Follow-up Letter to AMP Directors…

Members of the Board of Directors

AMP Limited

33 Alfred Street

Sydney, NSW 2000

Re: The Board’s Approval to Sell Businesses to Resolution Life

Lady and Gentlemen:

Thank you for facilitating Mike Wilkins response to our letter dated 27 October 2018; the release of additional information in relation to the AMP portfolio review; and, having David Murray outline the board’s position in relation to some of the issues raised on the ABC’s “The Business” program late yesterday. We are disappointed the board chose not to engage with us in relation to our requests or even acknowledge that it was in the process of reviewing our letter until after it was publicised in the media.

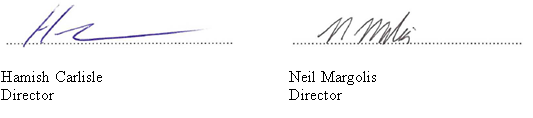

The table overleaf updates our assessment of the value destruction and various valuation multiples contained in our previous correspondence in light of additional AMP disclosures provided to the market. The impact of the additional information is inconsequential within the context of the sums involved. We maintain that the transaction represents approximately 0.6x embedded value and 6.5x historic earnings.

We acknowledge that AMP has responded to our request and provided the information necessary to reconcile the “0.82x pro forma embedded value” advertised in the company’s various releases with previously disclosed information. The new disclosures confirm our view that the 0.82x figure represented was disingenuous and highly misleading. Further, the new disclosure that the board knowingly forwent $705 million in franking credit value in considering this transaction causes us great concern. As you know, this value only represented 70% of the face value of franking credits under consideration. The value to AMP’s Australian shareholders is 100%, or just over $1 billion.

In an act that further undermines our confidence in the Board’s understanding of the transaction, you have provided additional disclosures that once again misrepresent its attractiveness. The construct of the “implied price / earnings multiple” of 11x on slide 3 of your additional background information release is farcical. In particular, we would note that it is not market practice to calculate price / earnings ratios using “annualised 6 months” earnings, and that it is inappropriate to capitalise depressed levels of earnings – for example your “implied price / earnings multiple” reflects an annualised profit margin of only $2 million for the wealth protection business. We are encouraged but sceptical that within the space of a week you have committed to extract $40 million of after tax expenses and replace an additional $65 million in after tax earnings lost as a direct result of the transaction. We look forward to hearing more about the various initiatives that will achieve these outcomes.

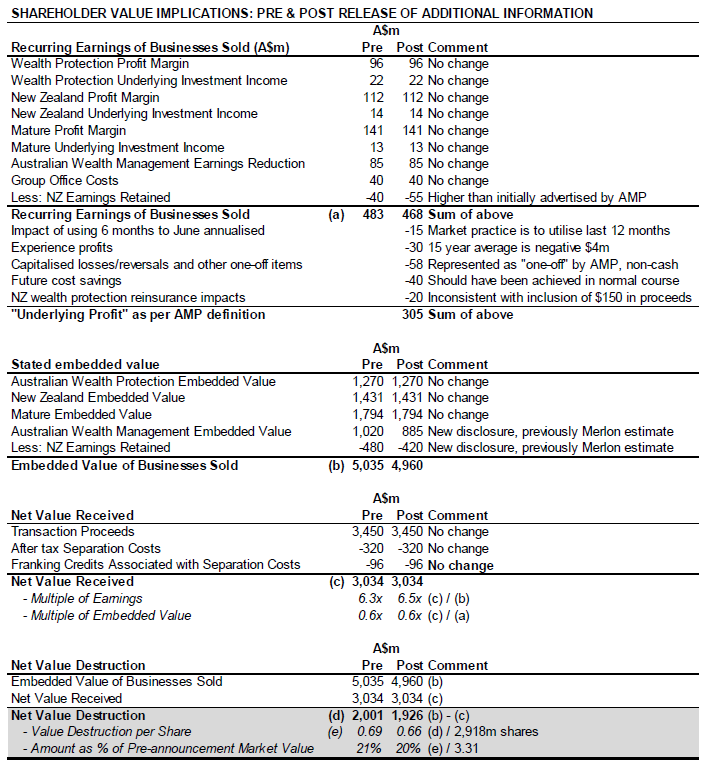

There are a number of areas where we continue to seek a response from the board. The table below outlines the status of the various items outlined in our letter dated 27 October 2018.

We are extremely concerned that a representative of AMP commented to the Australian Financial Review that “We believe there are a number of areas where Merlon have misunderstood or misinterpreted the company’s data. This has led to inaccuracies in their analysis.” This statement is demonstrably false in light of your subsequent release of information and could harm our reputations. We reserve all of our rights in relation to these false allegations.

We continue to be approached by other investors encouraging us to convene an Extraordinary General Meeting calling for change if the unresolved matters are not adequately addressed.

We take our responsibilities seriously and expect the AMP board to have the same regard for its shareholders as we do to our own investors.

Sincerely