Are Concerns About Housing Prices Overblown?

The state of the housing market remains a key consideration for any Australian equity investor. There is a constant flow of speculation as to the outlook for residential property ranging from predictions of a catastrophic collapse through to justifications for ever increasing house prices. In addition there is heated political debate about housing affordability and the future of tax benefits provided to owners of investment properties.

The listed banks are justifiably at the pointy end of this issue partly because the majority of their lending is secured by residential property and partly because their own lending standards play a role in driving demand for housing assets. Beyond the banks, changes in house prices can impact consumer spending, dwelling investment and small business investment. So any major correction would be a problem for the broader economy.

It seems conventional wisdom that the housing market in Australia is currently at a cyclical high point. House prices, housing finance activity and building approvals are all at historically elevated levels. At the same time, interest rates are at record lows and have begun to increase, particularly for investors.

In this paper, we consider house prices in Australia within a long term context and within the context of the Australian tax system that favours owner occupied housing over all other asset classes. On balance, we think the housing market is 5-15% overvalued relative to “mid-cycle” levels. Contrary to recent commentary, we do not find this over-valuation to be concentrated in the Sydney market.

We don’t find modest system wide “overvaluation” to be particularly surprising at the current point in the economic cycle and note that we are a long way off what we consider to be “mid-cycle” interest rates. Rising interest rates – as we are currently experiencing – are likely to be a precursor to a turn in the cycle so it is likely we will enter into a phase of more subdued house price inflation.

That said, favourable tax treatment of housing coupled with historically low interest rates and favourable fundamentals (income and rental growth) mean we have low conviction that house prices will retrace to “mid-cycle” levels in the foreseeable future.

It follows that we think regulator concerns about house prices are overblown. Regulations that have forced banks to ration lending are probably unnecessary and will achieve little other than improving short term bank profitability through higher interest rates for borrowers. In the long term, the RBA will take bank pricing decisions into account when setting official rates and unregulated lenders will emerge if market fundamentals remain sound.

We continue to hold banks in our portfolios although have no exposure to companies benefitting from unsustainably high residential development profits.

House Price Valuation Metrics

Within the context of Merlon’s investment philosophy, it’s not just the direction of economic indicators that matter but also the starting point. First and foremost we are value investors and we value companies on the basis of sustainable conditions. So the question must be asked – are current house prices in Australia sustainable?

Price-to-income ratios

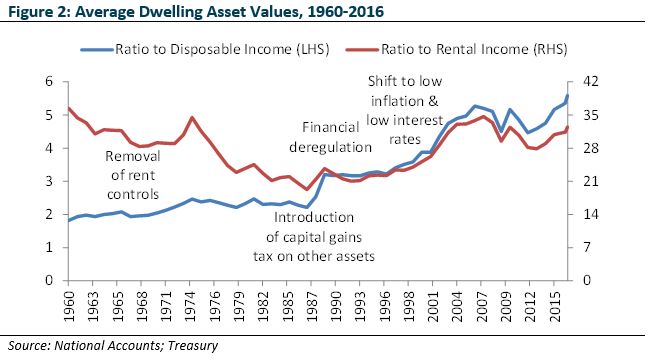

A popular approach to answering this question is to compare current house price-to-income ratios to historic averages. During the 1960s the ratio was around 2 times. During the 1970s, the ratio increased to approximately 2.5 times. This coincided with the unwind of rent controls which existed in full or part from 1939 until the mid-1960s. Indeed, price-to-rent ratios during this period were historically high.

Subsequent expansion in the price-to-income ratio has widely been attributed to deregulation of the financial sector during the 1980s and the shift to a low inflation and low interest rate environment during the 1990s. It is also worth noting that capital gains tax was introduced in Australian in 1985 and applied to assets other than the family home. This change arguably increased the attractiveness of owner occupied housing over other types of investments.

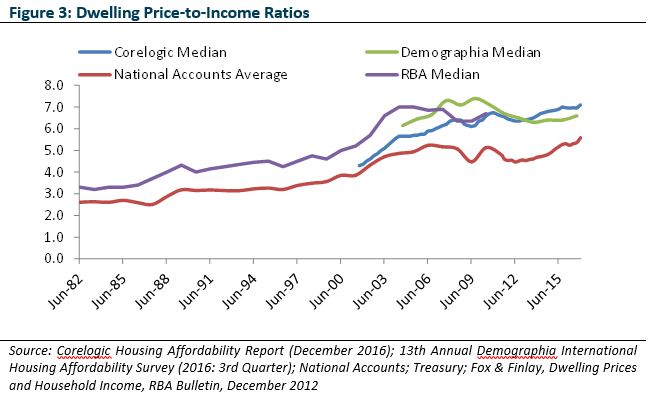

The evolution of the average price-to-income-ratio from the National Accounts (depicted above) is consistent with other commonly reported calculations based on median prices and median incomes. This is illustrated in Figure 3. The difference in the absolute level of the series is due mainly by the inclusion of certain on non-cash income items in the National Accounts not captured in surveys conducted by the Australian Bureau of Statistics (ABS).

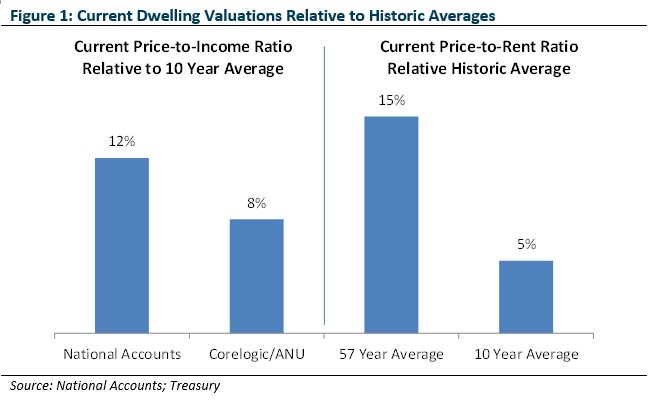

Given the sustained upward trend in price-to-income ratios since the 1960s and associated structural changes to the market, we don’t think it’s appropriate to compare current ratios to very long term averages. However, it is interesting to note that price-to-income ratios have fluctuated within a tighter band over the last 10-15 years. Along these lines, we note that price-to-income ratios are currently between 8% and 10% higher than 10 year averages depending on whether we utilise average or median data series.

Price-to-rent ratios

Consistent with our investment philosophy, we believe the only way to value assets is based on the cash flows they deliver to their owners. For residential property, this cash flow is roughly proportionate to rental income (or rental savings in the case of owner occupiers). It follows that we think the price-to-rent ratio is a better indicator of fundamental value in the housing market than the price-to-income ratio.

As illustrated in Figure 2 using data from the National Accounts and Treasury papers we also constructed a longer term time series of the price-to-rent ratio. The data we utilised includes the aggregate imputed and actual rent for all dwellings in Australia.

The analogy to the stock market is straight forward: the price-to-rent ratio in the housing market is like the price-to-earnings (P/E) ratio in the stock market. By this standard, the value of dwelling assets is approximately 15% above the 57 year average and 5% above the 10 year average.

Interestingly, what can also be seen in Figure 1 is that – relative to rents – house prices bottomed out in 1987. Coincidentally this is the first year for which Australian Bureau of Statistics house price data is readily available and has thereby become the anchor point for popular analysis.

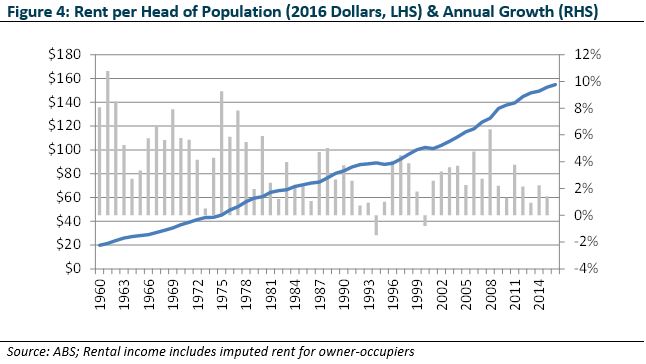

Of course when valuing companies, we look very closely at the sustainability of cash flow. If earnings and cash flow are cyclically inflated the multiples we’re prepared to pay are lower. Similarly, it’s worth considering whether dwelling rents are sustainable at current levels. A collapse in rents would significantly undermine any assessment of value.

Dwelling rents are notably resilient to the economic cycle and have shown a remarkable tendency to grow above inflation over a long period of time. There are a variety of reasons why this might have been the case, most obvious of which is that over time productivity gains allow wages to grow faster than inflation and housing quality/location has consistently ranked high in consumer preferences. As households’ basic needs are met (after all, how many flat screen TVs we need?), households have shown a willingness to allocate an increasing proportion of their income to their homes.

Regional Comparisons

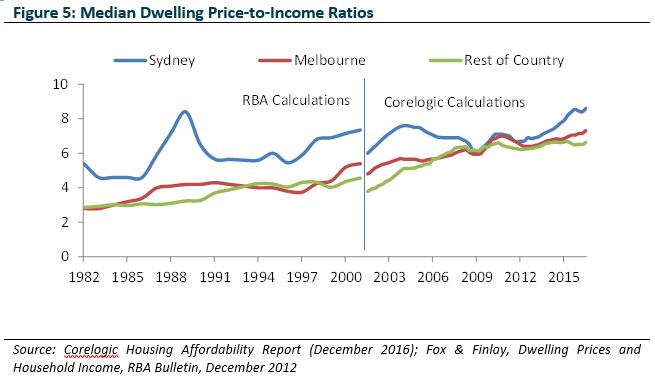

Our analysis to this point has focused on national level statistics. It is also worth comparing valuations across various regions. This has been topical of late with Demographia.com finding Sydney to be the fourth most expensive city in the world at a price-to-income ratio of 12.2x. Median dwelling price-to-income ratios are presented in Figure 5.

The key takeaway here is that Sydney and Melbourne have historically traded at a premium to the rest of the country. Although Sydney has experienced more rapid price inflation recently, this is arguably catch up following a period of underperformance between 2004 and 2010. The “Sydney premium” is currently broadly in line with historic averages.

Interestingly, the price-to-income ratio for Sydney calculated by Corelogic – arguably the most comprehensive property information source in Australia – of 8.4x is significantly lower than the headline grabbing 12.2x publicised by Demographia. This largely reflects the median dwelling price of $785k utilised by Corelogic compared to the $1,077k median house price utilised by Demographia. It is likely, in our view, that median incomes are higher for house owners compared to apartment owners and therefore likely that the Demographia calculation is overinflated.

International Comparisons

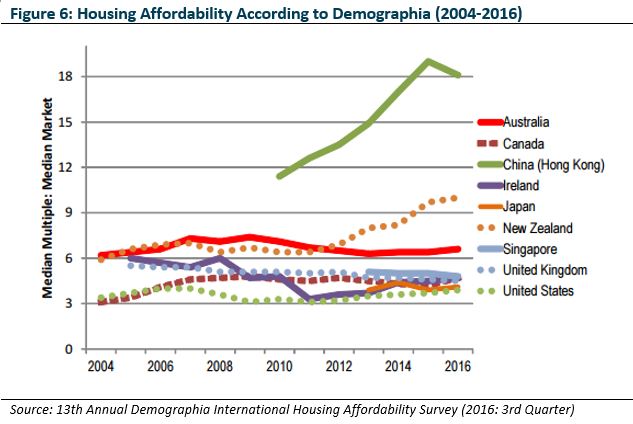

Another popular approach to assessing house prices has been to compare different geographies. Similar to longitudinal studies these types of headline grabbing analyses usually raise more questions than answers. Differences in tax systems, wealth and household preferences are some of the reasons why comparisons across countries should be treated with caution.

This has led many such comparisons to focus on “English Speaking Countries” where (arguably) wealth and household preferences are more closely aligned. Even here though there are major structural differences. For example, in the United States interest on mortgages is tax deductable, land taxes are levied on property owners while at the same time states and cities can levy income tax on their residents. All of these factors have the capacity to greatly distort headline comparisons.

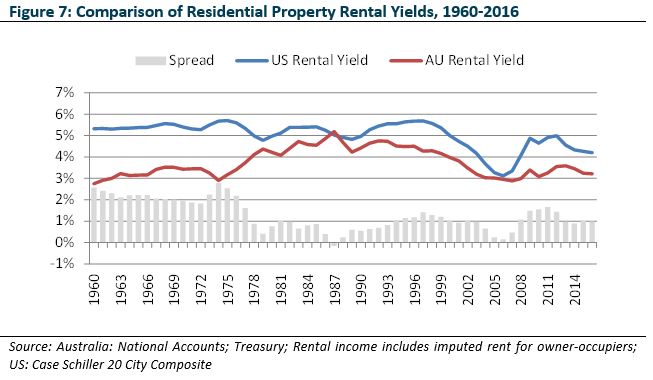

Having said all that, in the chart below compares a commonly quoted rental yield index for US dwellings with the rental yields imputed for Australia. The obvious point to make is that while Australian property does indeed look expensive relative to the United States, this has been the case for many years.

Tax Advantages

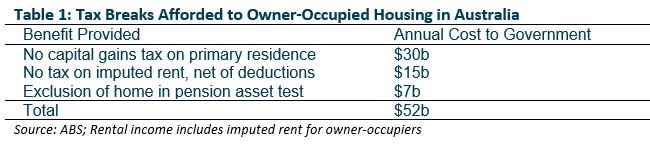

There has been much debate about the impact of the tax system on property values in Australia. Oddly enough, the perception seems to be that negative gearing is a tax break for investment property owners and has served to inflate property values. In fact, the tax and welfare system in Australia is enormously favourably to owner occupiers when compared to investors.

Each year The Treasury publish a “Tax Expenditure Statement” which estimates the cost to taxpayers of situations where the “actual tax treatment of an activity differs from the benchmark tax treatment”.

No Capital Gains Tax

This Tax Expenditure Statement highlights that the single largest tax exemption offered by the Australian federal government relates to the capital gains tax exemption on owner occupied housing. If capital gains on owner occupied housing were subject to the same treatment as capital gains on other assets (including investment property) the government would be better off to the tune of approximately $30 billion per annum.

The approach to capital gains tax is not unique to Australia although it is worth noting that many countries (including the United States) have caps on the amount of capital gains income from primary residencies that can be treated as tax exempt.

No Tax on Imputed Rent

The Tax Expenditure Statement also notes that imputed rent from owner occupied housing is not included in taxable income. Similarly, expenditure incurred in earning imputed rent is not deductable. Interestingly, The Treasury do not include this favourable treatment as a gift to owner-occupiers despite acknowledging that it departs from the “Schanz-Haig Simons definition of income”.

Estimating the size of this tax break is complex and requires assumptions about the distribution of marginal tax rates amongst homeowners and borrowers. Having said that, using data from the Australian Bureau of Statistics Survey of Income and Housing, we estimate that taxing owner occupiers on imputed rent and allowing deductions on housing related expenses would raise $15 to 20 billion per annum in net taxes.

A popular approach to capturing this revenue in other countries is simply to levy land tax on owner occupied property. Indeed, the introduction of land taxes was a recommendation of the Henry Tax System Review commissioned by the Rudd Government in 2008 as was allowing tax deductions on mortgage debt for owner occupiers and introducing capital gains tax.

Primary Residence Excluded Assets When Testing for Pension Eligibility

A further feature of the Australian housing market is that owner occupied properties are excluded from the “asset test” when assessing eligibility for aged pensions. The Grattan Institute – a public policy “think tank” – estimate that including owner owner-occupied housing in the pension assets test could improve the Commonwealth’s budget position by about $7 billion a year.

No surprise, this was also a recommendation of the Henry Tax Review.

Concluding Remarks

It is easy to forget that 75 percent of the dwelling assets in Australia are unencumbered by mortgage debt. For the fortunate owner occupiers falling into this category, the imputed rents on these property assets are tax free and for all owners in aggregate virtually certain to grow at a rate above the CPI over the long term.

The limited prospect of owners of dwellings foregoing a largely tax free and growing income stream in favour of the currently pitiful and taxable interest on bank deposits mean we have low conviction that house prices will retrace to its historical average levels while interest rates remain below long term average levels.

As with all our investing, we work on the basis that, over time, interest rates will revert back to long term levels as will aggregate housing valuation metrics. Against this, we think aggregate rents and household incomes will continue to grow which will cushion the overall impact on dwelling prices and that the exposure of the household sector to higher interest rates means that the time frame over which interest rates will rise could be quite protracted. As such, we think the risk of a catastrophic collapse in the housing market is low.

Author: Hamish Carlisle, Analyst/Portfolio Manager