total volumes.

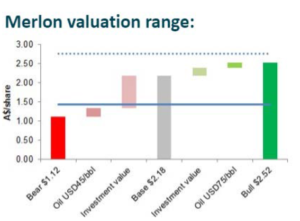

Valuation & market reasoning: We value Viva at AUD2.21/share, within a range of AUD1.12 per share to AUD2.52 per share, based on its sustainable free cash flow under a range of scenarios. The stock is currently trading towards the bottom of this range as the market is concerned about the impact of COVID on retail volumes, longer term declining fuel volumes (including the effect of electric vehicles), and the sustainability of premium fuel margins.

Valuation & market reasoning: We value Viva at AUD2.21/share, within a range of AUD1.12 per share to AUD2.52 per share, based on its sustainable free cash flow under a range of scenarios. The stock is currently trading towards the bottom of this range as the market is concerned about the impact of COVID on retail volumes, longer term declining fuel volumes (including the effect of electric vehicles), and the sustainability of premium fuel margins.

Merlon view: VEA is trading roughly 50% below our central case. We believe historically cyclical refining margins, currently 40% below mid-cycle, will revert to normal levels. More importantly, the industry structure has enabled retail fuel margins to more than offset COVID driven volume declines (1H20 retail EBIT was higher than pre-COVID levels). Further, we believe the market is not factoring in the value of its retail model, nor the latent value of its physical asset base (including the property value of its Gore Bay terminal in harbour-front Sydney, should this be converted).

Merlon view: VEA is trading roughly 50% below our central case. We believe historically cyclical refining margins, currently 40% below mid-cycle, will revert to normal levels. More importantly, the industry structure has enabled retail fuel margins to more than offset COVID driven volume declines (1H20 retail EBIT was higher than pre-COVID levels). Further, we believe the market is not factoring in the value of its retail model, nor the latent value of its physical asset base (including the property value of its Gore Bay terminal in harbour-front Sydney, should this be converted).

Author: Ben Goodwin, Analyst/Portfolio Manager