Merlon Franking Update

As the final election results trickle in, the Coalition is predicted to return with a majority government. Taxation was a dominant issue throughout the election, and Labor’s proposed changes to franking credits received a large amount of media attention.

The Merlon Australian Share Income Fund aims to provide a higher level of tax-effective (franked) income with a lower level of risk than the S&P/ASX 200 Accumulation Index, whilst also providing the potential for capital growth and inflation protection over the medium to long term.

This is an outcome of our sustainable free cash flow investing approach, the benchmark unaware portfolio construction and downside protection overlay.

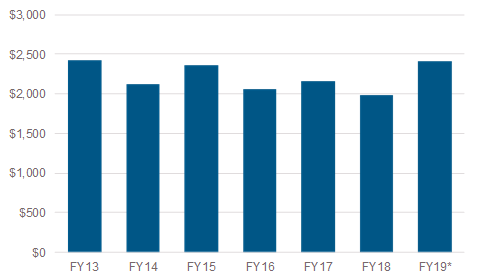

An investment of $100,000 on 1 July 2012 would have generated cumulative gross franking credits of $13,000 (or 13% franking yield) to date, plus an additional $2,400 (or 2% yield) expected this financial year. This valuable source of return is not dependent on the direction of the market and is over and above the return derived from distributions received and any capital growth in the unit price.

The reason Merlon generates such an attractive level of franking credits comes back to our long-held investment philosophy to view franking credits no different to cash returns and our investment process which explicitly values franking credits alongside sustainable free cash flow.

Merlon Australian Share Income Fund – Annual franking credits generated on $100k

Source: Merlon Capital Partners as at 20 May 2019.

* Franking credits received based on $100k invested on 1 July 2012, FY19 estimate based on forecast FY19 distribution. Information is predictive in nature and may differ materially from actual figures